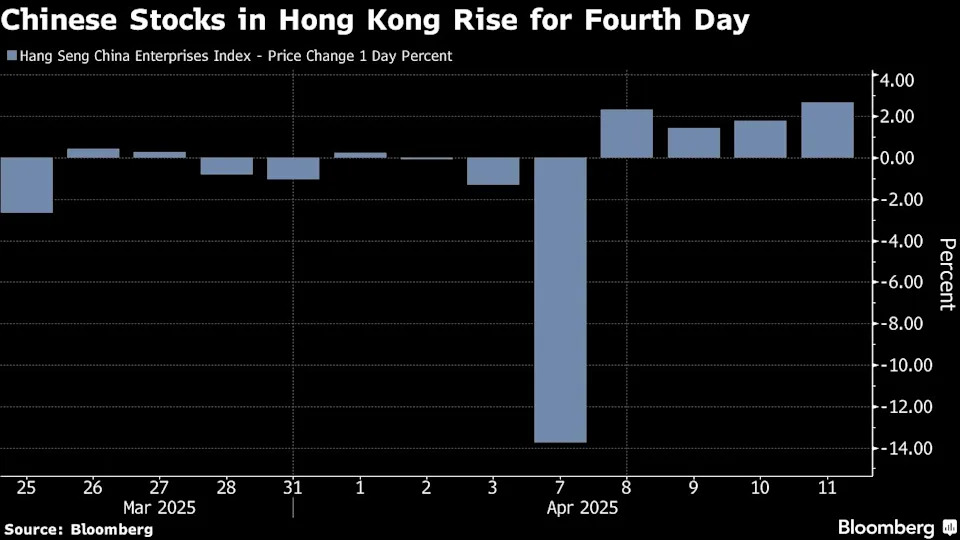

China Stocks Extend Gains as Stimulus, Deal Hopes Get Upper Hand

(Bloomberg) — Chinese shares were on track for a four-day rally as expectations for stronger stimulus and hopes of an eventual trade deal with the US outweighed Donald Trump’s 145% tariffs.

Most Read from Bloomberg

A key gauge of Hong Kong-listed Chinese stocks jumped as much as 2.7% after swinging between gains and losses earlier Friday. The onshore CSI 300 Index erased its declines to add 0.4%. Both outperformed a broader Asian market gauge.

The gains signal continued bets for Beijing to roll out fresh growth support as investors await the outcome of a Thursday meeting planned by China’s top leaders to discuss additional stimulus. Hope is also alive for the world’s two largest economies to reach compromise after Trump indicated willingness to be “flexible” on exemptions for companies or countries from the tariff regime.

The mood was less upbeat in the morning session, after the White House clarified Thursday that after including a 20% levy imposed earlier this year, the total tariffs on China stand at 145%, a level far above what many economists said could decimate US-China trade.

Stocks were rising on the potential easing in US-China tensions after Trump indicated the willingness to “exempt thousands of products from tariffs,” said Steven Leung, an executive director at UOB Kay Hian Hong Kong. “Investors are also expecting some supportive measures in China after top officials’ recent meetings.”

Trump said Thursday he thought the first trade deals are “very close” and voiced optimism that China would eventually come to the table.

The US’s latest tariff increase came after Beijing on late Wednesday said it will impose an 84% levy on all imports from the US. That was after Trump earlier raised the tariffs on Chinese goods to 104%.

Chinese authorities on Tuesday pledged to “fight to the end” in response to Trump’s tariffs, while signaling willingness to talk with the US. They also stepped up efforts to prop up stocks, with some state-backed funds purchasing equities and exchange-traded funds.

Despite the resilience of Chinese equities, the increasingly adversarial bilateral relations have prompted some global investors to cut exposure. Three of the largest US-listed exchange-traded funds tracking Chinese stocks saw a deepened selloff on Wednesday, with traders offloading almost $1 billion worth of shares in a single day.