3 Reasons LFST is Risky and 1 Stock to Buy Instead

LifeStance Health Group trades at $6.79 per share and has moved almost in lockstep with the market over the last six months. The stock has lost 7.1% while the S&P 500 is down 8.3%. This may have investors wondering how to approach the situation.

Is now the time to buy LifeStance Health Group, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free .

Despite the more favorable entry price, we're swiping left on LifeStance Health Group for now. Here are three reasons why we avoid LFST and a stock we'd rather own.

Why Is LifeStance Health Group Not Exciting?

With over 6,600 licensed mental health professionals treating more than 880,000 patients annually, LifeStance Health (NASDAQ:LFST) provides outpatient mental health services through a network of clinicians offering psychiatric evaluations, psychological testing, and therapy across 33 states.

1. Fewer Distribution Channels Limit its Ceiling

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With just $1.25 billion in revenue over the past 12 months, LifeStance Health Group is a small company in an industry where scale matters. This makes it difficult to build trust with customers because healthcare is heavily regulated, complex, and resource-intensive.

2. Shrinking Adjusted Operating Margin

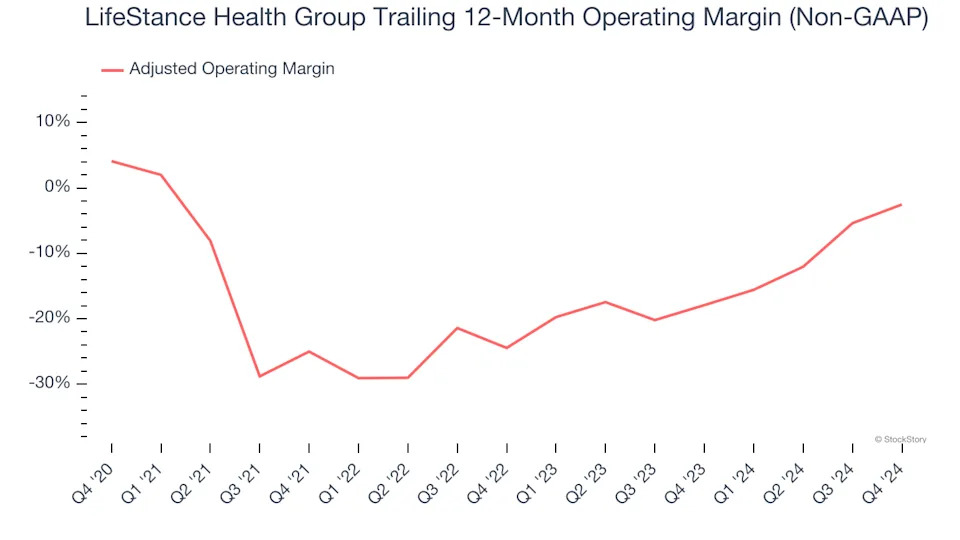

Adjusted operating margin is a key measure of profitability. Think of it as net income (the bottom line) excluding the impact of non-recurring expenses, taxes, and interest on debt - metrics less connected to business fundamentals.

Analyzing the trend in its profitability, LifeStance Health Group’s adjusted operating margin decreased by 6.6 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. LifeStance Health Group’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers. Its adjusted operating margin for the trailing 12 months was negative 2.5%.

3. Previous Growth Initiatives Have Lost Money

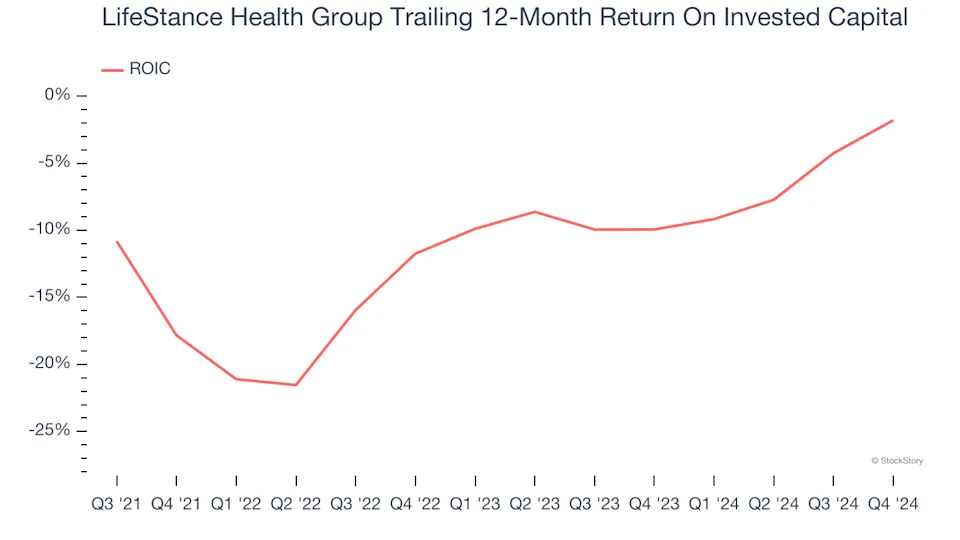

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).