3 Reasons ATRO is Risky and 1 Stock to Buy Instead

Since April 2020, the S&P 500 has delivered a total return of 85%. But one standout stock has more than doubled the market - over the past five years, Astronics has surged 197% to $24 per share. Its momentum hasn’t stopped as it’s also gained 14.1% in the last six months thanks to its solid quarterly results, beating the S&P by 23%.

Is now the time to buy Astronics, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free .

We’re glad investors have benefited from the price increase, but we don't have much confidence in Astronics. Here are three reasons why we avoid ATRO and a stock we'd rather own.

Why Is Astronics Not Exciting?

Integrating power outlets into many Boeing aircraft, Astronics (NASDAQ:ATRO) is a provider of technologies and services to the global aerospace, defense, and electronics industries.

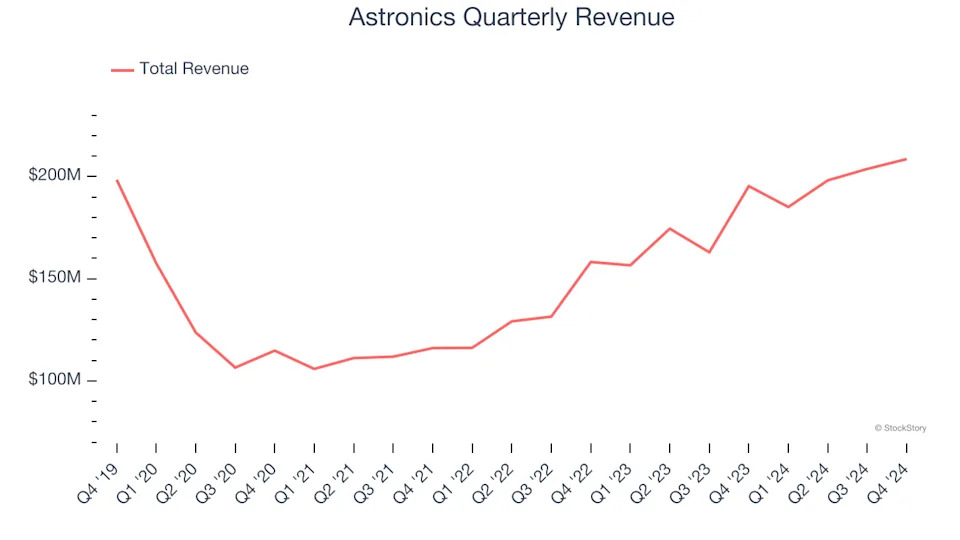

1. Long-Term Revenue Growth Flatter Than a Pancake

Reviewing a company’s long-term sales performance reveals insights into its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Unfortunately, Astronics struggled to consistently increase demand as its $795.4 million of sales for the trailing 12 months was close to its revenue five years ago. This wasn’t a great result and signals it’s a lower quality business.

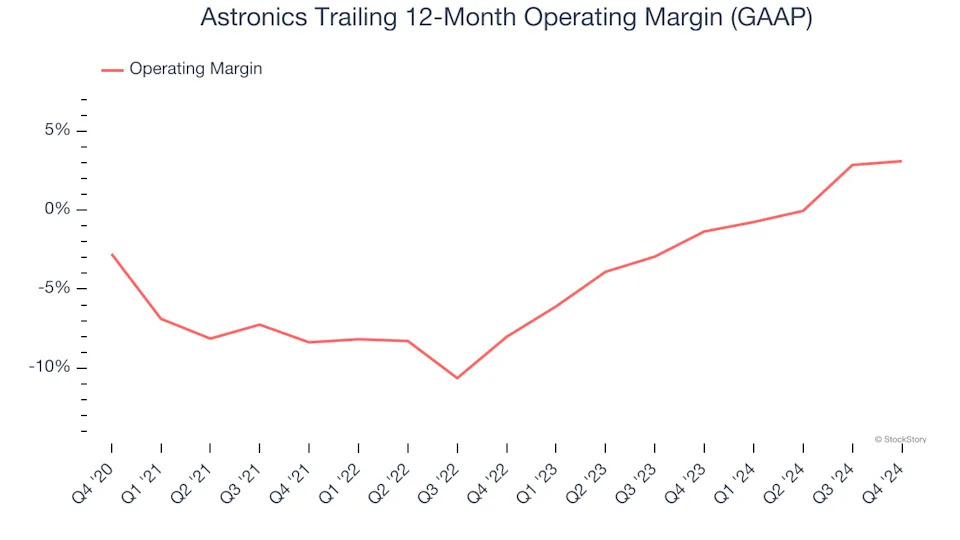

2. Operating Losses Sound the Alarms

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling those products, and most importantly, keeping them relevant through research and development.

Although Astronics was profitable this quarter from an operational perspective, it’s generally struggled over a longer time period. Its expensive cost structure has contributed to an average operating margin of negative 2.7% over the last five years. Unprofitable industrials companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

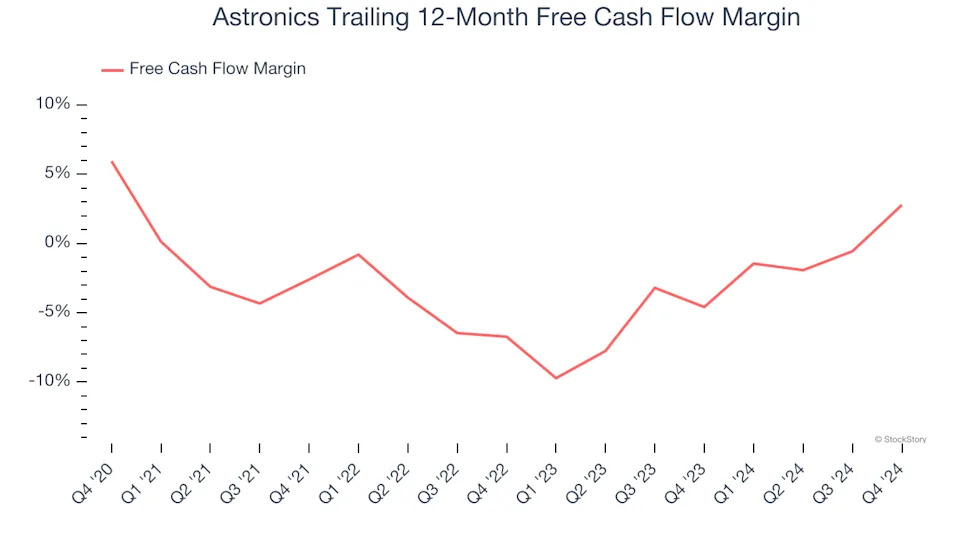

3. Breakeven Free Cash Flow Limits Reinvestment Potential

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Astronics broke even from a free cash flow perspective over the last five years, giving the company limited opportunities to return capital to shareholders.