3 Reasons to Sell MGM and 1 Stock to Buy Instead

What a brutal six months it’s been for MGM Resorts. The stock has dropped 23.9% and now trades at $29.97, rattling many shareholders. This may have investors wondering how to approach the situation.

Is there a buying opportunity in MGM Resorts, or does it present a risk to your portfolio? Get the full breakdown from our expert analysts, it’s free .

Even with the cheaper entry price, we don't have much confidence in MGM Resorts. Here are three reasons why you should be careful with MGM and a stock we'd rather own.

Why Do We Think MGM Resorts Will Underperform?

Operating several properties on the Las Vegas Strip, MGM Resorts (NYSE:MGM) is a global hospitality and entertainment company known for its resorts and casinos.

1. Long-Term Revenue Growth Disappoints

Examining a company’s long-term performance can provide clues about its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Regrettably, MGM Resorts’s sales grew at a sluggish 6% compounded annual growth rate over the last five years. This was below our standard for the consumer discretionary sector.

2. Projected Revenue Growth Shows Limited Upside

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect MGM Resorts’s revenue to stall, a deceleration versus its 14.6% annualized growth for the past two years. This projection doesn't excite us and indicates its products and services will see some demand headwinds.

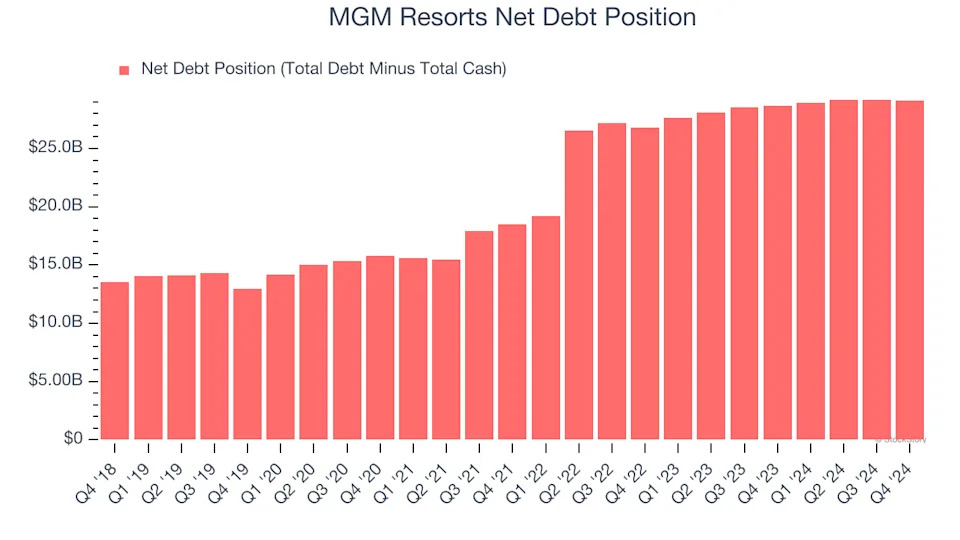

3. High Debt Levels Increase Risk

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

MGM Resorts’s $31.51 billion of debt exceeds the $2.42 billion of cash on its balance sheet. Furthermore, its 12× net-debt-to-EBITDA ratio (based on its EBITDA of $2.40 billion over the last 12 months) shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. MGM Resorts could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.

We hope MGM Resorts can improve its balance sheet and remain cautious until it increases its profitability or pays down its debt.