3 Reasons HOG is Risky and 1 Stock to Buy Instead

Shareholders of Harley-Davidson would probably like to forget the past six months even happened. The stock dropped 35.3% and now trades at $22.95. This was partly driven by its softer quarterly results and might have investors contemplating their next move.

Is now the time to buy Harley-Davidson, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free .

Even with the cheaper entry price, we're cautious about Harley-Davidson. Here are three reasons why we avoid HOG and a stock we'd rather own.

Why Do We Think Harley-Davidson Will Underperform?

Founded in 1903, Harley-Davidson (NYSE:HOG) is an American motorcycle manufacturer known for its heavyweight motorcycles designed for cruising on highways.

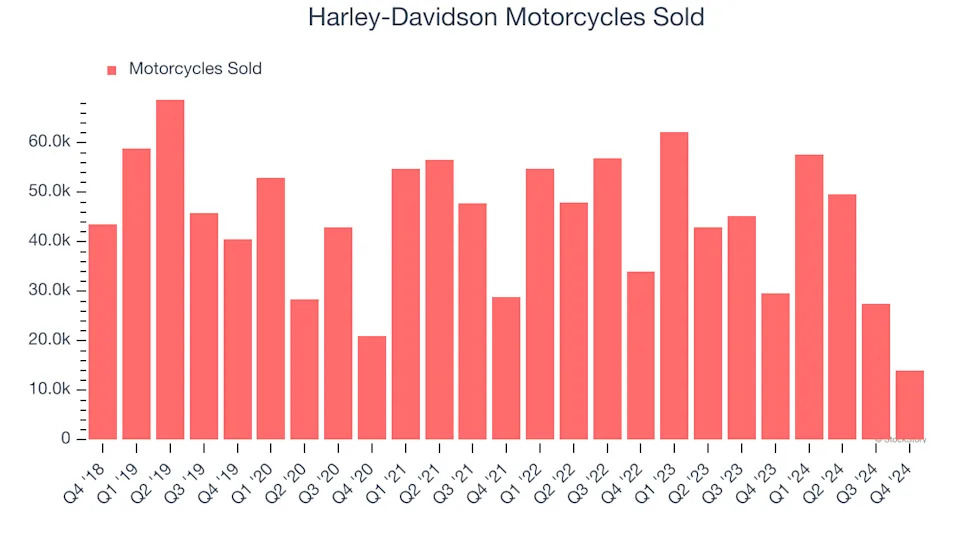

1. Decline in Motorcycles Sold Points to Weak Demand

Revenue growth can be broken down into changes in price and volume (for companies like Harley-Davidson, our preferred volume metric is motorcycles sold). While both are important, the latter is the most critical to analyze because prices have a ceiling.

Harley-Davidson’s motorcycles sold came in at 14,010 in the latest quarter, and over the last two years, averaged 14.2% year-on-year declines. This performance was underwhelming and implies there may be increasing competition or market saturation. It also suggests Harley-Davidson might have to lower prices or invest in product improvements to grow, factors that can hinder near-term profitability.

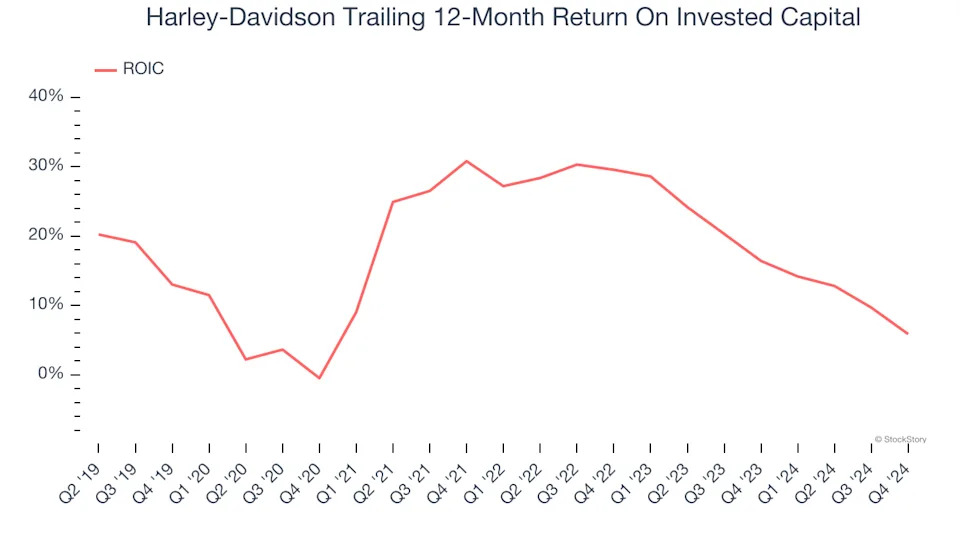

2. New Investments Fail to Bear Fruit as ROIC Declines

ROIC, or return on invested capital, is a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. On average, Harley-Davidson’s ROIC decreased by 4 percentage points annually over the last few years. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

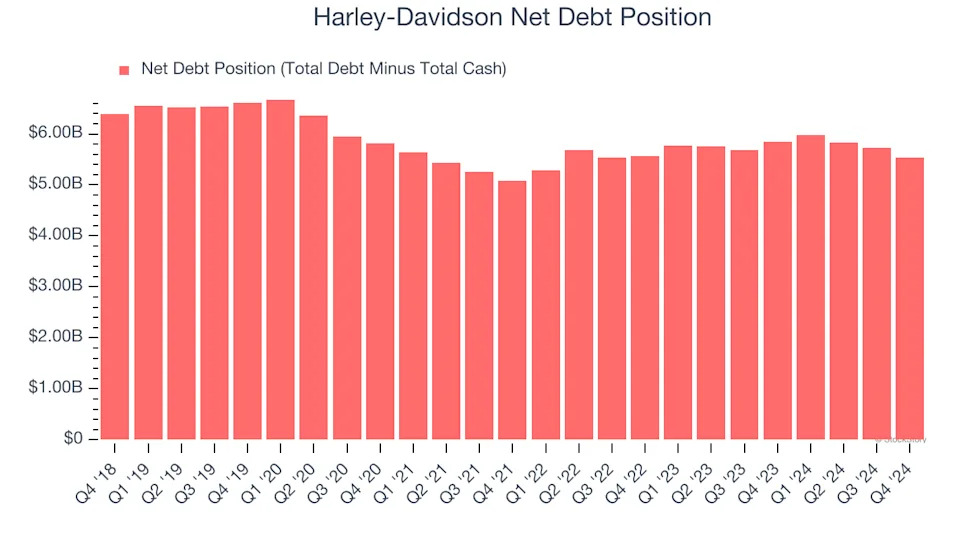

3. High Debt Levels Increase Risk

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

Harley-Davidson’s $7.13 billion of debt exceeds the $1.59 billion of cash on its balance sheet. Furthermore, its 10× net-debt-to-EBITDA ratio (based on its EBITDA of $531.7 million over the last 12 months) shows the company is overleveraged.