Wall Street plunges after China hit with 145pc tariff

- April 10, 2025

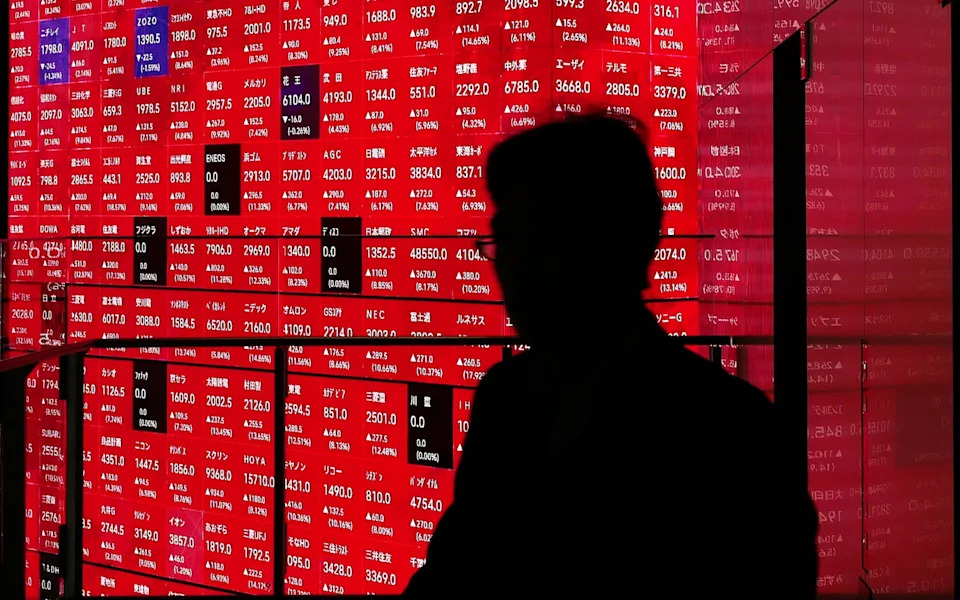

Stock markets plunged again on Thursday as the White House confirmed China will be hit with 145 per cent tariffs.

Following an escalation in Donald Trump’s trade war with Beijing, the S&P 500 and the Nasdaq fell by as much as 6.3 per cent and 7.2 per cent respectively.

The dollar also sank by 1.1 per cent against the pound and oil prices tumbled by 3 per cent, as the president admitted there will be “transition problems” from his tariffs.

The falls came less than 24 hours after the US president pulled back from his global tariff onslaught, in a move that saw Wall Street post its biggest jump since 2001.

Mr Trump announced a 90-day pause on his most aggressive tariffs and lowered country-specific levies to a baseline 10 per cent rate for almost every nation except China, which he said he was raising to 125 per cent, “effective immediately”.

However, a White House official said on Thursday that the levy on Chinese imports now “effectively totals 145 per cent”, including a 20 per cent fentanyl-related tariff already imposed on Beijing.

The announcement led to a previous stock market rally fizzling out, as investors bet Mr Trump’s climbdown would not prevent a US recession.

When asked about the impact of his tariffs during a cabinet meeting on Thursday, the president said: “There’ll be a transition cost and transition problems, but in the end, it’s going to be a beautiful thing.”

Mr Trump also suggested that a trade deal could soon be struck with China, despite the new 145 per cent tariff.

He said: “I think that we’ll end up working on something that’s very good for both countries.”

It comes after China hit back against America with 84 per cent tariffs earlier this week.

Mr Trump’s latest comments signal a potential softening in tone from the president, as he previously blamed his tariffs reversal on people “getting a little bit afraid”.

It followed a global market meltdown in which investors sold off US debt over fears that the trade war would trigger a financial crisis.

US borrowing costs edged up again on Thursday as traders warned that America was now an “unreliable partner”.

Wall Street giant Jefferies said it was increasing investments in Europe as it pulls back from the US.

However, in a blow to Sir Keir Starmer’s hopes of a trade deal with the world’s biggest economy, White House adviser Kevin Hassett also suggested that 10pc tariffs were here to stay.

“It’s going to take some kind of extraordinary deal for the president to go below there,” he told CNBC.

Mr Hassett also admitted that the turmoil in bond markets “may have” played a part in Mr Trump’s decision to delay the tariffs, although he insisted this had not been a “panic move”.

Read the latest updates below.

09:31 PM BST

Signing off...

Thanks for joining us on a day that saw European and Asian stocks jump, but US stocks fall as fear on Wall Street spiked.

The Vix, Wall Street’s “fear gauge”, spiked by 63.2pc during trading today, and is at the highest level since Covid upended the world’s economies.

09:19 PM BST

Warner and Disney shares plummet as trade war hurts

The stock price of Warner Brothers Discovery, the company behind Wonka, dropped 12.5pc for one of Wall Street’s sharpest losses today after China said it will “appropriately reduce the number of imported US films.” Disney’s stock sank 6.8pc.

A spokesperson for the China Film Administration said it is “inevitable” that Chinese audiences would find American films less palatable given the “wrong move by the US to wantonly implement tariffs on China”.

That was after Donald Trump and his Treasury secretary, Scott Bessent, sent a clear message to other countries Wednesday after announcing their tariff pause: “Do not retaliate, and you will be rewarded.”

09:09 PM BST

Wall Street ends sharply lower as tariff risks send investors fleeing

Wall Street stocks tumbled today on mounting worries over the economic impact of Donald Trump’s trade war.

