3 Reasons to Avoid CCK and 1 Stock to Buy Instead

Crown Holdings trades at $81.71 per share and has stayed right on track with the overall market, losing 11.9% over the last six months while the S&P 500 is down 9.9%. This may have investors wondering how to approach the situation.

Is there a buying opportunity in Crown Holdings, or does it present a risk to your portfolio? See what our analysts have to say in our full research report, it’s free .

Even with the cheaper entry price, we're cautious about Crown Holdings. Here are three reasons why you should be careful with CCK and a stock we'd rather own.

Why Do We Think Crown Holdings Will Underperform?

Formerly Crown Cork & Seal, Crown Holdings (NYSE:CCK) produces packaging products for consumer marketing companies, including food, beverage, household, and industrial products.

1. Declining Constant Currency Revenue, Demand Takes a Hit

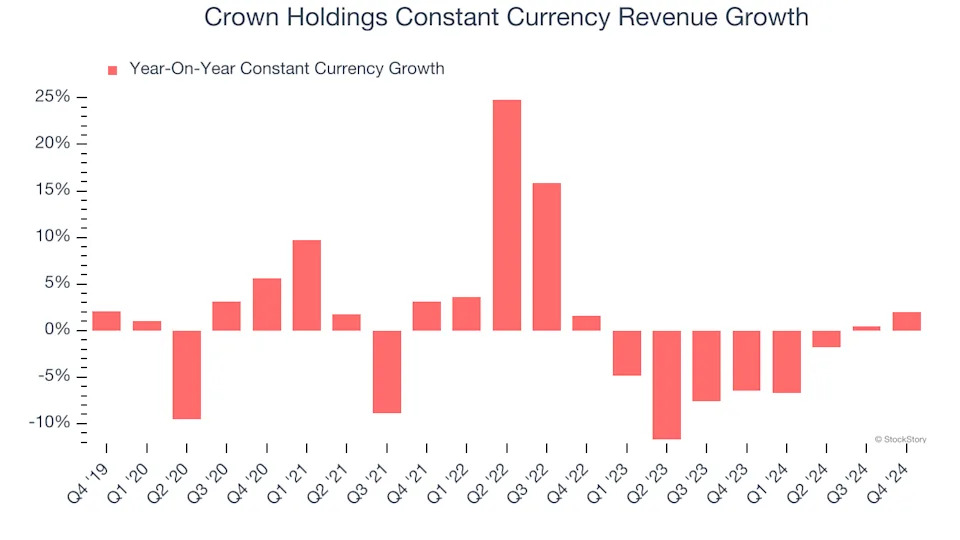

In addition to reported revenue, constant currency revenue is a useful data point for analyzing Industrial Packaging companies. This metric excludes currency movements, which are outside of Crown Holdings’s control and are not indicative of underlying demand.

Over the last two years, Crown Holdings’s constant currency revenue averaged 4.6% year-on-year declines. This performance was underwhelming and implies there may be increasing competition or market saturation. It also suggests Crown Holdings might have to lower prices or invest in product improvements to accelerate growth, factors that can hinder near-term profitability.

2. Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Crown Holdings’s revenue to rise by 1.7%. While this projection implies its newer products and services will catalyze better top-line performance, it is still below the sector average.

3. EPS Barely Growing

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Crown Holdings’s EPS grew at an unimpressive 4.6% compounded annual growth rate over the last five years. On the bright side, this performance was better than its flat revenue and tells us management responded to softer demand by adapting its cost structure.

Final Judgment

Crown Holdings doesn’t pass our quality test. Following the recent decline, the stock trades at 12× forward price-to-earnings (or $81.71 per share). This valuation multiple is fair, but we don’t have much confidence in the company. There are superior stocks to buy right now. We’d suggest looking at one of our top digital advertising picks .