3 Reasons to Avoid PRSU and 1 Stock to Buy Instead

Although the S&P 500 is down 10% over the past six months, Pursuit’s stock price has fallen further to $30.38, losing shareholders 15.1% of their capital. This might have investors contemplating their next move.

Is now the time to buy Pursuit, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free .

Even though the stock has become cheaper, we're cautious about Pursuit. Here are three reasons why we avoid PRSU and a stock we'd rather own.

Why Do We Think Pursuit Will Underperform?

With attractions ranging from glacier tours in the Canadian Rockies to an oceanfront geothermal lagoon in Iceland, Pursuit Attractions and Hospitality (NYSE:PRSU) operates iconic travel experiences, experiential marketing services, and exhibition management across North America and Europe.

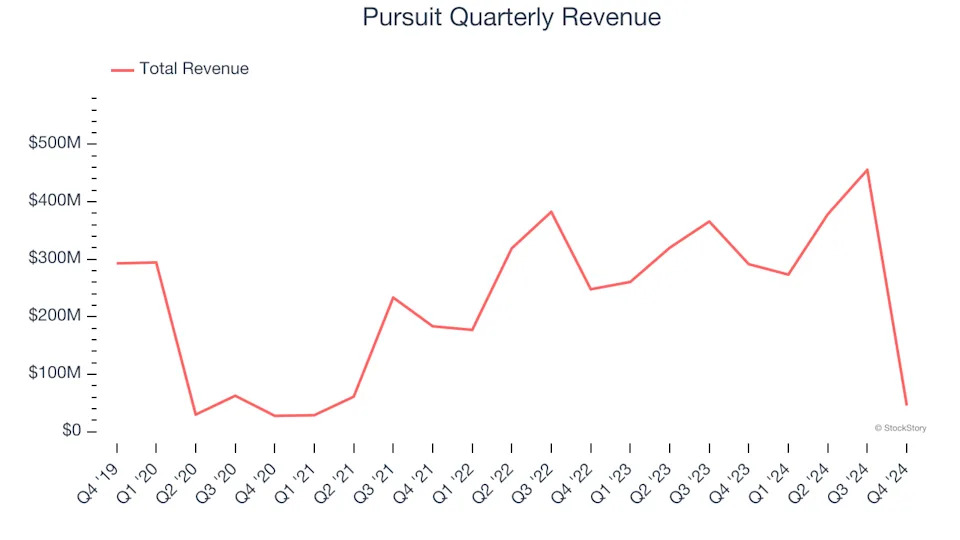

1. Revenue Spiraling Downwards

A company’s long-term performance is an indicator of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Pursuit’s demand was weak over the last five years as its sales fell at a 2.4% annual rate. This wasn’t a great result and is a sign of poor business quality.

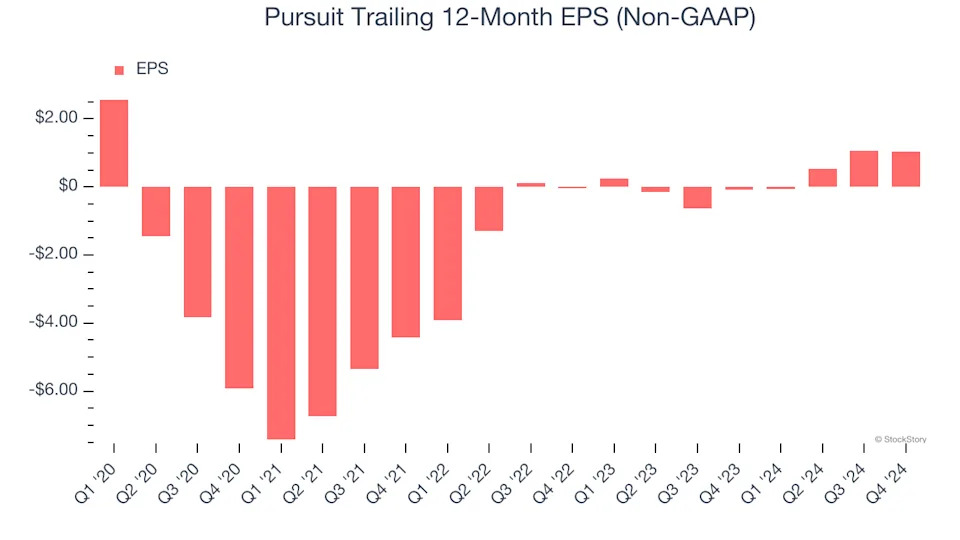

2. EPS Trending Down

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Sadly for Pursuit, its EPS declined by 6.3% annually over the last five years, more than its revenue. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

3. Previous Growth Initiatives Have Lost Money

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Pursuit’s five-year average ROIC was negative 7.1%, meaning management lost money while trying to expand the business. Its returns were among the worst in the consumer discretionary sector.

Final Judgment

Pursuit falls short of our quality standards. Following the recent decline, the stock trades at 121.6× forward price-to-earnings (or $30.38 per share). This multiple tells us a lot of good news is priced in - we think there are better investment opportunities out there. Let us point you toward one of Charlie Munger’s all-time favorite businesses .

Stocks We Would Buy Instead of Pursuit

The market surged in 2024 and reached record highs after Donald Trump’s presidential victory in November, but questions about new economic policies are adding much uncertainty for 2025.