All three major US stock indexes suffered steep losses, forfeiting much of last night’s gains.

Following Wednesday’s bounce and today’s sell-off, the S&P 500 remained well below levels before the reciprocal tariffs were announced last week.

According to preliminary data, the S&P 500 lost 3.5pc, to end at 5,267.11 points, while the Nasdaq Composite lost 4.3pc, to 16,387.31. The Dow Jones Industrial Average fell 2.5pc, to 39,578.94.

Big Tech came under pressure once again, with each of the so-called Magnificent Seven group of artificial intelligence-related momentum ending with steep losses.

09:06 PM BST

Fed officials warn over inflation risks

US central bankers warned over the risk of heightened inflation today, a week after Donald Trumpc alled on the Federal Reserve to cut interest rates.

Jeff Schmid, head of the Kansas City Fed, said: “It appears as though we have seen a marked increase in the upside risks around inflation along with elevated downside risks to the outlook for employment and growth.

“With renewed price pressures likely, I am not willing to take any chances when it comes to maintaining the Fed’s credibility on inflation.”

The view was echoed by Lorie Logan, Dallas Fed head, who said: “To sustainably achieve both of our dual-mandate goals [of stable prices and maximum employment], it will be important to keep any tariff-related price increases from fostering more persistent inflation. For now, I believe the stance of monetary policy is well positioned.”

08:56 PM BST

US retailers raise prices to get ahead of tariffs

Shops in the US are starting to hike prices to offset the likely effect of tariffs, a retail expert has said.

Aaron Rubin, chief executive of ShipHero, which provides software for merchants to help book shipments and track order deliveries, said his data indicates that retailers are already starting to raise prices to get ahead of the tariffs.

ShipHero’s data captures prices on several million products equivalent to about 1pc of overall US e-commerce sales. Prices rose 3.9pc on Sunday and Monday on a variety of goods compared with the week before Trump announced more tariffs, Mr Rubin said.

Scott Lincicome, a trade analyst at the free-market Cato Institute said: “Freer trade has helped moderate inflation over the long term.

“If we are entering a more restricted supply side ... then you’re likely to see more expensive stuff.

Globalisation, factory automation and technological innovation, particularly in electronics such as TVs, have brought down consumer prices. Imports help keep prices in check, economists say, partly because of lower labour costs overseas and because increased competition in the US market forces American companies to be more efficient.

After the double-digit inflation of the 1970s was defeated in the early 1980s, inflation still regularly topped 4pc yearly until the mid-1990s, when freer trade and globalisation began to intensify. From 1995 through 2020, it averaged less than 2.2pc.

American shoppers reaped the benefits. Average clothing costs fell 8pc from 1995 to 2020, at the same time that overall prices rose 74pc, according to government data. Furniture costs were roughly unchanged. The average price of shoes rose just 10pc.

Trump administration officials have at times acknowledged the prospect of higher prices from the tariffs.

In a speech last month to the Economic Club of New York, US treasury secretary Scott Bessent said: “Access to cheap goods is not the essence of the American dream.”

08:35 PM BST

Ivory Coast threatens more expensive cocoa in response to US tariffs

Ivory Coast, the world’s biggest cocoa producer, could take measures to make the product more expensive if tariffs proposed by Donald Trump go into effect, the West African country’s agriculture minister has said.

The Trump administration last week announced tariffs of 21pc, the highest in West Africa, on Ivory Coast as part of higher targeted duties on dozens of countries. On Wednesday, Mr Trump announced he was pausing them for 90 days.

Speaking to reporters in Abidjan on Thursday, agriculture minister Kobenan Kouassi Adjoumani said his country wanted Washington to reconsider the tariffs.

“When you tax our product that we export to your country, we will increase the price of cocoa and that will have a repercussion on the price to the consumer,” he said.

It was not immediately clear what specific measures he was referring to. The country could raise export taxes on cocoa to earn more revenue, which would make the product more expensive for consumers.

“It’s the end consumer who will be harmed,” Kouassi said.

Ivory Coast exports between 200,000 and 300,000 tonnes of cocoa to the US each year, according to data from the Coffee and Cocoa Council (CCC).

The minister also said Ivory Coast would seek stronger ties with the European Union to ensure that “if our products are not accepted in the United States, the EU can recover all of them.”

07:59 PM BST

Dollar hits 10-year low against Swiss franc as markets digest trade war drama

The US dollar fell against its major peers today, hitting a ten-year low against the safe-haven Swiss franc, as markets digested Donald Trump’s chaotic moves with tariffs.

The dollar fell 3.7pc against the Swiss Franc, around 2pc against the Japanese yen, 2.4pc against the euro and 1.2pc against the pound.

The US dollar index, which measures the American currency against a basket of rivals, is down 2.1pc.

07:49 PM BST

Bond rout the ‘catalytic event’ for Trump tariff pause

This week’s rout in US government debt was the catalyst for Donald Trump pausing his all-out trade war.

Clay Lowery, a former senior Treasury official now at the Institute of International Finance, said Trump’s reversal reflected concern that investors were taking assets out of both the stock market and Treasuries (US government bonds).

He said: “The 10-year Treasury yield was going up, and it was going precipitously.

“That was the catalytic event. Having volatility in the markets, OK, but we’re not trying to create a financial crisis or financial stability problem here.”

07:42 PM BST

Wall Street tumbles as ‘fear index’ jumps

Wall Street stocks tumbled today on mounting worries over the economic impact of Donald Trump’s multi-front tariff war.

