EM Stocks Gain as Talks Between Japan and US Boost Sentiment

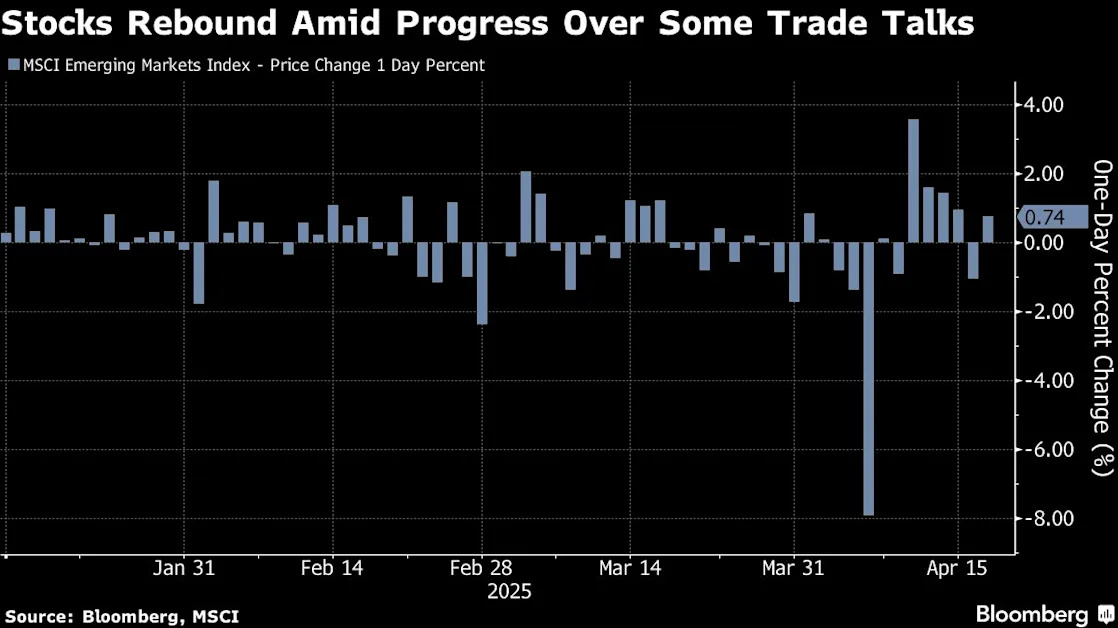

(Bloomberg) -- Stocks in developing nations were on track for their best daily performance in a month on Thursday, as progress in trade talks between the US and Japan spurred investor optimism.

Most Read from Bloomberg

The Japan talks are being closely watched as a test case for other nations uncertain over what concessions President Donald Trump will seek to extract in order to soften or remove tariffs. A gauge that tracks emerging-market stocks reacted positively, rising 0.8% with Asian shares leading the gains.

A sister index for currencies gained as much as 0.2% during the morning trading session, buoyed by a rising Mexican peso. Earlier, Trump posted on Truth Social that he had a productive call with Mexico’s President Claudia Sheinbaum on Wednesday, briefly pushing the currency to a session high.

Listen to the Here’s Why podcast on Apple, Spotify or anywhere you listen.

Eastern European currencies lagged their peers, with the Hungarian forint and the Polish zloty leading the losses.

“EM FX is benefitting from renewed hopes that tariff talks between the U.S and other regions can reach a resolution to disagreements over trade,” said Juan Perez, a foreign-exchange trader at Monex. “Emerging markets have a lot to gain from a more flexible White House.”

Meanwhile, Turkey raised its one-week repo rate to 46% from 42.5%, a surprise move aimed at reassuring investors after domestic turmoil and worries over US tariffs triggered a selloff in the lira. The currency strengthened as much as 0.2% against the US dollar after the decision.

Money managers accelerated their exodus from Turkish lira-denominated government bonds last week, which led a record weekly outflow of $2.8 billion.

Investors are also awaiting a rate decision in Egypt. The central bank is poised to cut interest rates for the first time in almost five years, with expectations for a cut varying between 75 and 225 basis points, a sign of the unpredictability wrought by US tariff plans.

Most Read from Bloomberg Businessweek

©2025 Bloomberg L.P.