3 Reasons to Sell CNMD and 1 Stock to Buy Instead

Over the last six months, CONMED shares have sunk to $51.84, producing a disappointing 19.7% loss - worse than the S&P 500’s 7.3% drop. This was partly driven by its softer quarterly results and may have investors wondering how to approach the situation.

Is now the time to buy CONMED, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free .

Even though the stock has become cheaper, we don't have much confidence in CONMED. Here are three reasons why you should be careful with CNMD and a stock we'd rather own.

Why Is CONMED Not Exciting?

With over five decades of experience in surgical innovation since its founding in 1970, CONMED (NYSE:CNMD) develops and manufactures medical devices and equipment for surgical procedures, specializing in orthopedic and general surgery products.

1. Long-Term Revenue Growth Disappoints

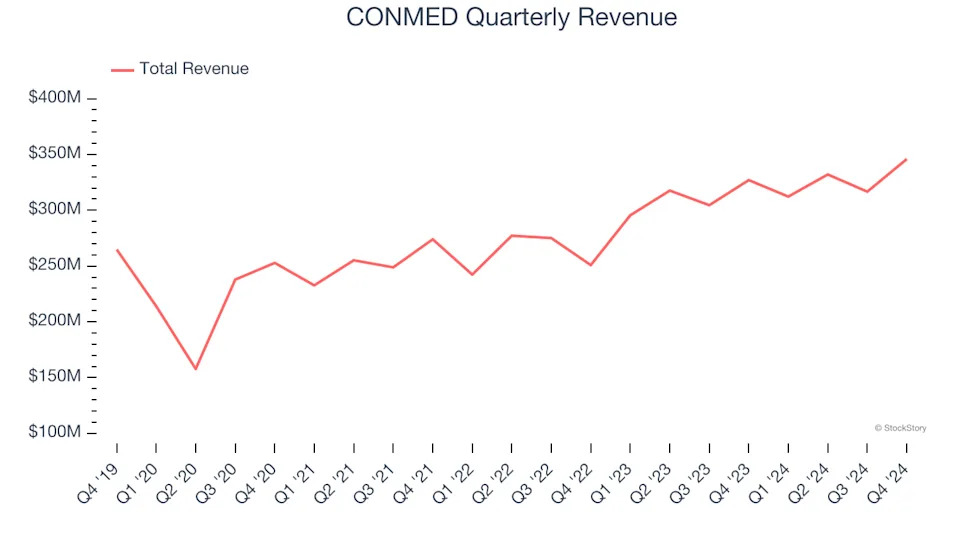

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Unfortunately, CONMED’s 6.5% annualized revenue growth over the last five years was mediocre. This was below our standard for the healthcare sector.

2. Fewer Distribution Channels Limit its Ceiling

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With just $1.31 billion in revenue over the past 12 months, CONMED is a small company in an industry where scale matters. This makes it difficult to build trust with customers because healthcare is heavily regulated, complex, and resource-intensive.

3. Previous Growth Initiatives Haven’t Impressed

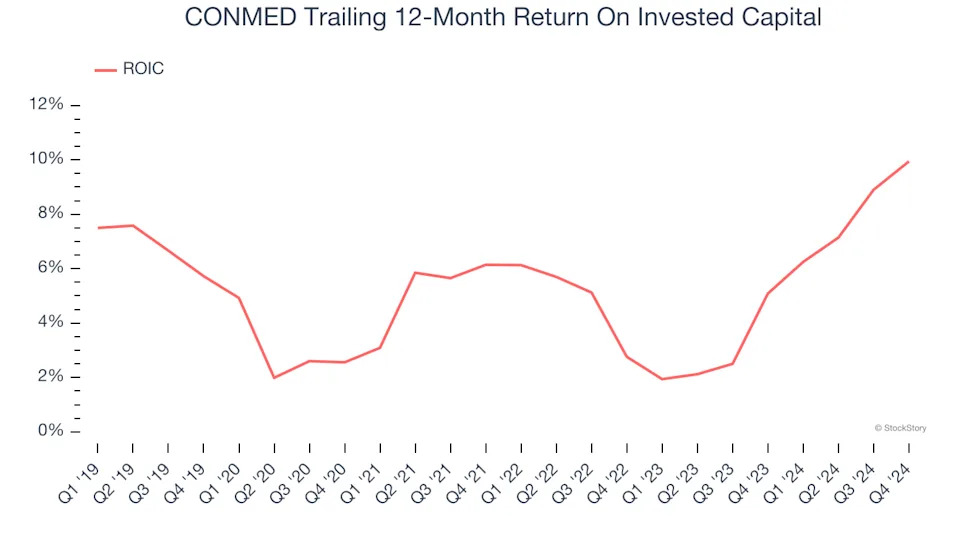

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

CONMED historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 5.3%, somewhat low compared to the best healthcare companies that consistently pump out 20%+.

Final Judgment

CONMED isn’t a terrible business, but it doesn’t pass our quality test. After the recent drawdown, the stock trades at 10.9× forward price-to-earnings (or $51.84 per share). Beauty is in the eye of the beholder, but our analysis shows the upside isn’t great compared to the potential downside. We're pretty confident there are more exciting stocks to buy at the moment. Let us point you toward a top digital advertising platform riding the creator economy .