3 Reasons to Sell WWD and 1 Stock to Buy Instead

Woodward has been treading water for the past six months, recording a small return of 3.4% while holding steady at $170.57. However, the stock is beating the S&P 500’s 10% decline during that period.

Is now the time to buy Woodward, or should you be careful about including it in your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free .

Despite the relative momentum, we're sitting this one out for now. Here are three reasons why we avoid WWD and a stock we'd rather own.

Why Is Woodward Not Exciting?

Initially designing controls for water wheels in the early 1900s, Woodward (NASDAQ:WWD) designs, services, and manufactures energy control products and optimization solutions.

1. Long-Term Revenue Growth Disappoints

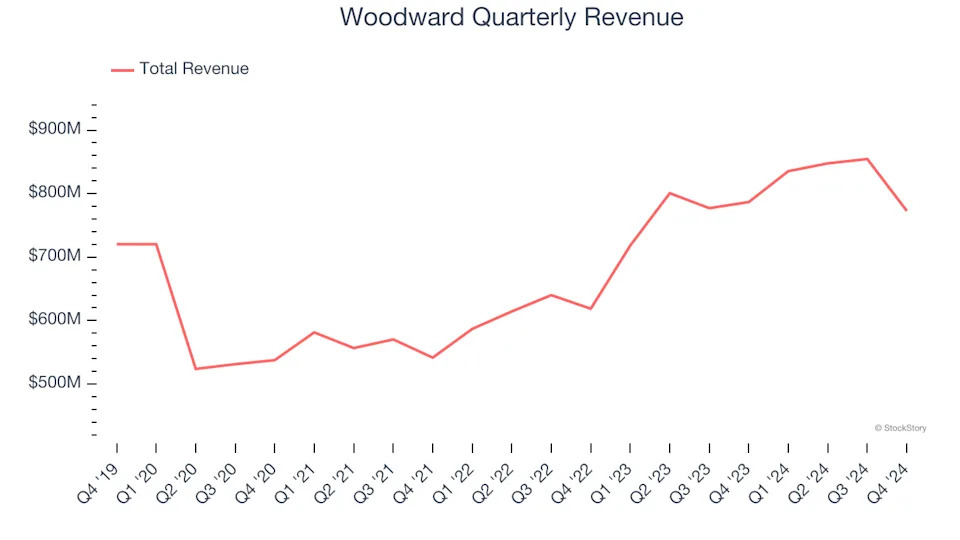

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Woodward grew its sales at a sluggish 2.2% compounded annual growth rate. This fell short of our benchmarks.

2. EPS Barely Growing

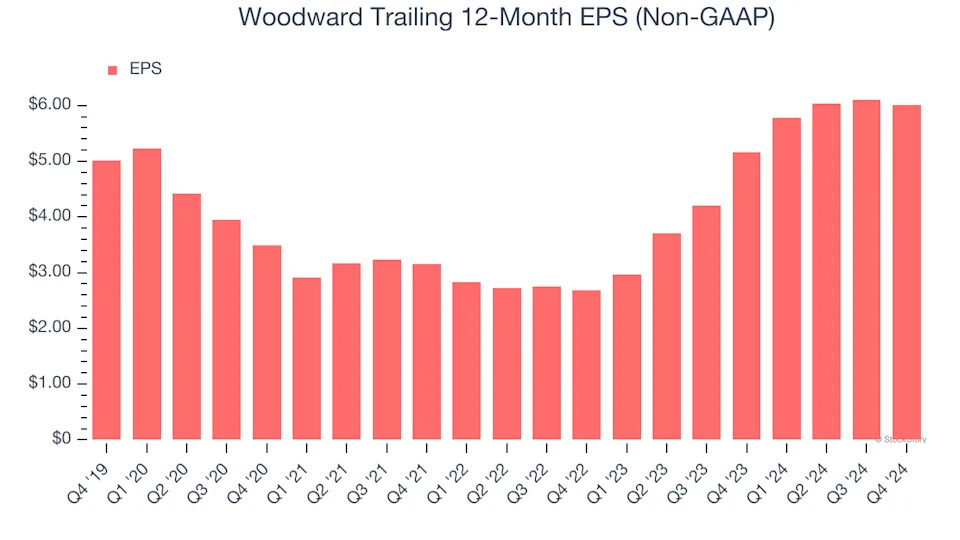

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Woodward’s EPS grew at a weak 3.7% compounded annual growth rate over the last five years. On the bright side, this performance was better than its 2.2% annualized revenue growth and tells us the company became more profitable on a per-share basis as it expanded.

3. Free Cash Flow Margin Dropping

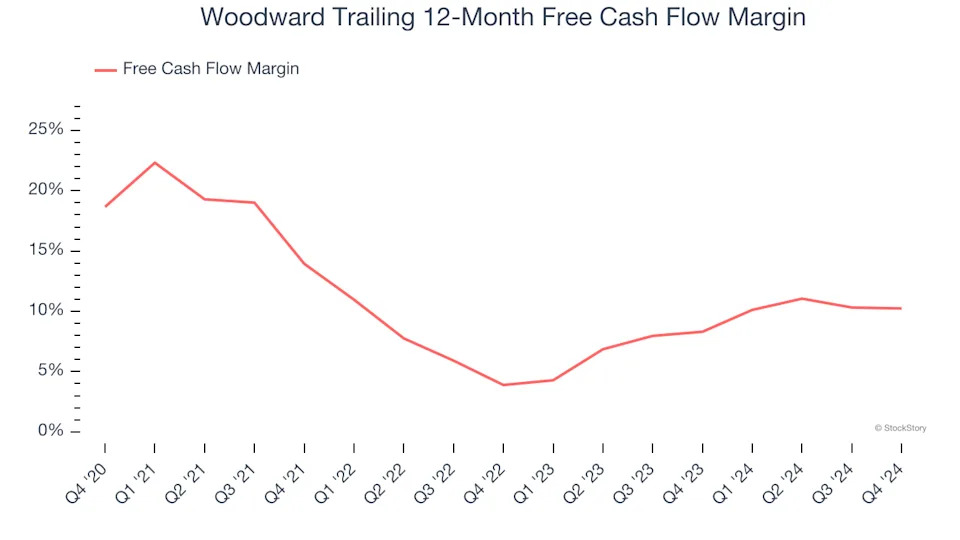

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, Woodward’s margin dropped by 8.4 percentage points over the last five years. If its declines continue, it could signal increasing investment needs and capital intensity. Woodward’s free cash flow margin for the trailing 12 months was 10.2%.

Final Judgment

Woodward isn’t a terrible business, but it isn’t one of our picks. Following its recent outperformance amid a softer market environment, the stock trades at 26.2× forward price-to-earnings (or $170.57 per share). This valuation tells us it’s a bit of a market darling with a lot of good news priced in - we think there are better investment opportunities out there. Let us point you toward the most entrenched endpoint security platform on the market .

Stocks We Like More Than Woodward

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.