All three major US stock indexes fell sharply, forfeiting much of the last night’s gains as growing concerns over the escalating Washington-Beijing trade face-off dampened optimism.

After Mr Trump announced a 90-day tariff reprieve on Wednesday, the S&P 500 surged 9.5pc, the largest one-day percentage jump since October 2008. The tech-heavy Nasdaq soared 12.2pc, notching its second-biggest daily gain on record.

Despite Wednesday’s bounce, the S&P 500 remained more than 6pc below levels before the reciprocal tariffs were announced last week.

Paul Nolte, senior wealth advisor at Murphy & Sylvest in Illinois, said: “Investors are still uncomfortable with it, because they don’t know what the end game is.

“I think what we’re seeing, still, is investor concern about tariffs and that is pretty much front and centre for everything.”

The Vix, often called the Wall Street “fear index,” remained elevated, up 26.9pc today.

“It’s hard for investors to feel comfortable about buying stocks with volatility so high,” Mr Nolte added.

The S&P 500 is down 2.9pc, the Nasdaq is down 3.7pc and the Dow Jones is down 2.2pc.

07:39 PM BST

US budget deficit surges despite tariff hikes

The US budget deficit expanded significantly last six months, including the start of Donald Trump’s presidency, according to official data.

The deficit widened to the second-highest on record for the October to March period, US officials told reporters.

This came despite the Trump administration starting efforts to slash the federal workforce and government spending, with the recent creation of the Department of Government Efficiency led by Trump ally Elon Musk.

Mr Trump, who returned to the presidency in late January, also imposed fresh tariffs on imports from China in February and March, and revenue collections are beginning to show up in the Treasury’s figures.

The budget gap grew 23pc to $1.3 trillion from the same period a year earlier, with spending boosted by interest on the public debt and areas like Medicare.

In the October to March period, revenues rose by three percent to $2.3 trillion, while expenditures grew 10 percent to $3.6 trillion.

Customs duties collected grew by $6 billion in the six-month period from a year ago, reaching $47 billion, data showed.

US officials told reporters that there is usually a month’s delay between a tariff’s enactment and revenue collection.

This means that customs duties collections will likely rise further in upcoming months, as Trump’s various waves of tariffs, including those on metals and cars, take effect.

07:26 PM BST

Tariffs are a ‘stagflationary shock’, says US rate-setter

A US Fed rate-setter has warned that tariffs could deliver a “stagflationary shock” after Donald Trump hiked them on China to 145pc.

Austan Goolsbee told the Economic Club of New York: “A tariff is like a negative supply shock. That’s a stagflationary shock, which is to say it makes both sides of the Fed’s dual mandate worse at the same time.”

The Fed is required to both maintaining stable prices and maximise employment.

Mr Goolsbee explained: “Prices are going up while jobs are being lost and growth is coming down, and there is not a generic playbook for how the central bank should respond to a stagflationary shock.”

Bloomberg reported that that Mr Goolsbee, head of the Chicago Fed, said that the sooner the uncertainty around tariffs lowers, the sooner the Fed can cut rates. He said that the Fed is currently in a wait and see mode.

07:12 PM BST

Musk attends cabinet meeting days after ‘moron’ spat

Tech billionaire Elon Musk attended Donald Trump’s cabinet meeting this evening, days after he accused the President’s trade tsar of being “dumber than a sack of bricks”.

Mr Musk had claimed that Peter Navarro, the US president’s senior counsellor for trade, was “truly a moron” in a growing White House split over tariffs.

The comments came after Mr Navarro claimed the Tesla founder was merely a “car assembler” rather than a manufacturer.

This evening, however, Mr Musk remained part of Mr Trump’s inner circle and said he anticipates saving the US taxpayer $150bn (£116bn) next year from a “reduction of waste and fraud”.

The White House had shrugged off the spat between Mr Musk and Mr Navarro by saying: “Boys will be boys, and we will let their public sparring continue.”

07:00 PM BST

Beijing bites back at US tariffs by curbing Hollywood imports

China has said it will immediately restrict imports of Hollywood films in retaliation for Donald Trump’s escalation of his trade war.

Industry analysts said the financial impact was likely to be minimal, however, because Hollywood’s box office returns in China have declined significantly in recent years.

Hollywood studios once looked to China, the world’s second-largest film market, to help boost box office performance of movies. But domestic movies increasingly have outperformed Hollywood’s fare in China, with “Ne Zha 2” this year eclipsing Pixar’s “Inside Out 2” to become the highest-grossing animated film of all time.

Chris Fenton, author of Feeding the Dragon , said limiting US-made films was a “super high-profile way to make a statement of retaliation with almost zero downside for China”.

Hollywood films now account for only 5pc of the overall box office receipts in China’s market. And Hollywood studios receive only 25pc of ticket sales in China, compared with double that in other markets, Mr Fenton said.

“Such a high-profile punishment of Hollywood is an all-win motion of strength by Beijing that will surely be noticed by Washington,” Mr Fenton added.

06:56 PM BST

First trade deal ‘very close’, says Trump

Donald Trump said his first deal on tariffs with a foreign nation was “very close” but added: “We have to have a deal that we like.

Asked if countries could negotiate away the 10 per cent baseline tariff, Mr Trump said: “It depends what they’re adding.”

He said the EU had been “very smart” after deciding to hold back on imposing retaliatory tariffs of 25pc on the US to give trade negotiations a chance.

Member states would be treated as a bloc for the purposes of US tariffs rather than individually, he added.

