3 Reasons to Avoid CMPO and 1 Stock to Buy Instead

What a brutal six months it’s been for CompoSecure. The stock has dropped 27.9% and now trades at $10.31, rattling many shareholders. This was partly due to its softer quarterly results and might have investors contemplating their next move.

Is now the time to buy CompoSecure, or should you be careful about including it in your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free .

Even though the stock has become cheaper, we're swiping left on CompoSecure for now. Here are three reasons why you should be careful with CMPO and a stock we'd rather own.

Why Is CompoSecure Not Exciting?

Pioneer of the luxury metal credit card that's in the wallets of affluent consumers worldwide, CompoSecure (NASDAQ:CMPO) designs and manufactures premium metal payment cards and secure authentication solutions for financial institutions and digital asset storage.

1. Fewer Distribution Channels Limit its Ceiling

With $420.6 million in revenue over the past 12 months, CompoSecure is a small player in the business services space, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and numerous distribution channels. On the bright side, it can grow faster because it has more room to expand.

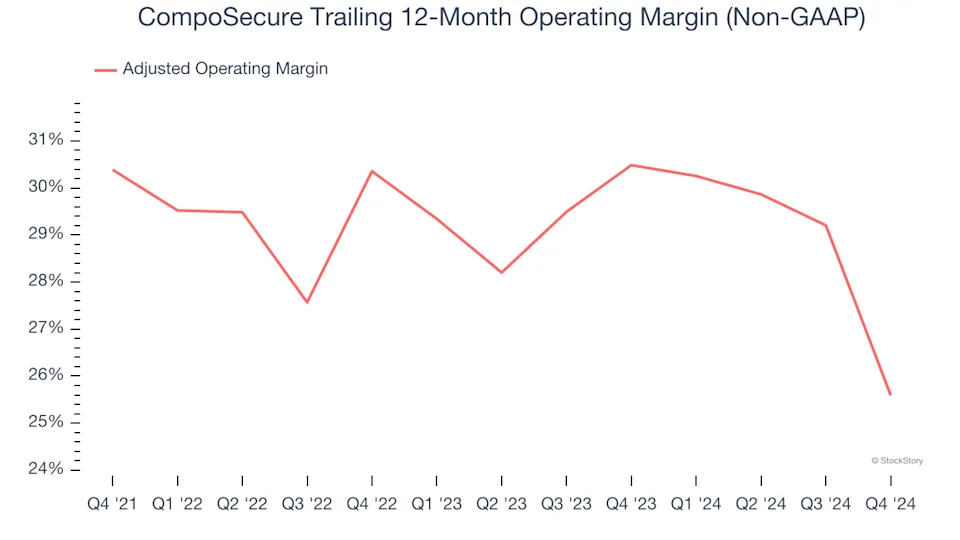

2. Shrinking Adjusted Operating Margin

Adjusted operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies because it excludes non-recurring expenses, interest on debt, and taxes.

Analyzing the trend in its profitability, CompoSecure’s adjusted operating margin decreased by 4.8 percentage points over the last four years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Its adjusted operating margin for the trailing 12 months was 25.6%.

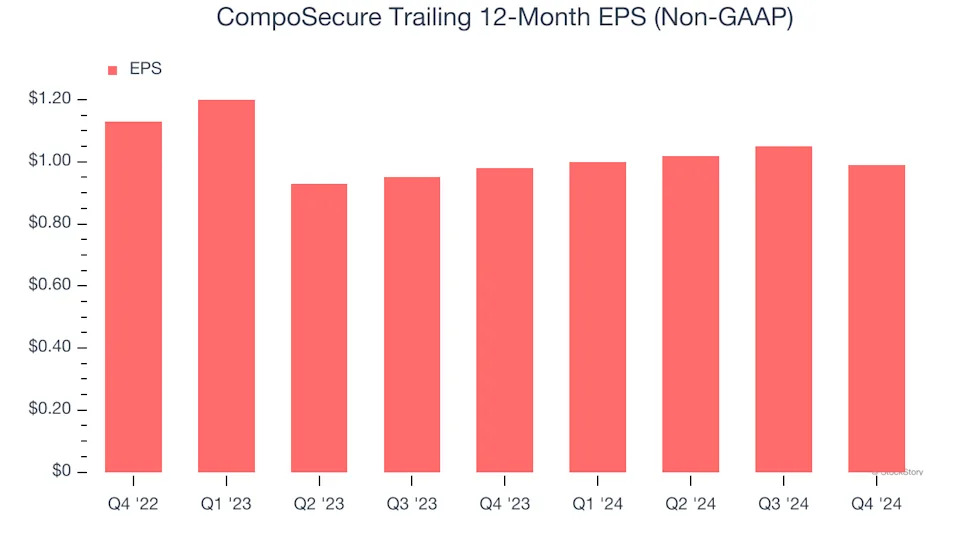

3. EPS Trending Down

Analyzing the change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

CompoSecure’s full-year EPS dropped 13.2%, or 6.4% annually, over the last two years. We tend to steer our readers away from companies with falling revenue and EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, CompoSecure’s low margin of safety could leave its stock price susceptible to large downswings.