Transportation and Logistics Stocks Q4 In Review: CSX (NASDAQ:CSX) Vs Peers

As the Q4 earnings season wraps, let’s dig into this quarter’s best and worst performers in the transportation and logistics industry, including CSX (NASDAQ:CSX) and its peers.

The growth of e-commerce and global trade continues to drive demand for shipping services, presenting opportunities for transportation and logistics companies. The industry continues to invest in advanced technologies such as automated sorting systems and real-time tracking solutions to enhance operational efficiency. Companies that win in this space boast speed, reach, reliability, and last-mile efficiency while those who do not see their market shares diminish. Like other industrials companies, transportation and logistics companies are at the whim of economic cycles. Consumer spending, for example, can greatly impact the demand for these companies’ offerings while fuel costs influence profit margins.

The 30 transportation and logistics stocks we track reported a mixed Q4. As a group, revenues were in line with analysts’ consensus estimates.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 21.4% since the latest earnings results.

CSX (NASDAQ:CSX)

Established as part of the Chessie System and Seaboard Coast Line Industries merger, CSX (NASDAQ:CSX) is a transportation company specializing in freight rail services.

CSX reported revenues of $3.54 billion, down 3.8% year on year. This print fell short of analysts’ expectations by 0.9%. Overall, it was a slower quarter for the company with a miss of analysts’ EBITDA estimates.

The stock is down 17.4% since reporting and currently trades at $27.79.

Read our full report on CSX here, it’s free .

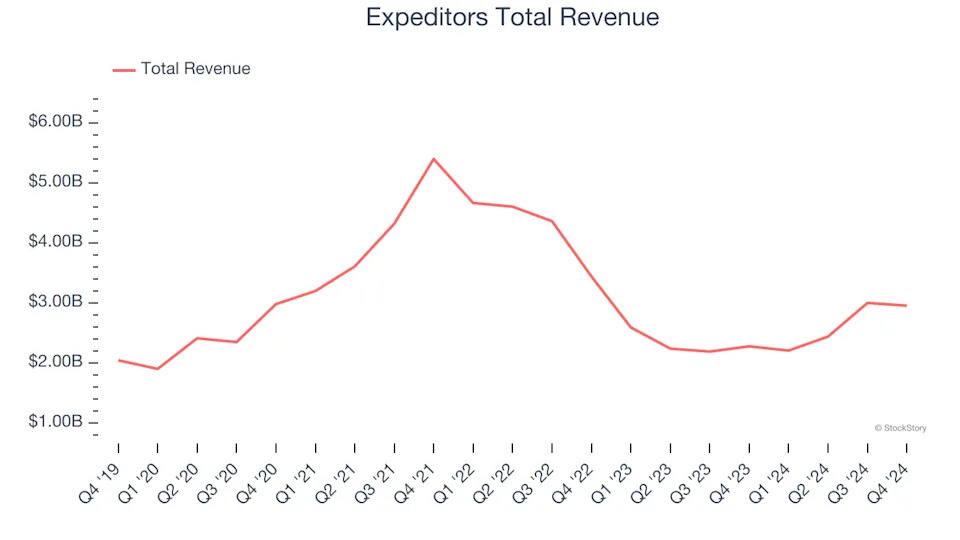

Best Q4: Expeditors (NYSE:EXPD)

Expeditors (NYSE:EXPD) offers air and ocean freight as well as brokerage services.

Expeditors reported revenues of $2.95 billion, up 29.7% year on year, outperforming analysts’ expectations by 4.3%. The business had a stunning quarter with a solid beat of analysts’ EBITDA estimates and a solid beat of analysts’ adjusted operating income estimates.

The stock is down 4.5% since reporting. It currently trades at $108.60.

Is now the time to buy Expeditors? Access our full analysis of the earnings results here, it’s free .

Weakest Q4: Avis Budget Group (NASDAQ:CAR)

The parent company of brands such as Zipcar and Budget Truck Rental, Avis (NASDAQ:CAR) is a provider of car rental and mobility solutions.

Avis Budget Group reported revenues of $2.71 billion, down 2% year on year, falling short of analysts’ expectations by 1%. It was a disappointing quarter as it posted a significant miss of analysts’ adjusted operating income estimates.