Apparel and Accessories Stocks Q4 In Review: Stitch Fix (NASDAQ:SFIX) Vs Peers

The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how Stitch Fix (NASDAQ:SFIX) and the rest of the apparel and accessories stocks fared in Q4.

Thanks to social media and the internet, not only are styles changing more frequently today than in decades past but also consumers are shifting the way they buy their goods, favoring omnichannel and e-commerce experiences. Some apparel and accessories companies have made concerted efforts to adapt while those who are slower to move may fall behind.

The 16 apparel and accessories stocks we track reported a strong Q4. As a group, revenues beat analysts’ consensus estimates by 2.5% while next quarter’s revenue guidance was in line.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 17.5% since the latest earnings results.

Stitch Fix (NASDAQ:SFIX)

One of the original subscription box companies, Stitch Fix (NASDAQ:SFIX) is an online personal styling and fashion service that curates personalized clothing selections for customers.

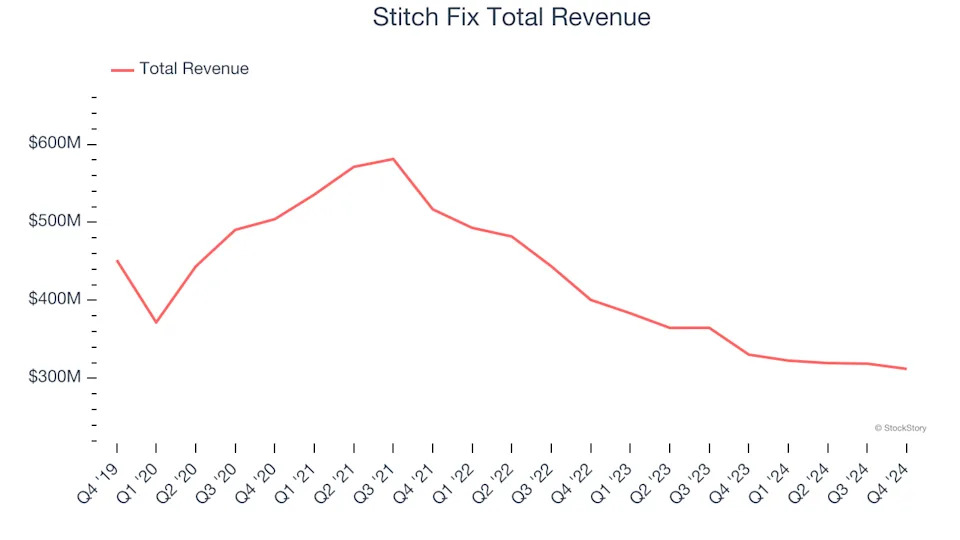

Stitch Fix reported revenues of $312.1 million, down 5.5% year on year. This print exceeded analysts’ expectations by 4.4%. Overall, it was a very strong quarter for the company with EBITDA guidance for next quarter exceeding analysts’ expectations and an impressive beat of analysts’ EPS estimates.

The stock is down 26.5% since reporting and currently trades at $3.10.

Is now the time to buy Stitch Fix? Access our full analysis of the earnings results here, it’s free .

Best Q4: VF Corp (NYSE:VFC)

Owner of The North Face, Vans, and Supreme, VF Corp (NYSE:VFC) is a clothing conglomerate specializing in branded lifestyle apparel, footwear, and accessories.

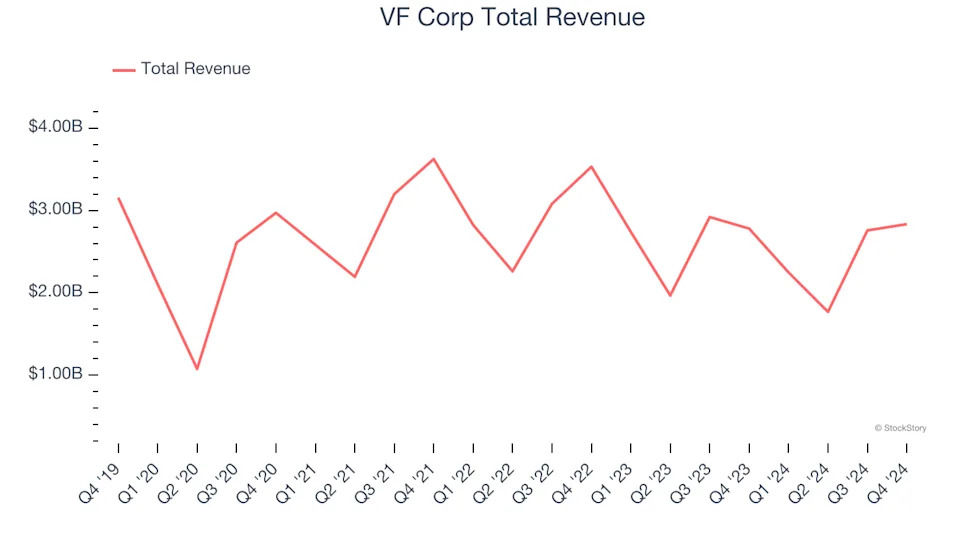

VF Corp reported revenues of $2.83 billion, up 1.9% year on year, outperforming analysts’ expectations by 1.2%. The business had a stunning quarter with an impressive beat of analysts’ constant currency revenue and EPS estimates.

The stock is down 57.7% since reporting. It currently trades at $11.25.

Is now the time to buy VF Corp? Access our full analysis of the earnings results here, it’s free .

Weakest Q4: Columbia Sportswear (NASDAQ:COLM)

Originally founded as a hat store in 1938, Columbia Sportswear (NASDAQ:COLM) is a manufacturer of outerwear, sportswear, and footwear designed for outdoor enthusiasts.

Columbia Sportswear reported revenues of $1.10 billion, up 3.5% year on year, exceeding analysts’ expectations by 1.4%. Still, it was a slower quarter as it posted full-year EPS guidance missing analysts’ expectations and a miss of analysts’ EPS estimates.