Healthcare Technology Stocks Q4 In Review: Hims & Hers Health (NYSE:HIMS) Vs Peers

Let’s dig into the relative performance of Hims & Hers Health (NYSE:HIMS) and its peers as we unravel the now-completed Q4 healthcare technology earnings season.

Healthcare Technology

The 9 healthcare technology stocks we track reported a slower Q4. As a group, revenues beat analysts’ consensus estimates by 2.3% while next quarter’s revenue guidance was in line.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 17.7% since the latest earnings results.

Hims & Hers Health (NYSE:HIMS)

Originally launched with a focus on stigmatized conditions like hair loss and sexual health, Hims & Hers Health (NYSE:HIMS) operates a consumer-focused telehealth platform that connects patients with healthcare providers for prescriptions and wellness products.

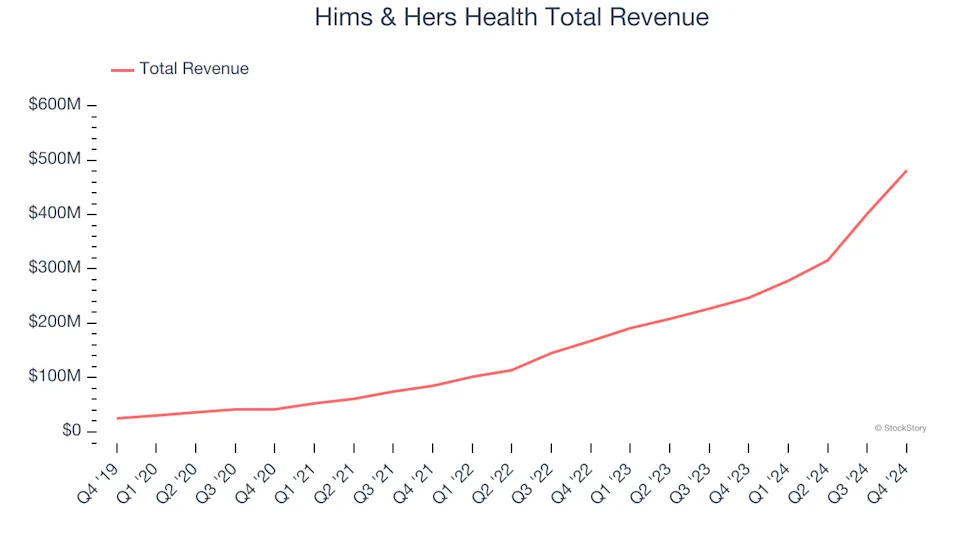

Hims & Hers Health reported revenues of $481.1 million, up 95.1% year on year. This print exceeded analysts’ expectations by 2.2%. Overall, it was a satisfactory quarter for the company with full-year revenue guidance exceeding analysts’ expectations.

“2024 was a fantastic year at Hims and Hers as we continue to build a platform that leverages personalization and technology unlike any traditional healthcare system,” said Andrew Dudum, co-founder and CEO.

Hims & Hers Health achieved the fastest revenue growth and highest full-year guidance raise of the whole group. The company added 182,000 customers to reach a total of 2.23 million. Even though it had a relatively good quarter, the market seems discontent with the results. The stock is down 0.6% since reporting and currently trades at $27.49.

Is now the time to buy Hims & Hers Health? Access our full analysis of the earnings results here, it’s free .

Best Q4: Phreesia (NYSE:PHR)

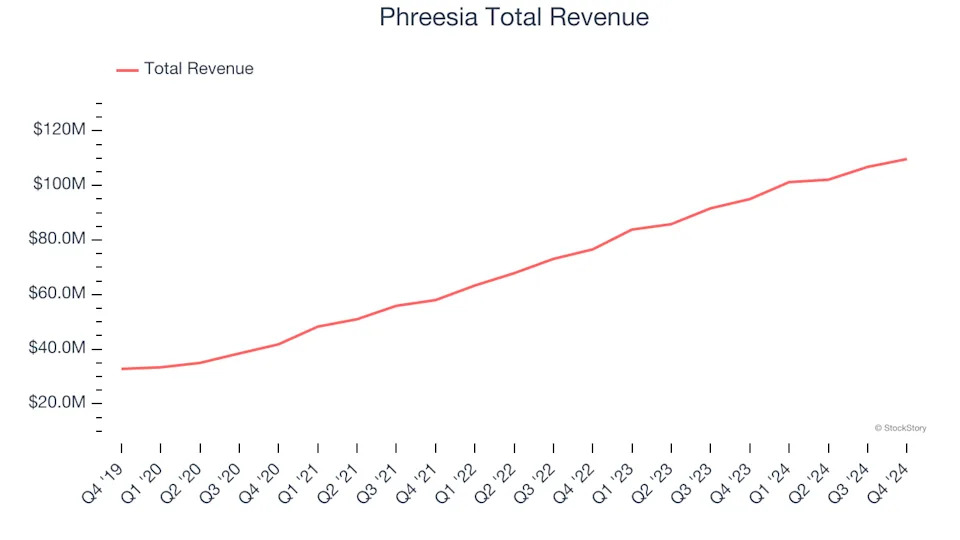

Founded in 2005 to streamline the traditionally paper-heavy patient check-in process, Phreesia (NYSE:PHR) provides software solutions that automate patient intake, registration, and payment processes for healthcare organizations while improving patient engagement in their care.

Phreesia reported revenues of $109.7 million, up 15.4% year on year, outperforming analysts’ expectations by 0.7%. The business had a strong quarter with an impressive beat of analysts’ EPS estimates and full-year EBITDA guidance topping analysts’ expectations.

However, the results were likely priced into the stock as it’s traded sideways since reporting. Shares currently sit at $24.03.

Is now the time to buy Phreesia? Access our full analysis of the earnings results here, it’s free .

Weakest Q4: Evolent Health (NYSE:EVH)

Founded in 2011 to transform how healthcare is delivered to patients with complex needs, Evolent Health (NYSE:EVH) provides specialty care management services and technology solutions that help health plans and providers deliver better care for patients with complex conditions.