3 Reasons to Sell BTSG and 1 Stock to Buy Instead

Even during a down period for the markets, BrightSpring Health Services has gone against the grain, climbing to $17.29. Its shares have yielded a 8.7% return over the last six months, beating the S&P 500 by 17.6%. This run-up might have investors contemplating their next move.

Is there a buying opportunity in BrightSpring Health Services, or does it present a risk to your portfolio? See what our analysts have to say in our full research report, it’s free .

We’re glad investors have benefited from the price increase, but we're swiping left on BrightSpring Health Services for now. Here are three reasons why BTSG doesn't excite us and a stock we'd rather own.

Why Is BrightSpring Health Services Not Exciting?

Founded in 1974, BrightSpring Health Services (NASDAQ:BTSG) offers home health care, hospice, neuro-rehabilitation, and pharmacy services.

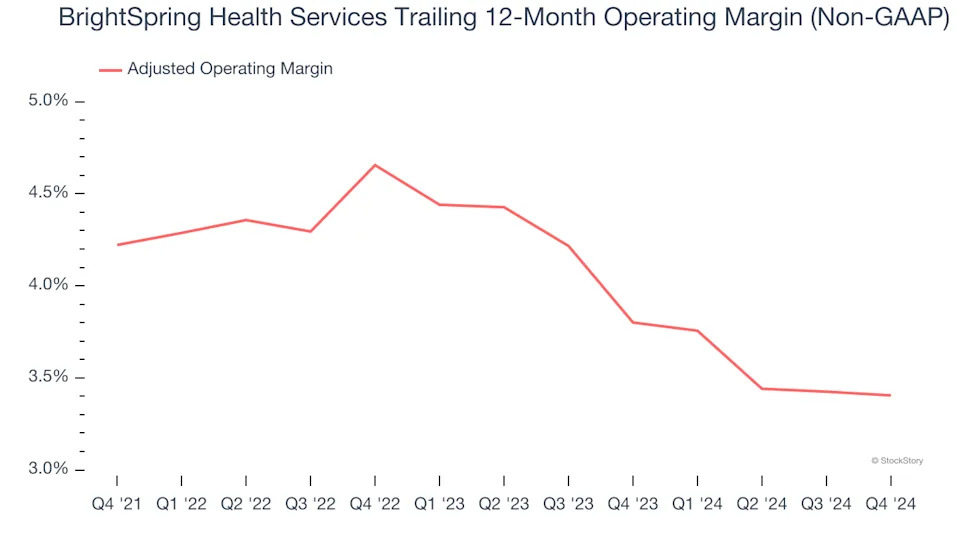

1. Shrinking Adjusted Operating Margin

Adjusted operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies because it excludes non-recurring expenses, interest on debt, and taxes.

Looking at the trend in its profitability, BrightSpring Health Services’s adjusted operating margin decreased by 1.3 percentage points over the last two years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. BrightSpring Health Services’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers. Its adjusted operating margin for the trailing 12 months was 3.4%.

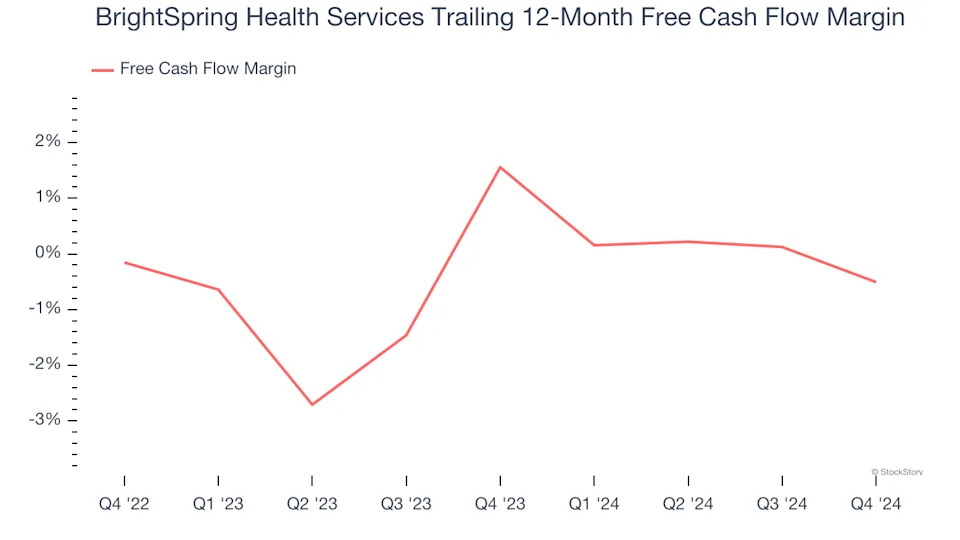

2. Free Cash Flow Margin Dropping

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, BrightSpring Health Services’s margin dropped by 6.2 percentage points over the last five years. Almost any movement in the wrong direction is undesirable because of its already low cash conversion. If the trend continues, it could signal it’s becoming a more capital-intensive business. BrightSpring Health Services’s free cash flow margin for the trailing 12 months was breakeven.

3. Previous Growth Initiatives Haven’t Impressed

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).