Resist the urge to buy the dip in stocks because recession risk is still being ignored, research firm says

Daniel von Ahlen, a senior macro strategist at GlobalData TS Lombard, says now is not the time to buy the broad decline in stocks.

The S&P 500 is down 13% from its mid-February peak as investors worry about the impacts of President Donald Trump's tariffs.

But they're not worrying enough, von Ahlen said in a note on Wednesday, adding that investors are complacent and "significantly underpricing" the risk of an imminent recession.

"Trump's tariff reprieve has triggered a relief rally in equity markets, but we think it will be short-lived and recommend selling into rallies and staying away from buying the dip," von Ahlen said.

He said consensus estimates for US GDP growth this year were "too rich" at 1.8%. That type of growth is inconsistent with a tariff-induced downturn taking shape, as higher prices are likely to weigh down consumers' purchasing power.

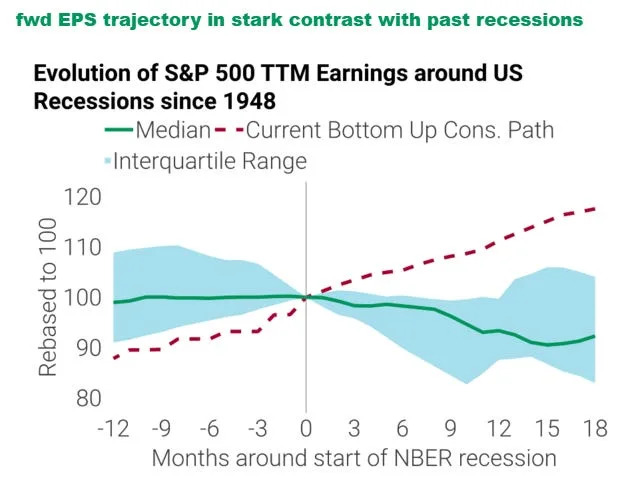

This disconnect is clearly illustrated in the chart below, which shows the median decline in corporate earnings during past recessions compared with rising corporate profit expectations over the next year.

And it's not just the tariffs

Von Ahlen said federal government spending cuts by the White House DOGE office would negatively influence the labor market and lead to lower corporate profits.

And if the Trump administration wants to pass tax cuts, DOGE will have to do a lot more spending cuts as an offset, which would put further pressure on the economy, the note said.

Another concern for investors is the potential for a slowdown in corporate investment spending and hiring intentions due to the "pervasive uncertainty" of Trump's economic policies, the note added.

Finally, the crackdown on immigration could lead to a decline in the US labor force growth.

"Collectively, these factors could be powerful enough to push the US economy into recession, especially as rapidly cooling real personal income growth leaves little room for error," von Ahlen said.

The stock market sell-off is its own problem

While the stock market is not the economy, they are closely linked, and the sky-high volatility in recent weeks could ultimately become a problem for the economy .

That's because of the wealth effect , which is the idea that rising asset values make consumers more confident to spend more money.