3 Reasons SPHR is Risky and 1 Stock to Buy Instead

Sphere Entertainment has gotten torched over the last six months - since October 2024, its stock price has dropped 44.8% to $26.99 per share. This might have investors contemplating their next move.

Is there a buying opportunity in Sphere Entertainment, or does it present a risk to your portfolio? Get the full breakdown from our expert analysts, it’s free .

Even though the stock has become cheaper, we're cautious about Sphere Entertainment. Here are three reasons why we avoid SPHR and a stock we'd rather own.

Why Do We Think Sphere Entertainment Will Underperform?

Famous for its viral Las Vegas Sphere venue, Sphere Entertainment (NYSE:SPHR) hosts live entertainment events and distributes content across various media platforms.

1. Long-Term Revenue Growth Disappoints

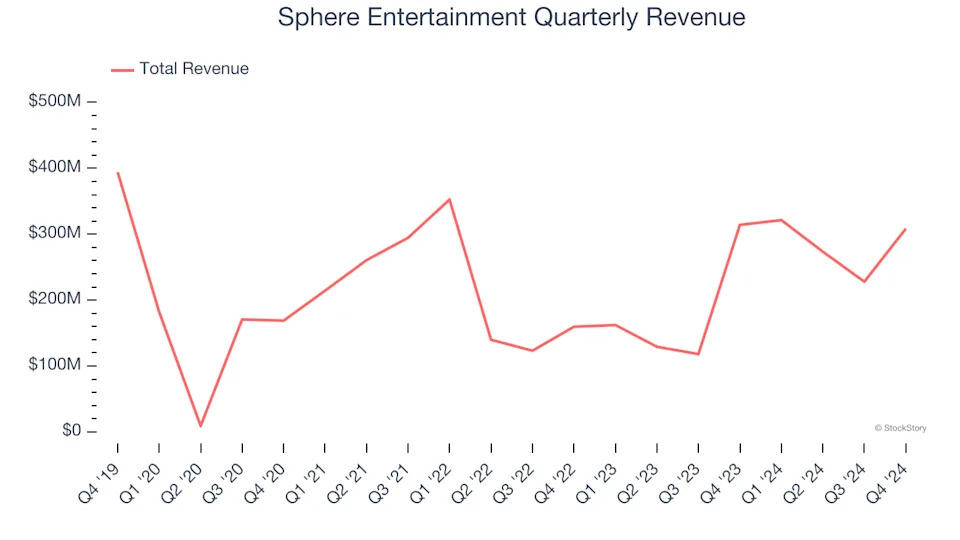

Examining a company’s long-term performance can provide clues about its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Unfortunately, Sphere Entertainment’s 1.7% annualized revenue growth over the last five years was weak. This fell short of our benchmarks.

2. Cash Burn Ignites Concerns

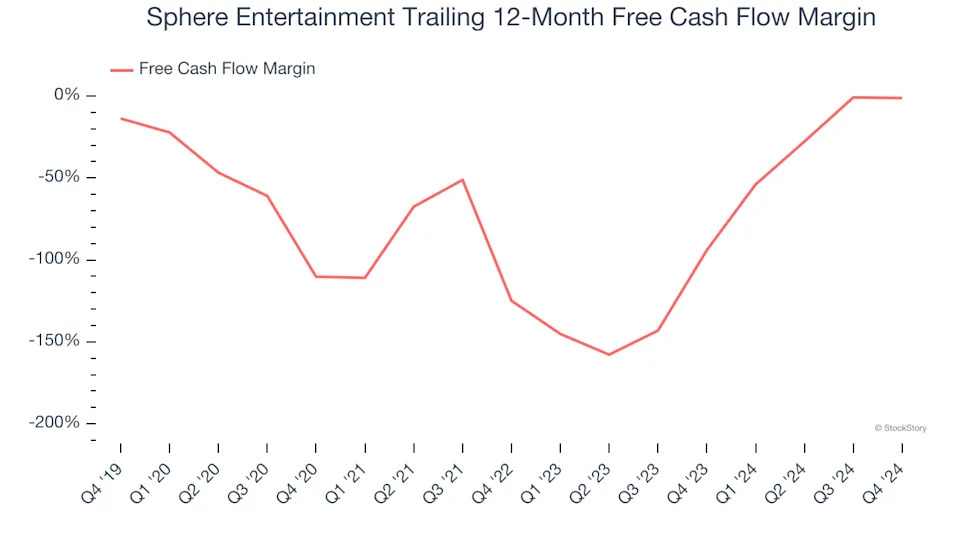

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Over the last two years, Sphere Entertainment’s demanding reinvestments to stay relevant have drained its resources, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 37.4%, meaning it lit $37.43 of cash on fire for every $100 in revenue.

3. Short Cash Runway Exposes Shareholders to Potential Dilution

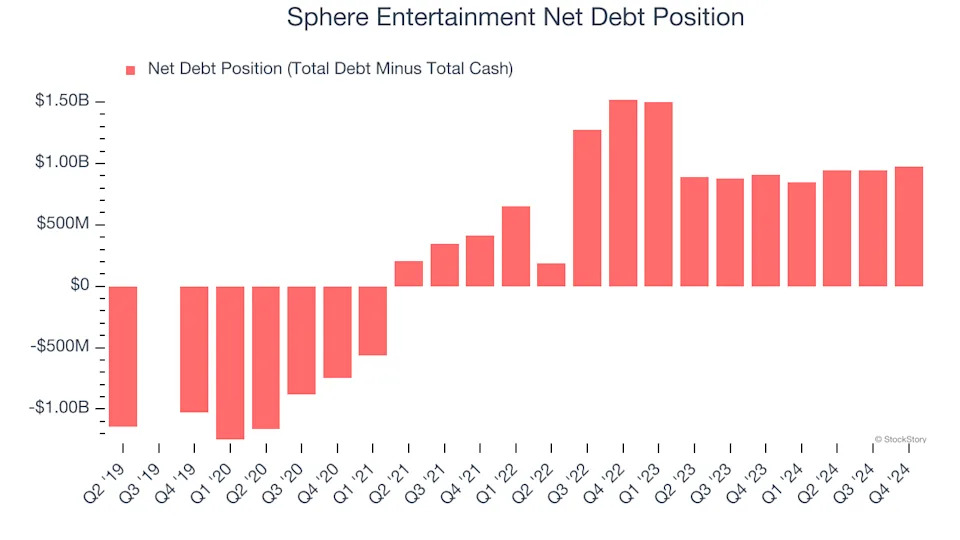

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

Sphere Entertainment burned through $13.76 million of cash over the last year, and its $1.49 billion of debt exceeds the $515.6 million of cash on its balance sheet. This is a deal breaker for us because indebted loss-making companies spell trouble.

Unless the Sphere Entertainment’s fundamentals change quickly, it might find itself in a position where it must raise capital from investors to continue operating. Whether that would be favorable is unclear because dilution is a headwind for shareholder returns.

We remain cautious of Sphere Entertainment until it generates consistent free cash flow or any of its announced financing plans materialize on its balance sheet.