3 Reasons to Sell CSV and 1 Stock to Buy Instead

Since April 2020, the S&P 500 has delivered a total return of 91.4%. But one standout stock has nearly doubled the market - over the past five years, Carriage Services has surged 170% to $37.31 per share. Its momentum hasn’t stopped as it’s also gained 18.6% in the last six months, beating the S&P by 26.9%.

Is there a buying opportunity in Carriage Services, or does it present a risk to your portfolio? Get the full breakdown from our expert analysts, it’s free .

We’re glad investors have benefited from the price increase, but we're sitting this one out for now. Here are three reasons why CSV doesn't excite us and a stock we'd rather own.

Why Is Carriage Services Not Exciting?

Established in 1991, Carriage Services (NYSE:CSV) is a provider of funeral and cemetery services in the United States.

1. Long-Term Revenue Growth Disappoints

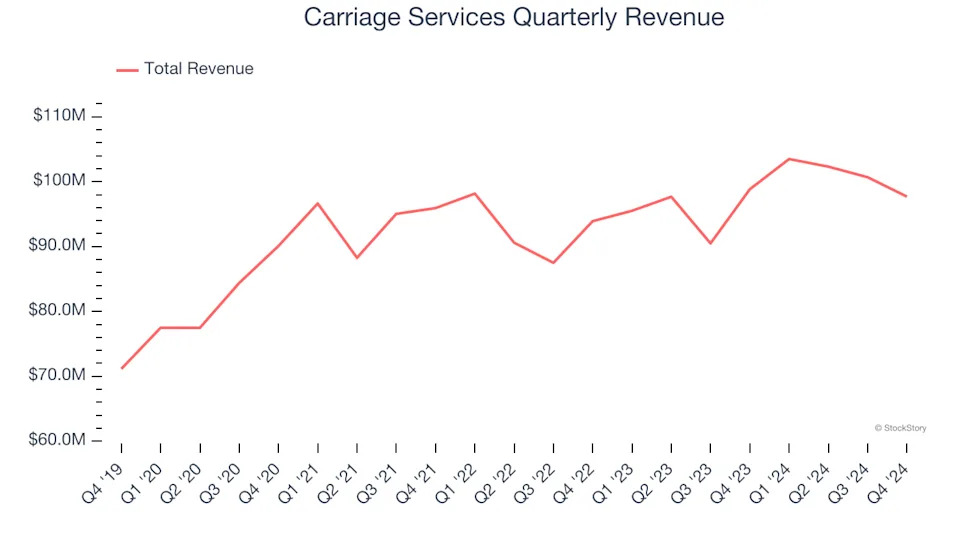

A company’s long-term sales performance is one signal of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Unfortunately, Carriage Services’s 8.1% annualized revenue growth over the last five years was sluggish. This was below our standard for the consumer discretionary sector.

2. Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Carriage Services’s revenue to rise by 7.2%. While this projection suggests its newer products and services will spur better top-line performance, it is still below the sector average.

3. Previous Growth Initiatives Haven’t Impressed

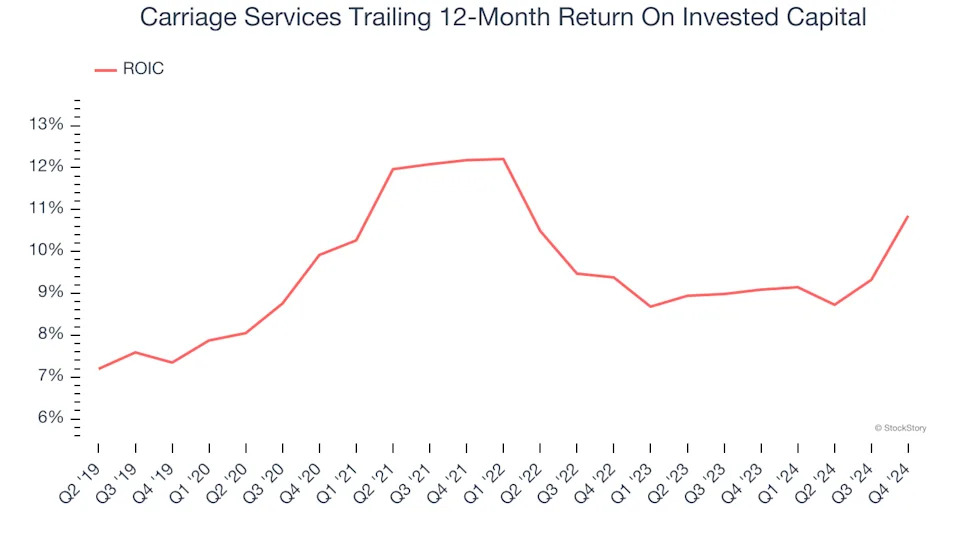

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Carriage Services historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 10.3%, somewhat low compared to the best consumer discretionary companies that consistently pump out 25%+.

Final Judgment

Carriage Services isn’t a terrible business, but it doesn’t pass our quality test. With its shares outperforming the market lately, the stock trades at 12.6× forward price-to-earnings (or $37.31 per share). This valuation multiple is fair, but we don’t have much faith in the company. We're fairly confident there are better investments elsewhere. We’d suggest looking at our favorite semiconductor picks and shovels play .