Spotting Winners: Olo (NYSE:OLO) And Vertical Software Stocks In Q4

As the craze of earnings season draws to a close, here’s a look back at some of the most exciting (and some less so) results from Q4. Today, we are looking at vertical software stocks, starting with Olo (NYSE:OLO).

Software is eating the world, and while a large number of solutions such as project management or video conferencing software can be useful to a wide array of industries, some have very specific needs. As a result, vertical software, which addresses industry-specific workflows, is growing and fueled by the pressures to improve productivity, whether it be for a life sciences, education, or banking company.

The 14 vertical software stocks we track reported a satisfactory Q4. As a group, revenues beat analysts’ consensus estimates by 3.3% while next quarter’s revenue guidance was in line.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 17.8% since the latest earnings results.

Olo (NYSE:OLO)

Founded by Noah Glass, who wanted to get a cup of coffee faster on his way to work, Olo (NYSE:OLO) provides restaurants and food retailers with software to manage food orders and delivery.

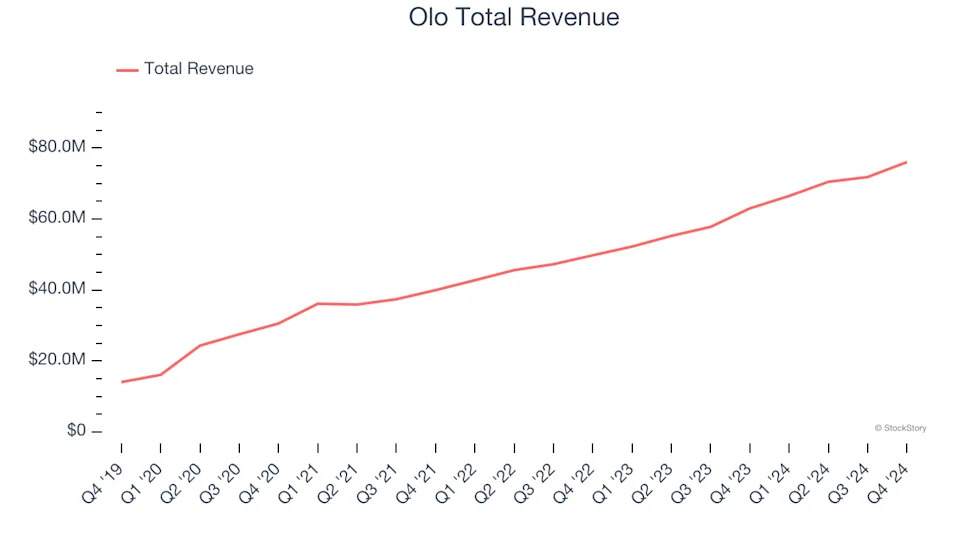

Olo reported revenues of $76.07 million, up 20.7% year on year. This print exceeded analysts’ expectations by 4.5%. Overall, it was a strong quarter for the company with a solid beat of analysts’ EBITDA estimates and an impressive beat of analysts’ billings estimates.

“Team Olo put together a fantastic 2024 that included strong financial performance, new and expansion deployments with marquee restaurant brands, and platform reliability and innovation that powered $29 billion in gross merchandise volume and $2.8 billion in gross payment volume for the year,” said Noah Glass, Olo’s Founder and CEO.

The stock is down 8.1% since reporting and currently trades at $6.06.

Is now the time to buy Olo? Access our full analysis of the earnings results here, it’s free .

Best Q4: Upstart (NASDAQ:UPST)

Founded by the former head of Google's enterprise business, Upstart (NASDAQ:UPST) is an AI-powered lending platform facilitating loans for banks and consumers.

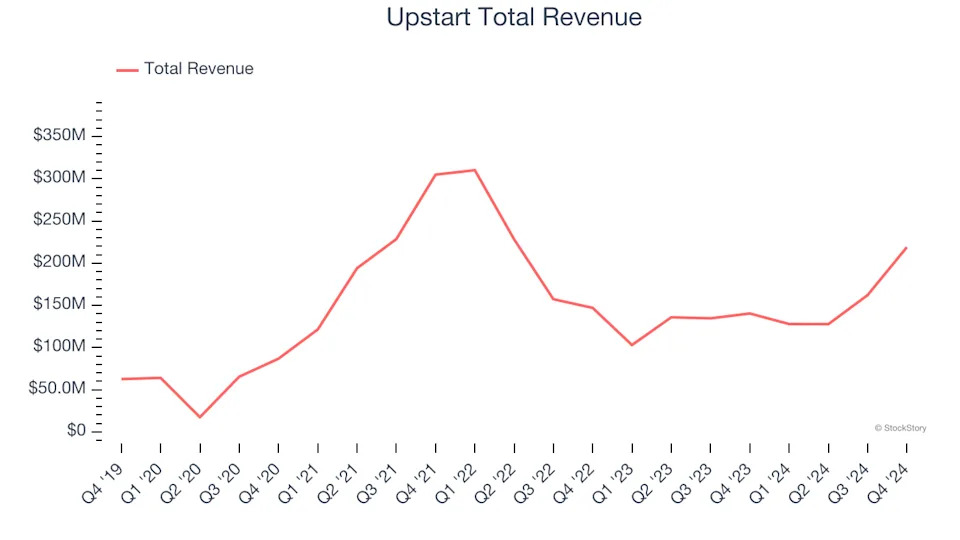

Upstart reported revenues of $219 million, up 56.1% year on year, outperforming analysts’ expectations by 20.1%. The business had an exceptional quarter with EBITDA guidance for next quarter exceeding analysts’ expectations.

Upstart pulled off the biggest analyst estimates beat, fastest revenue growth, and highest full-year guidance raise among its peers. The stock is down 39% since reporting. It currently trades at $41.07.

Is now the time to buy Upstart? Access our full analysis of the earnings results here, it’s free .