3 Reasons to Sell CRAI and 1 Stock to Buy Instead

CRA has followed the market’s trajectory closely. The stock is down 9.7% to $166.47 per share over the past six months while the S&P 500 has lost 9.3%. This might have investors contemplating their next move.

Is there a buying opportunity in CRA, or does it present a risk to your portfolio? Get the full breakdown from our expert analysts, it’s free .

Even though the stock has become cheaper, we don't have much confidence in CRA. Here are three reasons why there are better opportunities than CRAI and a stock we'd rather own.

Why Is CRA Not Exciting?

Often retained for high-stakes matters with multibillion-dollar implications, CRA International (NASDAQ:CRAI) provides economic, financial, and management consulting services to corporations, law firms, and government agencies for litigation, regulatory proceedings, and business strategy.

1. Fewer Distribution Channels Limit its Ceiling

With $687.4 million in revenue over the past 12 months, CRA is a small player in the business services space, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and numerous distribution channels. On the bright side, it can grow faster because it has more room to expand.

2. Revenue Projections Show Stormy Skies Ahead

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect CRA’s revenue to drop by 1.2%, a decrease from its 7.9% annualized growth for the past two years. This projection is underwhelming and suggests its products and services will see some demand headwinds.

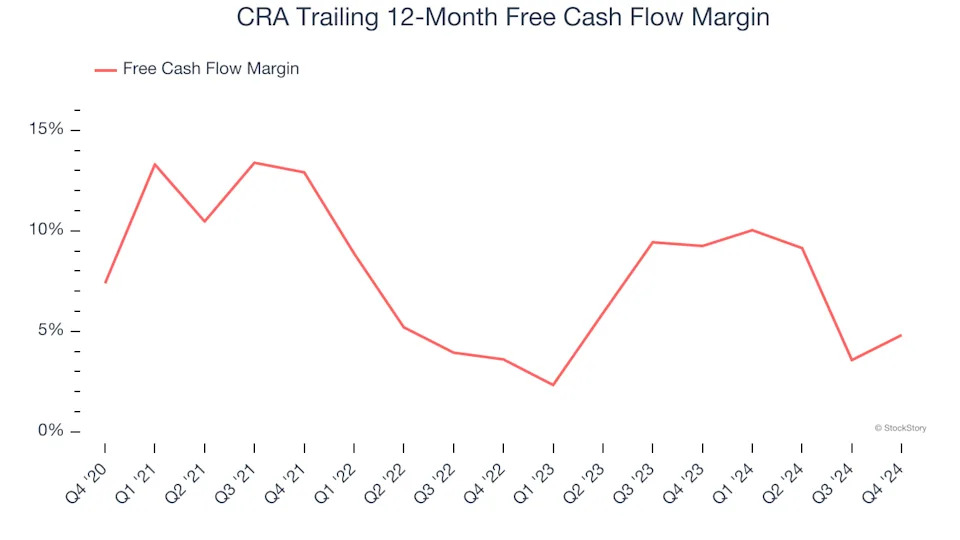

3. Free Cash Flow Margin Dropping

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, CRA’s margin dropped by 2.6 percentage points over the last five years. If its declines continue, it could signal increasing investment needs and capital intensity. CRA’s free cash flow margin for the trailing 12 months was 4.8%.

Final Judgment

CRA isn’t a terrible business, but it isn’t one of our picks. Following the recent decline, the stock trades at 22.5× forward price-to-earnings (or $166.47 per share). This valuation tells us a lot of optimism is priced in - we think there are better opportunities elsewhere. Let us point you toward one of our all-time favorite software stocks .