Analog Semiconductors Stocks Q4 Highlights: Analog Devices (NASDAQ:ADI)

As the Q4 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers in the analog semiconductors industry, including Analog Devices (NASDAQ:ADI) and its peers.

Demand for analog chips is generally linked to the overall level of economic growth, as analog chips serve as the building blocks of most electronic goods and equipment. Unlike digital chip designers, analog chip makers tend to produce the majority of their own chips, as analog chip production does not require expensive leading edge nodes. Less dependent on major secular growth drivers, analog product cycles are much longer, often 5-7 years.

The 15 analog semiconductors stocks we track reported a mixed Q4. As a group, revenues beat analysts’ consensus estimates by 1.7% while next quarter’s revenue guidance was above.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 27.4% since the latest earnings results.

Analog Devices (NASDAQ:ADI)

Founded by two MIT graduates, Ray Stata and Matthew Lorber in 1965, Analog Devices (NASDAQ:ADI) is one of the largest providers of high performance analog integrated circuits used mainly in industrial end markets, along with communications, autos, and consumer devices.

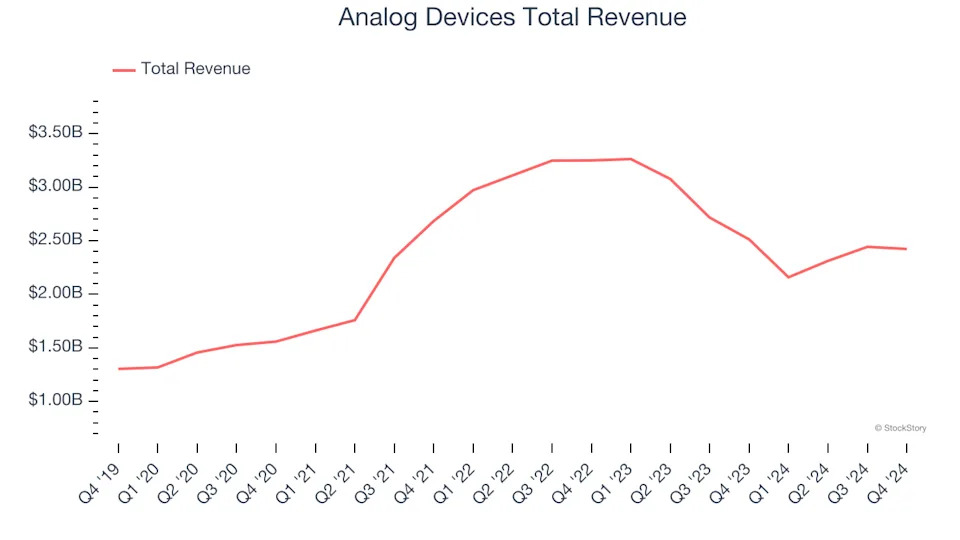

Analog Devices reported revenues of $2.42 billion, down 3.6% year on year. This print exceeded analysts’ expectations by 2.9%. Overall, it was a strong quarter for the company with a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ adjusted operating income estimates.

"ADI delivered first quarter revenue, profitability, and earnings per share above the midpoint of our outlook, despite the challenging macro and geopolitical backdrop," said Vincent Roche, CEO and Chair.

The stock is down 18.9% since reporting and currently trades at $178.47.

Is now the time to buy Analog Devices? Access our full analysis of the earnings results here, it’s free .

Best Q4: Himax (NASDAQ:HIMX)

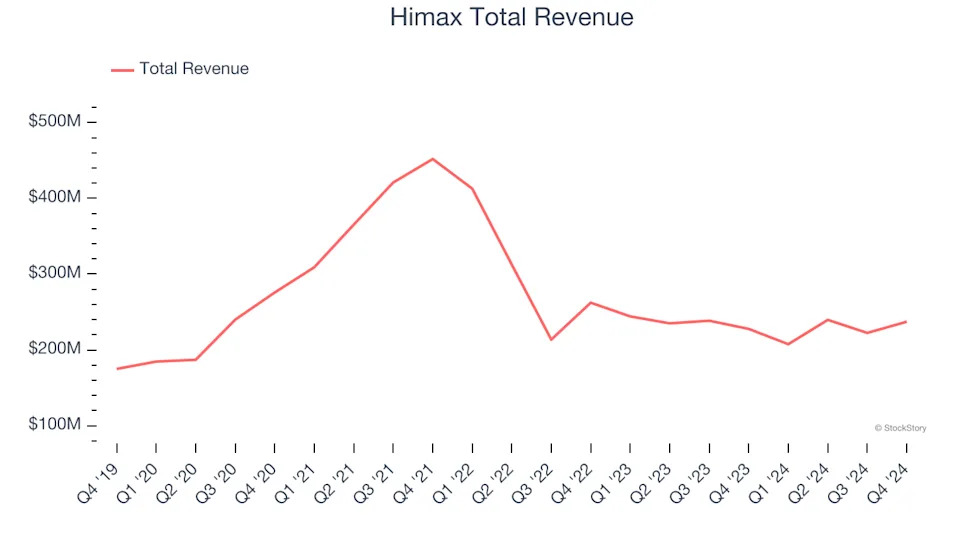

Taiwan-based Himax Technologies (NASDAQ:HIMX) is a leading manufacturer of display driver chips and timing controllers used in TVs, laptops, and mobile phones.

Himax reported revenues of $237.2 million, up 4.2% year on year, outperforming analysts’ expectations by 7.3%. The business had a stunning quarter with a significant improvement in its inventory levels and a solid beat of analysts’ EPS estimates.

The stock is down 27% since reporting. It currently trades at $6.66.

Is now the time to buy Himax? Access our full analysis of the earnings results here, it’s free .

Slowest Q4: Vishay Intertechnology (NYSE:VSH)

Named after the founder's ancestral village in present-day Lithuania, Vishay Intertechnology (NYSE:VSH) manufactures simple chips and electronic components that are building blocks of virtually all types of electronic devices.