The 14 Fortune 500 stocks most exposed to the tariff war

Tariff uncertainty is roiling the markets and leaving major companies in a state of heightened alert. The global stock market plummeted after President Donald Trump instituted tariffs for the vast majority of the U.S.'s trading partners on April 2, wiping out trillions of dollars of wealth in the process. While the market rebounded after Trump announced a 90-day pause on certain tariffs, others are still in effect—notably a 10% tariff on nearly all global imports, a 25% levy on imported cars and auto parts, and a 145% tariff on goods imported from China are in effect as well. Companies are already feeling the pain—and some more than others.

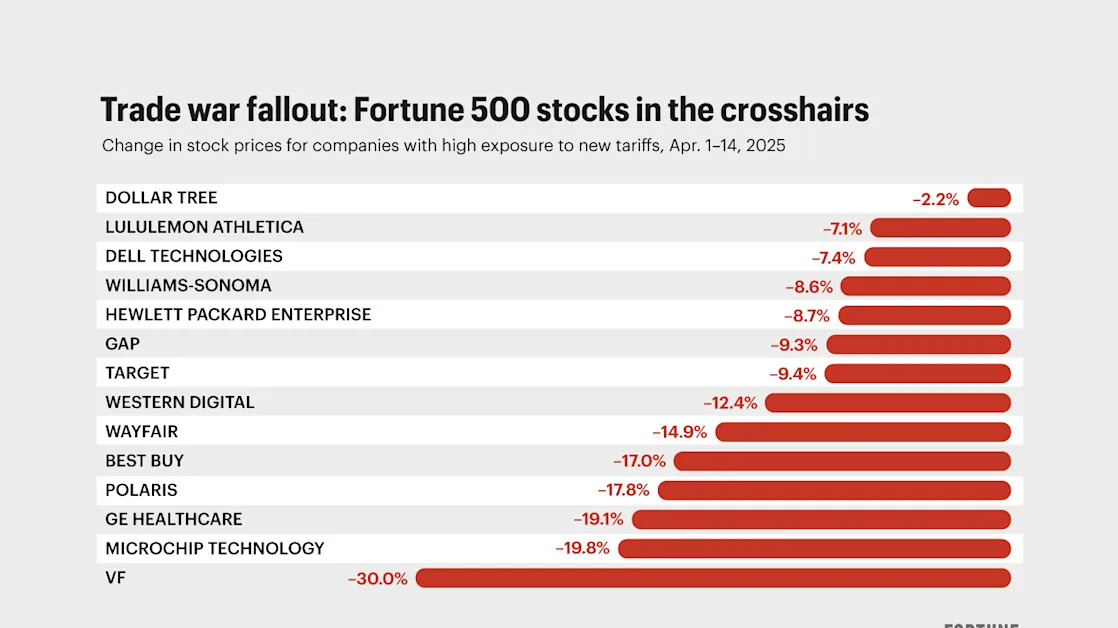

To get a sense of which companies are getting hit hardest by tariff turmoil, Fortune parsed stock market data from Morningstar. The findings are shown in the chart below, which identifies 14 Fortune 500 companies, along with their rank and industry sector, and shows how their share prices performed since tariffs began to bite.

View this interactive chart on Fortune.com

Apparel and retail

As the chart shows, the stock price of VF Corporation ( No. 355 ) has been hit particularly hard, declining 30%. The global apparel and footwear company is known for its portfolio of brands, including The North Face, Timberland, and Vans. VF has a strong reliance on China and Vietnam—both prime targets for Trump's tariffs—for its suppliers .

Meanwhile, Wayfair ( No. 346) , the online retailer of home goods, has experienced a 15% drop. The company has higher exposure to Vietnam than some of its competitors. Shares of athletic apparel retailer Lululemon ( No. 411 ) fell 7%.

Industrials, hardware, semiconductors

The stock price for Arizona-based Microchip Technology ( No. 447 ), a semiconductor company, was down about 20%. The company made its debut on the Fortune 500 in 2024. Currently, semiconductors are excluded from the tariff increases, but the stock price took a hit over concerns demand for chips would weaken. Microchip Technology's woes could soon worsen as the Trump administration is now eying new tariffs on semiconductors.

Western Digital ( No. 334 ), a data storage company, saw its stock price fall about 12%. The company has a significant presence in China . Shares of Dell Technologies ( No. 48 ) dipped 7% and HP Enterprise's ( No. 147 ) stock price fell about 9%.

Medical technology and devices

The stock price of GE Healthcare Technologies ( No. 206 ) fell 19%. Last week, GE Healthcare was among the U.S. companies that participated in a roundtable with China’s Ministry of Commerce. Despite ongoing trade tensions and China’s retaliatory tariffs, the vice minister of commerce said the country remains committed to reform and opening up.