06:55 PM BST

Trump says he has not seen stock market drop

Donald Trump said he had not seen a drop in the stock market on Thursday as the latest Chinese tariffs came into force.

The US president said he would “love to be able to work a deal” with Xi Jinping, the Chinese leader, for whom he said he had “great respect”.

“I think that we’ll end up working on something that’s very good for both countries. I look forward to it,” he added.

Scott Bessent, the US treasury secretary, said “I don’t think we saw anything unusual today” in the markets.

06:34 PM BST

Novartis to invest $23bn in US plants as Trump renews tariff threats

Swiss drugmaker Novartis said on Thursday it plans to spend $23bn (£17.8bn) to build and expand 10 facilities in the US, as it grapples with renewed threats of drug tariffs.

The drugmaker plans to build six new manufacturing plants, some of which will make raw pharmaceutical ingredients, as well as a new research and development site in San Diego, California.

Novartis makes drugs, including heart failure medicine Entresto and breast cancer therapy Kisqali, across 33 manufacturing sites globally.

The new sites and extensions will be built over the next five years and are expected to create more than 1,000 jobs for skilled workers including engineers and scientists as well as another 3,000 support staff and construction jobs.

The company said it had yet to decide where to build its new manufacturing plants.

The announcement comes two days after President Donald Trump said the US will soon announce a “major” tariff on pharmaceutical imports, sending shares of drugmakers plunging.

“We believe we can manage the tariffs - though of course they will be very painful - so while that is a factor [behind this investment], it’s not the driving factor,” Novartis chief Vas Narasimhan said.

06:31 PM BST

Trump has created space for trade deals, says US negotiator

Jamieson Greer, the US trade representative, said that Donald Trump had created room for a “reordering” of trade after declaring a 90-day pause in his planned tariffs.

“You’ve ... given room for negotiation,” he told the US president at a cabinet meeting.

“During this time, so we can open export markets for farmers and other producers and American workers.”

He said Mr Trump had “started a reordering of international trade” which “should have happened decades ago”.

06:19 PM BST

US and Vietnam to begin formal trade talks

The United States and Vietnam have agreed to begin formal discussions on reciprocal trade, US treasury secretary Scott Bessent has said after a meeting with Vietnamese Deputy Prime Minister Duc Phoc.

The US Treasury said: “During their talks, Secretary Bessent emphasised the importance of continued engagement with trade partners, and the need for quick, demonstrable progress to resolve outstanding issues.”

It comes a day after the US paused the implementation of global “reciprocal” tariffs, including a 46pc levy on Vietnam.

06:17 PM BST

Bessent hails bond auction success despite sell-off

Scott Bessent, the US treasury secretary, has hailed the success of a bond auction despite this week’s sharp bond sell-off.

He told a cabinet meeting that “the bond auction went very well yesterday”.

It came after the cost of borrowing by the US government jumped. The yield on benchmark 10-year US Treasury notes rose to 4.355pc today from 3.934pc on Monday.

Nicolas Forest, Candriam’s chief investment officer, told Bloomberg: “We were getting close to a Liz Truss scenario and that’s why the Trump administration made a reversal: the sell-off in the bond market was a real alert, it showed both stress across hedge funds and selling from Asian investors. Let’s bear in mind they have a massive debt to refinance.”

Mr Bessent also insisted that the US was “still the best place to invest” and that the 0.1pc fall in inflation in March, announced this morning, was “quite good”.

“Energy prices are down more than 20pc since January 20,” he added, telling Donald Trump that they were “great numbers”.

06:08 PM BST

EU to cut tariffs on Chinese EVs - but add a minimum price

The European Union is reportedly in talks with China to roll back tariffs on the Asian giant’s electric vehicles.

Last year, the EU imposed extra duties of 17.4pc on cars made by BYD, 20pc on those made by Volvo-owner Geely and 38pc for SAIC.

German media, including Zeit Online, say that China’s EV manufacturers are planning to share technology with European producers and invest more in EU. In return, the EU reportedly plans to cut duties and instead impose a minimum price for the cars.

06:02 PM BST

Trump may buy ships from allies as he seeks to ‘rebuilt’ domestic industry

Donald Trump has said the US wukk start “rebuilding” its shipbuilding industries but in the meantime would buy “top of the line ships” from other countries.

He told a cabinet meeting: “We may buy some ships from other countries that we’re close to and that do great jobs with ships.

“But we’re going to start the process of rebuilding.

“We don’t really essentially build ships anymore, which is ridiculous. It’s going to be a very big business for us.”

06:01 PM BST

British stocks mark strongest session in three years after Trump’s tariff pause

British stocks closed higher today, after Donald Trump dialled back duty rates on goods from many countries for 90 days.

The blue-chip FTSE 100 rose 3pc, posting its biggest one-day jump since March 2022.

The mid-cap FTSE 250 index climbed 3.5pc, notching up its biggest single-day gain since July 2023.

06:00 PM BST

Trump says US in ‘very good shape’ despite trade war

“We think we’re in very good shape. We think we’re doing very well again,” Donald Trump said at a cabinet meeting on Thursday.

Seemingly referring to 145 per cent tariffs being imposed on China, Mr Trump continued: “There’ll be a transition cost and transition problems, but in the end, it’s going to be, it’s going to be a beautiful thing.

“We’re doing again, what we should have done many years ago. We’re letting it out of control.

“And we allowed some countries to get very big and very rich at our expense... it’s not a sustainable formula.”

05:59 PM BST

Lutnick says US getting respect

US commerce secretary Howard Lutnick has claimed he does not have “enough time in the day” to talk to countries hoping to negotiate away tariffs due to be imposed in 90 days.

