3 Reasons to Avoid ACHC and 1 Stock to Buy Instead

What a brutal six months it’s been for Acadia Healthcare. The stock has dropped 56.9% and now trades at $24.75, rattling many shareholders. This was partly due to its softer quarterly results and may have investors wondering how to approach the situation.

Is there a buying opportunity in Acadia Healthcare, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free .

Even with the cheaper entry price, we don't have much confidence in Acadia Healthcare. Here are three reasons why there are better opportunities than ACHC and a stock we'd rather own.

Why Is Acadia Healthcare Not Exciting?

With a network of over 250 facilities serving patients in 38 states and Puerto Rico, Acadia Healthcare (NASDAQ:ACHC) operates facilities providing mental health and substance use disorder treatment services across the United States.

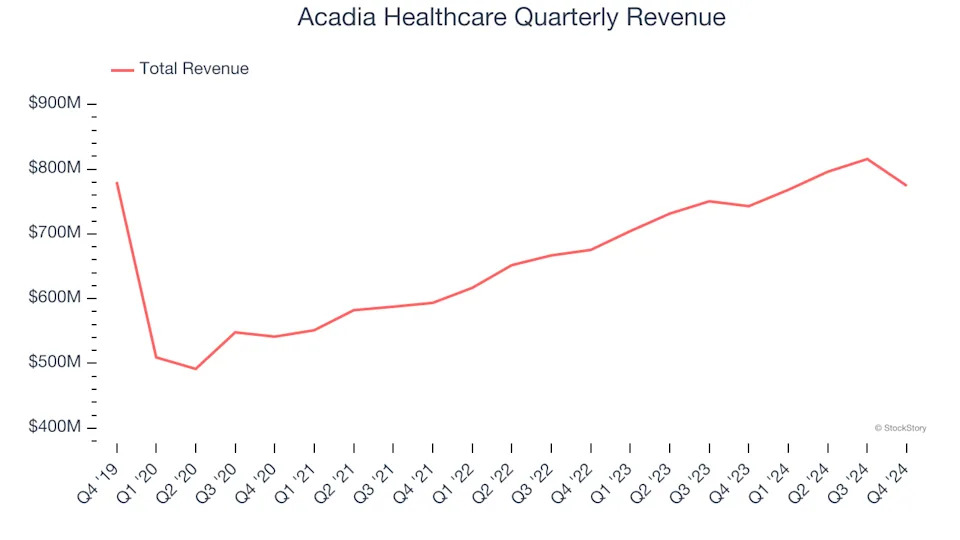

1. Long-Term Revenue Growth Flatter Than a Pancake

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Unfortunately, Acadia Healthcare struggled to consistently increase demand as its $3.15 billion of sales for the trailing 12 months was close to its revenue five years ago. This wasn’t a great result and signals it’s a lower quality business.

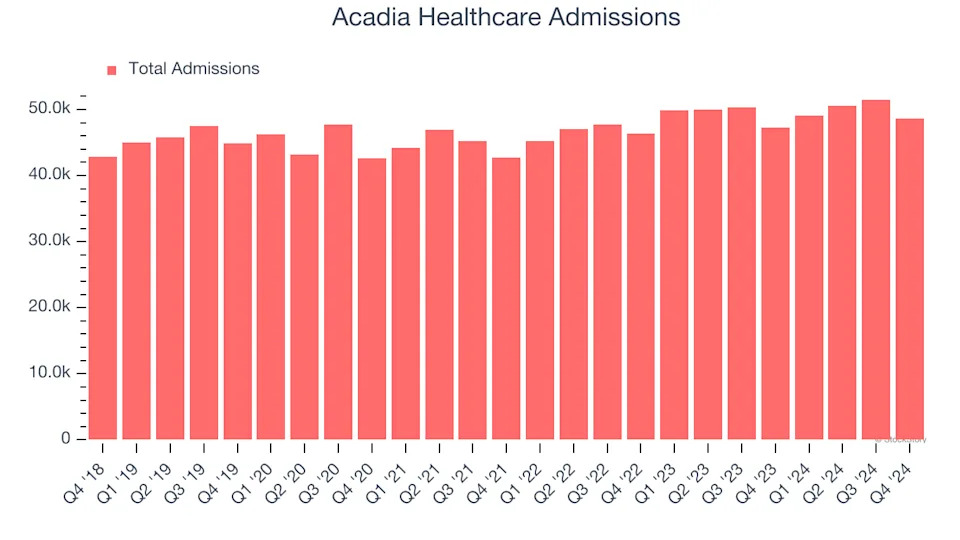

2. Weak Sales Volumes Indicate Waning Demand

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful Hospital Chains company because there’s a ceiling to what customers will pay.

Acadia Healthcare’s admissions came in at 48,679 in the latest quarter, and over the last two years, averaged 3.6% year-on-year growth. This performance slightly lagged the sector and suggests it might have to lower prices or invest in product improvements to accelerate growth, factors that can hinder near-term profitability.

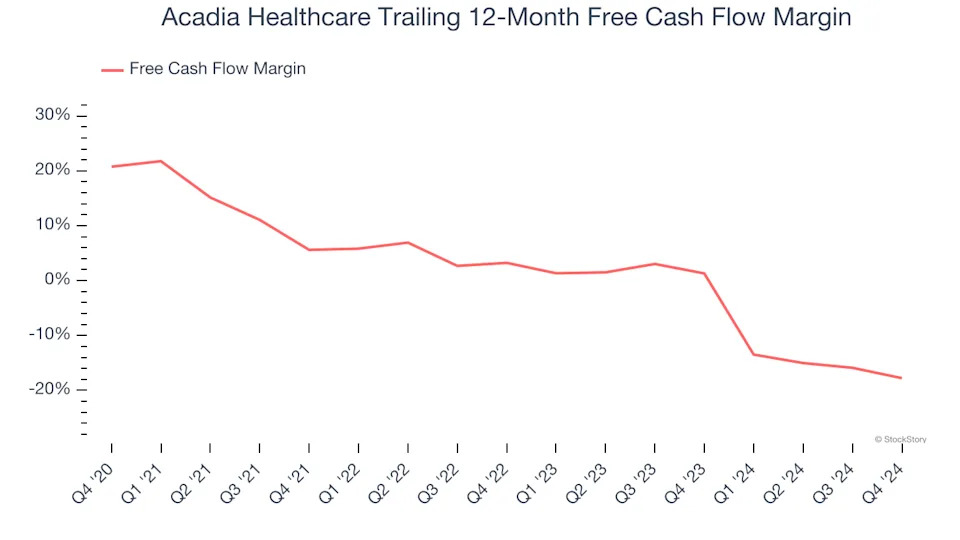

3. Free Cash Flow Margin Dropping

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, Acadia Healthcare’s margin dropped by 38.5 percentage points over the last five years. Almost any movement in the wrong direction is undesirable because of its already low cash conversion. If the trend continues, it could signal it’s becoming a more capital-intensive business. Acadia Healthcare’s free cash flow margin for the trailing 12 months was negative 17.8%.