3 Reasons to Avoid OLPX and 1 Stock to Buy Instead

Olaplex has gotten torched over the last six months - since October 2024, its stock price has dropped 45.5% to $1.14 per share. This may have investors wondering how to approach the situation.

Is now the time to buy Olaplex, or should you be careful about including it in your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free .

Even with the cheaper entry price, we're sitting this one out for now. Here are three reasons why there are better opportunities than OLPX and a stock we'd rather own.

Why Is Olaplex Not Exciting?

Rising to fame on TikTok because of its “bond building" hair products, Olaplex (NASDAQ:OLPX) offers products and treatments that repair the damage caused by traditional heat and chemical-based styling goods.

1. Revenue Spiraling Downwards

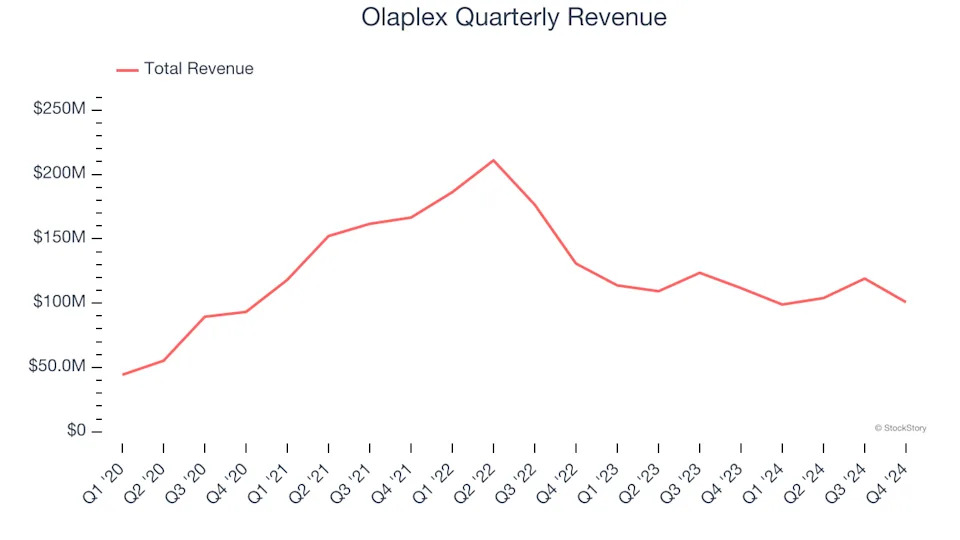

A company’s long-term sales performance is one signal of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Olaplex struggled to consistently generate demand over the last three years as its sales dropped at a 10.9% annual rate. This wasn’t a great result and signals it’s a lower quality business.

2. Shrinking Operating Margin

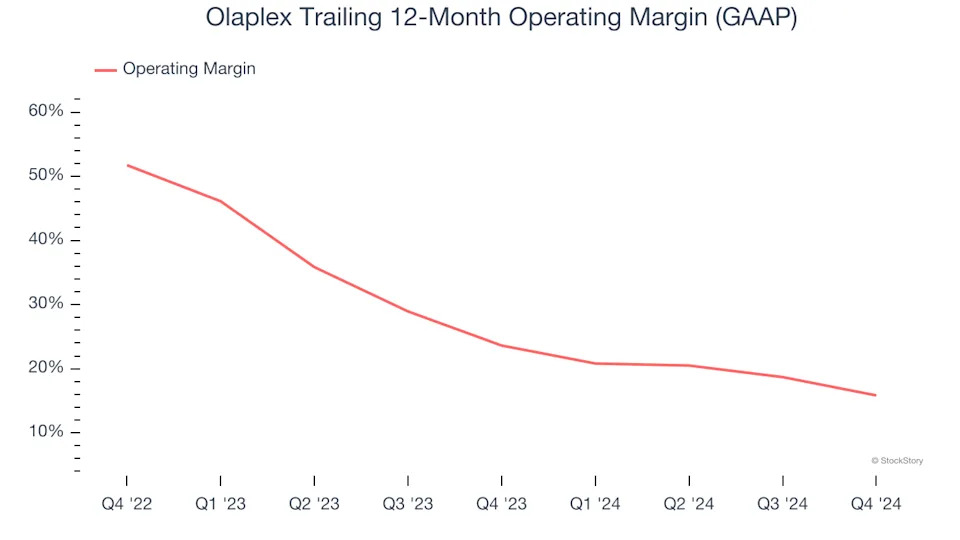

Operating margin is an important measure of profitability accounting for key expenses such as marketing and advertising, IT systems, wages, and other administrative costs.

Looking at the trend in its profitability, Olaplex’s operating margin decreased by 7.8 percentage points over the last year. Even though its historical margin was healthy, shareholders will want to see Olaplex become more profitable in the future. Its operating margin for the trailing 12 months was 15.8%.

3. EPS Trending Down

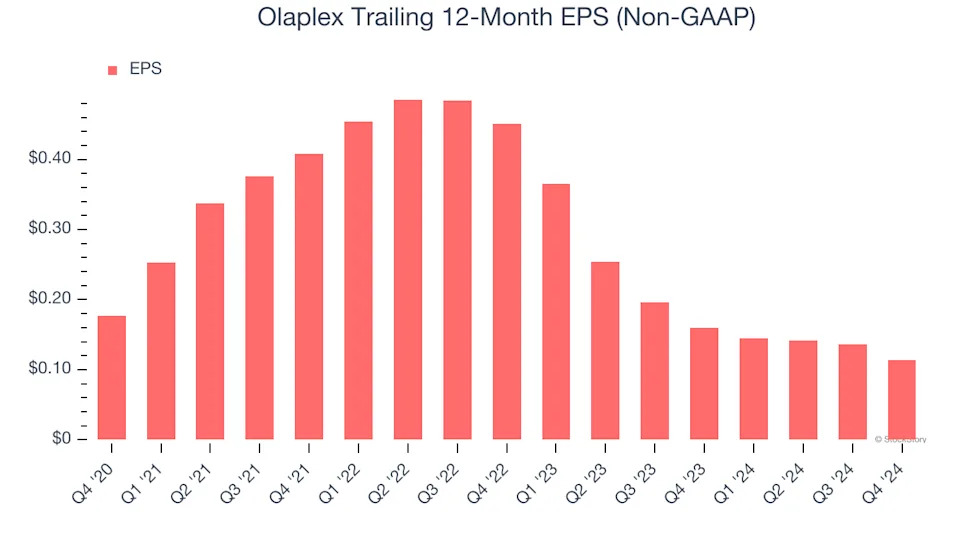

Analyzing the change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Sadly for Olaplex, its EPS declined by 34.7% annually over the last three years, more than its revenue. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

Final Judgment

Olaplex isn’t a terrible business, but it doesn’t pass our bar. After the recent drawdown, the stock trades at 10× forward price-to-earnings (or $1.14 per share). While this valuation is optically cheap, the potential downside is big given its shaky fundamentals. We're pretty confident there are superior stocks to buy right now. We’d recommend looking at one of our top software and edge computing picks .