“I’m not sure we could ever have enough time in the day to talk to all these countries, because they want to talk, and they want to talk now,” he said.

“They have come with offers that they never, ever, ever would have come with, but for the moves that the president has made, demanding that people treat the United States with respect.

“We’re getting the respect we deserve now.”

05:53 PM BST

Trump admits trade war will cause extra costs and problems

Donald Trump has admitted that his trade war will impose extra costs and create transition problems in the US economy.

The American president said: “It’s all going to work out very well. We’re in good shape. There’s very little inflation.”

He said his smaller-scale tariffs in his first administration meant “we took in hundreds of billions of dollars from China”.

He added: “There’ll be a transition cost and transition problems but in the end it’ll be a beautiful thing.”

05:42 PM BST

Trump celebrates ‘meaningless’ inflation figures

Donald Trump has celebrated “meaningless” inflation figures, an analyst has said.

Dan Coatsworth, at broker AJ Bell, said: “Fundamentally, the US still has a major problem on its hands by imposing such significant tariffs on Chinese imports, particularly with China having retaliated on a grand scale. Costs could go through the roof for US consumers and push up inflation.

“Today’s inflation reading is arguably meaningless as it relates to the pre-liberation day environment. What matters is where inflation is heading over the coming months, and the data could be ugly.

“Trump’s 90-day pause has brought some relative calm to markets but it doesn’t remove the clear risk of a global economic slowdown.”

05:23 PM BST

Yellen says bond rout influenced Trump tariff pause

Former US treasury secretary Janet Yellen has said that the threat of financial instability prompted by falling prices for US Treasury debt influenced President Donald Trump’s decision to reverse course and partially pause his tariff campaign.

Ms Yellen told CNN that US Treasury debt yields rose sharply amid the tariff financial turmoil, causing investors to question their safe-haven status. Bond yields move inversely to price.

“It caused highly leveraged hedge funds that hold US Treasuries to begin to sell their holdings, and that’s something that could really begin to trigger financial instability if there is massive sales of US Treasuries,” Ms Yellen said.

“So my understanding is that this is something that was an influence on President Trump in getting him to pause the reciprocal tariffs, and it’s certainly something that should be of concern.”

05:09 PM BST

FTSE 100 closes up 3pc

London’s main stock markets closed up today, with the FTSE 100 closing up more than 3pc after rising as much as 6.3pc.

Kathleen Brooks, research director at XTB, said that yesterday’s relief rally on Wall Street had spread to Europe. However, sai said that “tailwinds from the tariff threat remain”.

05:05 PM BST

EU and UAE to launch free trade talks in wake of Trump trade war

The European Union plans to “swiftly and ambitiously” negotiate a free trade deal with the United Arab Emirates after Donald Trump slapped a series of tariffs on European goods.

The European Commission said that talks would focus on liberalising trade in goods, services and investment.

04:46 PM BST

US stock markets continue to fall

Wall Street’s main indexes are continuing to fall this afternoon, with the S&P 500 down by 3.9pc, the Dow Jones down by 3.4pc and the Nasdaq down by 4.7pc.

David Morrison, an analyst Trade Nation, said: “The immediate danger is over. But investors are ... keenly aware that uncertainty still shrouds the markets.”

04:20 PM BST

Amazon boss warns over ‘flux’ in global trade

Amazon has shared its concerns with the Trump administration over the “flux” generated with the trade war, its boss has said.

Andy Jassy, chief executive, told CNBC: “We look at all the things that could impact consumers and customers. It’s hard to know what’s really going to happen. There’s a lot of flux right now.”

He added that Amazon is “doing everything we can to try and keep prices the way they’ve been for customers - as low as possible”.

To that end, it has been making “strategic forward inventory buys” and renegotiated prices with some sellers.

04:15 PM BST

China tariffs are 145pc not 125pc, White House says

The tariff rate on China is 145pc, not 125pc, a White House official has told CNBC.

Yesterday, Donald Trump wrote on his Truth Social platform: “Based on the lack of respect that China has shown to the World’s Markets, I am hereby raising the Tariff charged to China by the United States of America to 125%, effective immediately.”

But CNBC has been told that the 125pc comes on top of a 20pc fentanyl-related tariff.

03:55 PM BST

Starmer rejects claim UK has ‘no advantage’ in trade war

Sir Keir Starmer has rejected the suggestion that his administration has handled Donald Trump’s trade war poorly.

Asked whether he thought not retaliating to US tariffs had resulted in no advantage, the Prime Minister told reporters: “I don’t think having a strong relationship with the US has given us no advantage whatsoever. We have got a very strong relationship on defence, security, intelligence sharing.

“No two countries are as closely aligned as ours.”

When pressed that most nations now face the same tariff rate as the UK, Sir Keir said: “Of course we are continuing to talk to the US about how further we can mitigate the impact of the tariffs.

“But a trade war is in nobody’s interest and there is no business sector that is being impacted by these tariffs who is saying jump in with both feet to retaliate and cause a trade war.”

Asked if he was comfortable with the US president’s suggestions countries were “kissing my ass” to hold trade deal talks, Sir Keir insisted America was Britain’s “closest ally” and it was important to maintain a “calm and pragmatic approach” to negotiations.

03:48 PM BST

China won’t ‘beg for mercy’ from Trump, says official

A Chinese official has said that Donald Trump can never expect China to “beg for mercy” as he accused the US of acting like a “barbarian”.

