3 Reasons ENTG is Risky and 1 Stock to Buy Instead

What a brutal six months it’s been for Entegris. The stock has dropped 33.2% and now trades at $69, rattling many shareholders. This might have investors contemplating their next move.

Is now the time to buy Entegris, or should you be careful about including it in your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free .

Even though the stock has become cheaper, we're swiping left on Entegris for now. Here are three reasons why there are better opportunities than ENTG and a stock we'd rather own.

Why Is Entegris Not Exciting?

With fabs representing the company’s largest customer type, Entegris (NASDAQ:ENTG) supplies products that purify, protect, and generally ensure the integrity of raw materials needed for advanced semiconductor manufacturing.

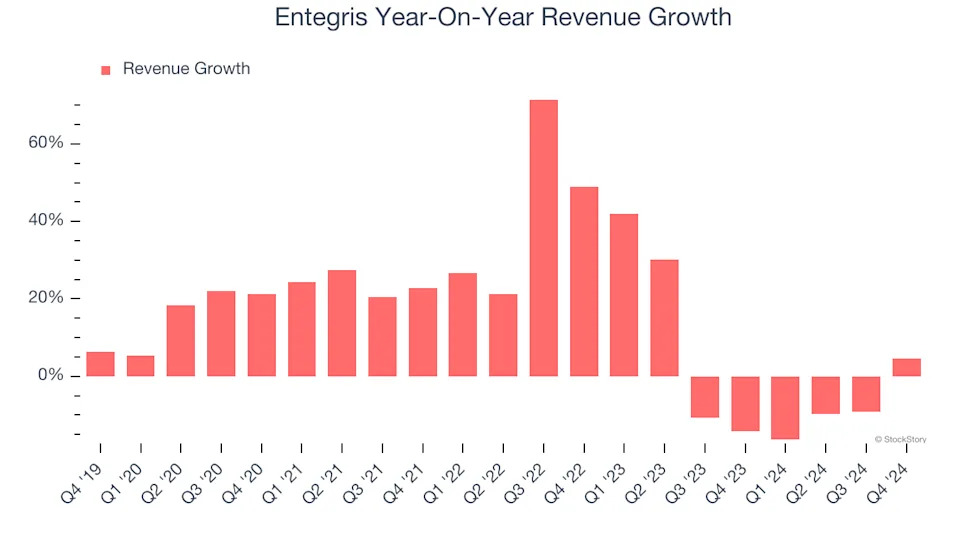

1. Revenue Growth Flatlining

Long-term growth is the most important, but short-term results matter for semiconductors because the rapid pace of technological innovation (Moore's Law) could make yesterday's hit product obsolete today. Entegris’s recent performance shows its demand has slowed significantly as its revenue was flat over the last two years.

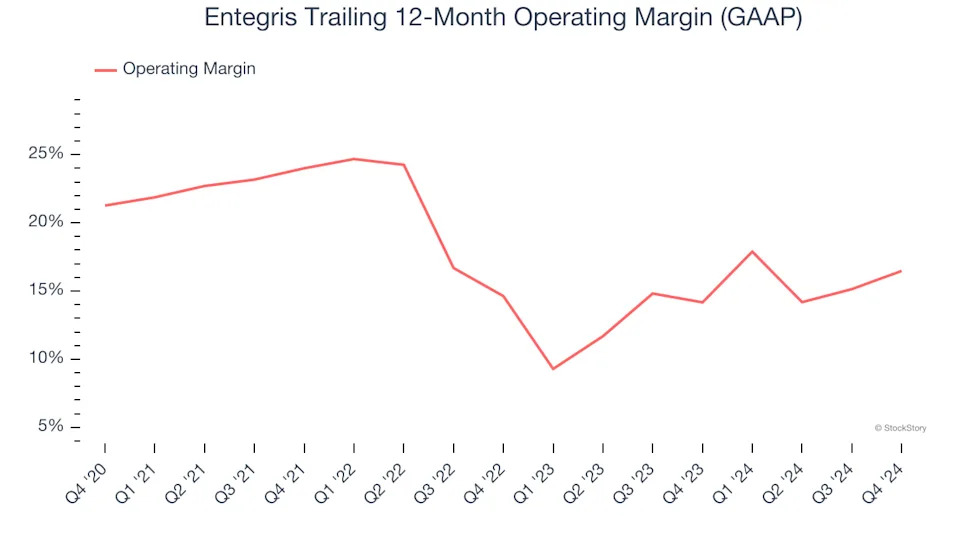

2. Shrinking Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Analyzing the trend in its profitability, Entegris’s operating margin decreased by 4.8 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Its operating margin for the trailing 12 months was 16.5%.

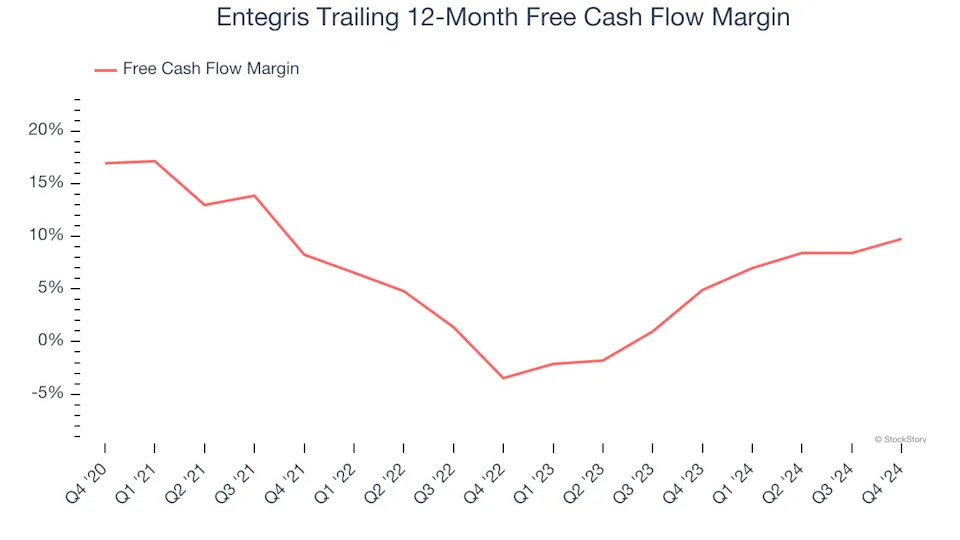

3. Free Cash Flow Margin Dropping

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, Entegris’s margin dropped by 7.2 percentage points over the last five years. It may have ticked higher more recently, but shareholders are likely hoping for its margin to at least revert to its historical level. Almost any movement in the wrong direction is undesirable because of its relatively low cash conversion. If the longer-term trend returns, it could signal it’s becoming a more capital-intensive business. Entegris’s free cash flow margin for the trailing 12 months was 9.8%.

Final Judgment

Entegris’s business quality ultimately falls short of our standards. Following the recent decline, the stock trades at 19× forward price-to-earnings (or $69 per share). This valuation tells us a lot of optimism is priced in - we think there are better opportunities elsewhere. We’d recommend looking at the most dominant software business in the world .