3 Reasons WBD is Risky and 1 Stock to Buy Instead

Even during a down period for the markets, Warner Bros. Discovery has gone against the grain, climbing to $8.03. Its shares have yielded a 6.8% return over the last six months, beating the S&P 500 by 16.6%. This performance may have investors wondering how to approach the situation.

Is there a buying opportunity in Warner Bros. Discovery, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free .

Despite the momentum, we're cautious about Warner Bros. Discovery. Here are three reasons why there are better opportunities than WBD and a stock we'd rather own.

Why Do We Think Warner Bros. Discovery Will Underperform?

Formed from the merger of WarnerMedia and Discovery, Warner Bros. Discovery (NASDAQ:WBD) is a multinational media and entertainment company, offering television networks, streaming services, and film and television production.

1. Revenue Tumbling Downwards

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Warner Bros. Discovery’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 4.5% over the last two years.

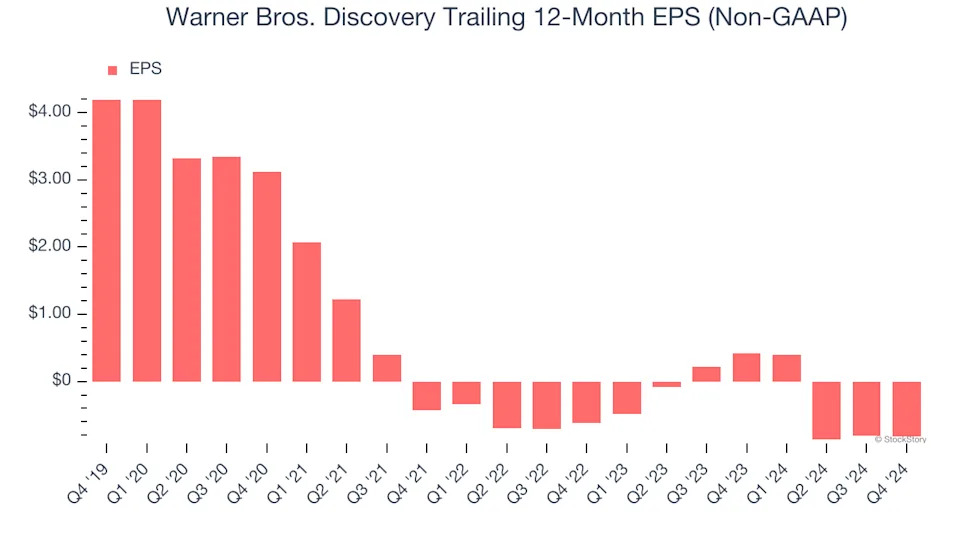

2. EPS Trending Down

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Sadly for Warner Bros. Discovery, its EPS declined by 17% annually over the last five years while its revenue grew by 28.7%. This tells us the company became less profitable on a per-share basis as it expanded.

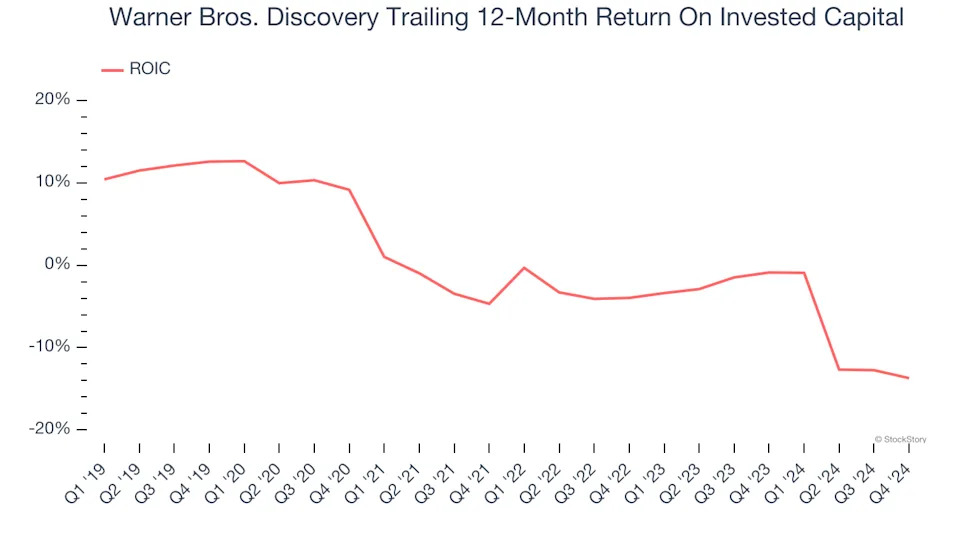

3. New Investments Fail to Bear Fruit as ROIC Declines

ROIC, or return on invested capital, is a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Warner Bros. Discovery’s ROIC has unfortunately decreased. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

Final Judgment

Warner Bros. Discovery falls short of our quality standards. With its shares topping the market in recent months, the stock trades at 2.1× forward EV-to-EBITDA (or $8.03 per share). While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are better investments elsewhere. Let us point you toward our favorite semiconductor picks and shovels play .