In a letter to the South China Morning Post , Huang Jingrui, the Hong Kong spokesperson for China’s foreign ministry, said: “The reality is that [America] does it understand the art of dealing with China or other countries. Instead, it is obsessed with the “art” of bullying and blackmailing the entire world.

“We must solemnly tell the US: a tariff-wielding barbarian who attempts to force countries to call and beg for mercy can never expect that call from China.”

03:35 PM BST

Germany to stagnate even without ‘reciprocal’ tariffs, say forecasters

Germany will grow just 0.1pc this year, down from the 0.8pc predicted in September, according to a group of influential economic forecasters.

The country’s economy ministry uses the forecasts - produced by a group of Germany’s institutes including the Ifo - when making its own predictions.

The further “reciprocal” tariffs announced by Donald Trump on April 2 and suspended yesterday could still deal a major blow to Europe’s biggest economy, the institutes said, possibly “doubling the negative effects”.

The tariffs could put Germany on track for a third year of recession for the first time in post-war history.

The institutes’ new forecasts factor in US tariffs of 25pc on EU aluminium, steel and cars - which are still in place - but not the tariff increases of 20pc on other goods announced last week and suspended for a 90-day period on Wednesday.

03:31 PM BST

Challenge hasn’t gone away, says Starmer after Trump tariff rethink

Sir Keir Starmer welcomed Donald Trump’s rethink on tariffs but said the “challenge hasn’t gone away”.

The Prime Minister said he believed the tariffs approach adopted by the US was not a “passing phase” and the UK needed to “step up” to protect its own economy.

He told Sky News: “I am very pleased to see the changes in relation to the tariffs. But the challenge hasn’t gone away and I don’t think this is a passing phase.

“I think we are living in a changing world. For defence and security we have already recognised that over recent months which is why we have increased defence spending and why we have stepped up across Europe in relation to defence and security.

“We now need to do the same on trade and the economy which has to be translated into one, turbo charging our own economy, going further and faster with the changes that we need… but also talking to international leaders about how we can lower trade barriers across the globe to make it easier for our businesses to thrive.

“We have got to step up here on trade and the economy in the same way that we have stepped up on trade and security.”

03:18 PM BST

Bank of England becoming ‘more responsive’ to turmoil, say economists

The Bank of England’s decision to delay a bond auction indicates it may be “more responsive than might have been expected” to Donald Trump’s trade war, economists said.

Threadneedle Street amended its schedule for bond sales “in light of recent market volatility” as US tariffs drove sharp swings in the cost of borrowing on the debt market.

Allan Monks, UK economist at JP Morgan said the Bank of England was unlikely to alter its planned sell-off of government bonds through quantitative tightening, as it battles to keep inflation under control.

He added: “That said, the decision today perhaps signals the Bank of England is more responsive than might have been expected to events this week.

“That potentially sets a precedent for expectations about how quickly it might respond to future episodes of market volatility.”

03:01 PM BST

US stocks slump as investors ‘opt to get out’

Wall Street stocks opened decisively lower following an historic surge on Wednesday after President Donald Trump backed down on many of his trade tariffs.

All three major indices were firmly in the red after notching some of the biggest single-day gains in history in the prior day.

Briefing.com analyst Patrick O’Hare said the “backtracking” in US stocks “is not surprising”.

He said: “Given the scope of yesterday’s gains, we suspect plenty of participants saw that as a gift that made them close to whole again in terms of the tariff sell-off and are opting to get out knowing that the tariff, economic, and earnings uncertainty was not resolved with yesterday’s 90-day pause (key word) and escalated tariff action for China.”

02:53 PM BST

Prada buys Versace in €1.3bn deal

Prada has agreed to buy Versace in a €1.25bn (£1.1bn) deal that will see two of Italy’s biggest luxury fashion brands come together just as the world economy faces turmoil from Donald Trump’s trade war.

The Milan-based Italian fashion house said it was acquiring 100pc of the brand from Michael Kors and Jimmy Choo owner Capri Holdings.

Prada said Versace would complement its portfolio of brands, which also includes Mui Mui and Church’s.

Founded in 1978 by Gianni Versace in Milan, his sister Donatella took over the family business when her brother was murdered outside his Miami mansion in 1997.

She dramatically quit as the head of the fashion empire last month after “clashing” with its owners as the Italian clothing giant suffers year-on-year losses.

Prada’s acquisition will be funded by €1.5bn (£1.3bn) of new debt comprising of a €1bn (£860m) loan and a €500m (£431bn) bridge facility.

02:34 PM BST

US stocks drop at the opening bell

Stock markets on Wall Street fell at the opening bell as Donald Trump’s trade war raised fears about the long-term impact on the US economy.

The Dow Jones Industrial Average fell 1.7pc to 39,901.31 at the start of trading, while the benchmark S&P 500 declined 2.3pc to 5,331.97.

The tech-heavy Nasdaq Composite dropped 2.6pc to 16,674.51.

02:24 PM BST

Tariff impact changing on ‘hourly basis’, says BAT

British American Tobacco has said it is “too early” to assess the implications of Donald Trump’s tariffs as the policies are changing on an “hourly basis”.

Asli Ertonguc, area director for Western Europe, said the company remains “agile and flexible” to cope with supply chain disruption.

She told The Telegraph: “We are observing. We have a very large footprint and we have quite an agile and flexible way of operating around the world with our supply chain.

“With many examples in the past like Covid we operated during a crisis moment in the world.

“We will observe the implications of course and adjust our operations wherever it is necessary. It is too early to conclude as the developments are happening on an hourly basis.

