3 Reasons to Sell BLCO and 1 Stock to Buy Instead

Bausch + Lomb has gotten torched over the last six months - since October 2024, its stock price has dropped 41.5% to $12.06 per share. This might have investors contemplating their next move.

Is now the time to buy Bausch + Lomb, or should you be careful about including it in your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free .

Even though the stock has become cheaper, we don't have much confidence in Bausch + Lomb. Here are three reasons why you should be careful with BLCO and a stock we'd rather own.

Why Is Bausch + Lomb Not Exciting?

With a nearly 170-year history dedicated to vision care and eye health innovation, Bausch + Lomb (NYSE:BLCO) develops and manufactures a comprehensive range of eye health products including contact lenses, pharmaceuticals, surgical devices, and consumer eye care solutions.

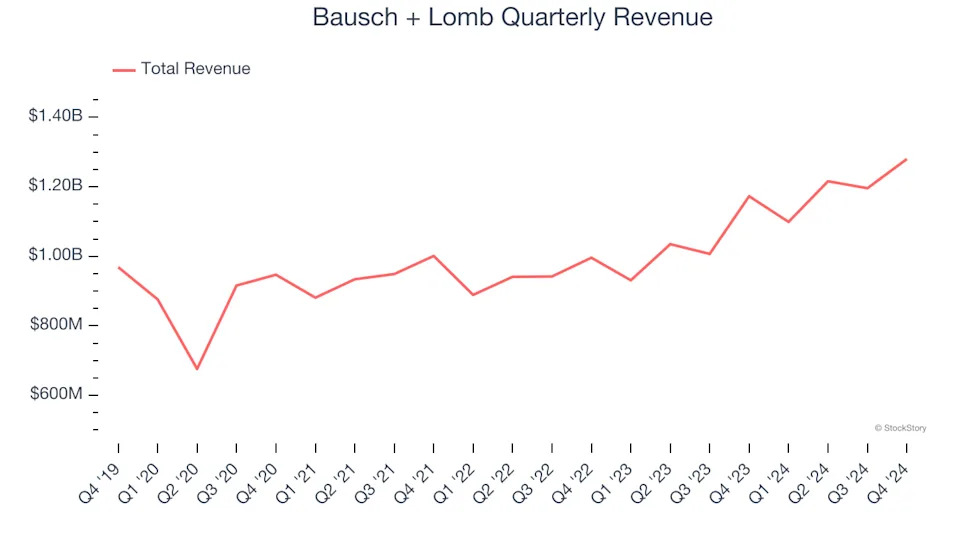

1. Long-Term Revenue Growth Disappoints

Reviewing a company’s long-term sales performance reveals insights into its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, Bausch + Lomb grew its sales at a mediocre 5% compounded annual growth rate. This fell short of our benchmark for the healthcare sector.

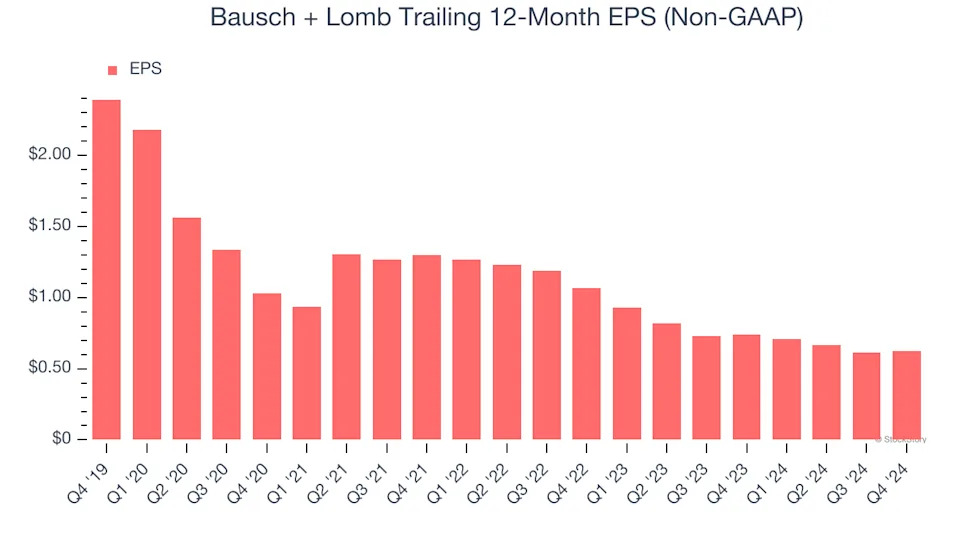

2. EPS Trending Down

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Sadly for Bausch + Lomb, its EPS declined by 23.5% annually over the last five years while its revenue grew by 5%. This tells us the company became less profitable on a per-share basis as it expanded.

3. Short Cash Runway Exposes Shareholders to Potential Dilution

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

Bausch + Lomb burned through $59 million of cash over the last year, and its $4.78 billion of debt exceeds the $316 million of cash on its balance sheet. This is a deal breaker for us because indebted loss-making companies spell trouble.

Unless the Bausch + Lomb’s fundamentals change quickly, it might find itself in a position where it must raise capital from investors to continue operating. Whether that would be favorable is unclear because dilution is a headwind for shareholder returns.

We remain cautious of Bausch + Lomb until it generates consistent free cash flow or any of its announced financing plans materialize on its balance sheet.