“It may have implications to our business, it is too early to say.”

02:04 PM BST

Bank of England postpones debt auction over Trump trade war losses

The Bank of England has delayed plans for an auction of gilts after Donald Trump’s trade war triggered a sell-off across global bond markets.

Threadneedle Street said it plans to delay a sale of longer-term bonds “in light of recent market volatility”, as borrowing costs rose sharply over fears the US president’s tariffs would spark a financial crisis.

President Trump announced on Wednesday he would suspend the most severe of his “reciprocal” tariffs by 90 days, barring levies on China, following a sharp sell-off on bond markets.

White House economic adviser Kevin Hassett admitted the turmoil in bond markets “may have” played a part in the US president’s decision to delay his “reciprocal” tariffs, although he insisted this had not been a “panic move”.

An auction at a time of turmoil on bond markets would risk the Bank of England suffering sharp losses pn the sales.

The Bank said: “Sales are being conducted so as not to disrupt the functioning of financial markets, and only in appropriate market conditions.”

Two-year gilt yields have fallen in recent days, pushing up their prices on bond markets, amid increasing expectations of interest rate cuts by the US Federal Reserve and the Bank of England this year.

However, longer-term yields have soared, pushing those bond prices lower, amid fears about damage to the world economy from President Trump’s trade war.

01:38 PM BST

Wall Street reduces losses ahead of opening bell

US stock indexes reduced their losses after a cooler-than-expected inflation reading bolstered expectations that the Federal Reserve would remain on track to cut interest rates this year.

A Commerce Department report showed the consumer price index rose 2.4pc in March on an annual basis, compared with expectations of a 2.5pc rise, according to economists.

Separately, a Labor Department report showed the number of new Americans filing for unemployment benefits came in at 223,000, in line with estimates.

In premarket trading, the Dow Jones Industrial Average was down 432 points, or 1.1pc, the S&P 500 was down 79.25 points, or 1.4pc and Nasdaq 100 contracts were down 349 points, or 1.8pc.

01:32 PM BST

US inflation falls further than expected in boost for Trump

The pace of US inflation declined last month in a boost to Donald Trump over fears his tariff regime threatens to increase prices.

The consumer prices index for the US fell from 2.8pc to 2.4pc in March, according to the Commerce Department. Analysts had forecast a fall to 2.5pc.

Core inflation, which strips out volatile food and energy prices, also declined by more than expected from 3.1pc to 2.8pc.

01:19 PM BST

Wall Street on track for slump over US-China stand-off

US stock indexes were down in premarket trading as Donald Trump’s trade war became a stand-off between the world’s two largest economies.

The US president’s tariff climbdown triggered a blistering rally on Thursday in which the Nasdaq posted its biggest one-day jump since 2001 and the S&P 500 made its biggest single-day percentage gain since 2008.

Mr Trump announced a 90-day pause on many of his new reciprocal tariffs, but raised them to 125pc on Chinese imports to punish Beijing for raising tariffs on US goods to 84pc.

Rabobank analysts said: “The trade war is now turning into a direct confrontation between the U.S. and China.

“We could again be seeing escalation and de-escalation at the same time, pulling markets in different directions.”

Most megacap and growth stocks slid in premarket trade after recording robust gains in the last session, with Tesla sliding 3.2pc and Nvidia down 2.9pc.

There was also uncertainty ahead of US inflation figures published shortly, although Wall Street’s “fear gauge” fell from its August highs.

In premarket trading, the Dow Jones Industrial Average was down 1.4pc, the S&P 500 fell 1.8pc and the Nasdaq 100 had declined 2.3pc.

12:58 PM BST

Labour tax decisions made UK ‘more fragile’ amid tariff war, claims Badenoch

Kemi Badenoch claimed Labour’s decisions since entering office had “made us more fragile” in the face of US global tariffs.

She told the BBC: “What we’re seeing right now is that Labour is learning on the job. I am worried that a lot of the mistakes that they’ve made have made us less able to weather the storm of tariffs.”

She said this included policies such as the rise in employer National Insurance contributions, changes to inheritance tax for farmers and means-testing the winter fuel allowance for pensioners.

“All of those things have made us more fragile,” Mrs Badenoch said.

12:50 PM BST

Trump aide admits bond market ‘may have’ played role in tariff climbdown

One of Donald Trump’s advisers admitted the turmoil in bond markets “may have” played a part in the US president’s decision to delay his “reciprocal” tariffs.

White House economic adviser Kevin Hassett insisted the surge in US government borrowing costs had not triggered a “panic move” by the President.

He added that the US is talking to trading partners and is close to reaching agreements with some on tariffs.

“There’s a big inventory of deals that are right close to the finish line,” Mr Hassett told CNBC.

The President’s decision to row back on tariffs still leaves his baseline 10pc duties on trading partners in place.

Asked if these would be permanent, Mr Hassett said everyone expects the 10pc tariffs to be “a baseline”.

12:38 PM BST

Reeves’ headroom ‘likely fully diminished’

Rachel Reeves’ financial headroom has likely been fully “diminished” just two weeks after the Spring Statement, an economist has said.

Sanjay Raja of Deutsche Bank said the Chancellor finds herself in a “difficult place” despite the temporary tariff reprieve.

He said: “Chancellor Reeves finds herself in a similar place to where she was at the start of the year.

“For all intents and purposes, her £9.9bn headroom (against her primary stability rule) has likely diminished significantly - if not fully.

“Lower equity prices, the tariff shock, higher long end yields, and stronger borrowing numbers from the current fiscal year will likely remove any remaining headroom just two weeks following the Spring Statement.”

Mr Raja expects the Government to take a “two-pronged” response of invigorating industrial policy and shielding businesses from tariff exposure.

He said Sir Keir Starmer’s relaxing of the Zero Emission Vehicle Mandate was a sign of policy to come, as Ms Reeves eyes bringing forward capital spending projects such as transport investment to improve northern rail links as well as re-nationalising British Steel and focusing on financial deregulation.

He said: “These ‘soft’ policy measures, we think, will rank highly in the Government’s playbook to shift-start the economy, following the tariff shock.”

He added that reimbursing UK plc in full for the trade shock would “end up costing something like gross £5-10bn”.

12:31 PM BST

Trump administration accused of insider trading after stocks soar

Democrat leaders are demanding an investigation into whether Donald Trump engaged in insider trading in the hours before he announced a reversal of his tariff policy .

On Wednesday afternoon, the US president paused his “reciprocal” tariffs for the next 90 days on all countries except China.

The S&P 500, which groups the largest companies in the United States, soared by more than 9pc following the news.

“THIS IS A GREAT TIME TO BUY,” Mr Trump wrote on Truth Social at 9:37am in the morning.

There was a spike in Nasdaq call volume, where traders buy the right to purchase a share at a certain price before a certain date, in the hour before the president announced his U-turn.

11:59 AM BST

EU pauses tariffs on $23bn worth of US goods

The European Union has suspended new tariffs that would have hit €20.9bn (£17.9bn/$23bn) of US goods.

Donald Trump had imposed a 20pc levy on goods from the EU as part of his onslaught of tariffs against global trading partners.

However, he said these would be paused for 90 days to give countries a chance to negotiate solutions to US trade concerns.

11:38 AM BST

EU delays tariffs by 90 days in olive branch to Trump

The European Union has delayed its counter tariffs against the US hours after Donald Trump backtracked on his “reciprocal” measures.

European Commission president Ursula von der Leyen said: “We want to give negotiations a chance.

“While finalising the adoption of the EU countermeasures that saw strong support from our Member States, we will put them on hold for 90 days.

“If negotiations are not satisfactory, our countermeasures will kick in.

“Preparatory work on further countermeasures continues.

“As I have said before, all options remain on the table.”

11:27 AM BST

US dollar sinks over fears of economic downturn

The dollar plunged against the pound and the euro after President Donald Trump abruptly paused higher tariffs on all countries except China.

The greenback lost over 1pc against the European single currency, as investors began to price in the risk of lasting economic damage from US trade policy.

Markets also expected data later today to show US inflation slowed in March.

The dollar was down 0.7pc versus the pound, which was worth $1.29, and fell further against the Japanese yen and the Swiss franc, which are seen as safe-haven currencies.

11:18 AM BST

Starmer vows to ‘rise to the moment’ amid economic instability

Sir Keir Starmer said the Government was not sitting back and hoping for a better future for the UK in the face of global economic insecurity triggered by Donald Trump’s tariffs.

The Prime Minister said he would not “pretend that tariffs are good news” and ministers intended to “rise to the moment”.

He said: “This Government is ambitious for Britain… and I’m not going to stand here and pretend that tariffs are good news. That is not true, and you wouldn’t believe me if I said it, but just as we’ve seen recently on defence and security across Europe, and with Ukraine, they do make one thing very clear, and that is that the world is changing, and we as a country must change with it.

“In other words, we’ve got to rise to the moment here, recognise where our future lies, renew Britain and deliver security for working people, and that’s why we’ve taken the decision to accelerate our plans to create wealth in every community, and every community is really important here…

“We are not a Government (that’s) just going to sit back and hope. I strongly believe that is how politics has failed our communities for so many years… what we’ve got to do, what we’re offering, is fundamental change.”

11:05 AM BST

Tariffs will have ‘no impact on inflation’, insists ECB policymaker

The Governor of the Bank of France said the US trade war would have a limited impact on inflation in Europe and that the European Central Bank still had “room” to lower its interest rates.

François Villeroy de Galhau admitted there would be an “effect on growth” in the eurozone, estimated at 0.25 points of GDP.

However, the European Central Bank (ECB) policymaker said there would be little or “probably no impact on inflation”.

“Tariffs will have much less impact on European inflation than on American inflation”, he added.

He welcomed Donald Trump’s tariff U-turn as a “return to economic realism and a little reality”. But he warned that US policy remained “unpredictable” and that there would be a “negative impact” in Europe.

His comments came as the French government cut its growth forecast for 2025 because of the uncertainty over world trade.

The government had forecast annual growth of 0.9pc when presenting its 2025 budget, but Economy Minister Eric Lombard told TF1 television that it would be trimmed to 0.7pc.

The Bank of France had already revised its growth forecast for 2025 to 0.7pc in March, and the French Economic Observatory (OFCE) lowered its forecast to 0.5pc on Wednesday.

Asked about a possible further downward revision, the minister said that “would depend on the negotiations that will be initiated with the United States and the decisions that are taken on customs duties.”

“If we succeed in lowering tariffs, we could even get better, and if not, we will see,” he added, although he ruled out raising taxes in 2025.

Regarding the US tariff suspension, he called it “good news, but we must remain calm,” adding that he hoped to find “a new agreement” with the Americans.

10:44 AM BST

Chancellor keeps Nikhil Rathi as head of financial watchdog

Rachel Reeves has granted Nikhil Rathi a second term as boss of the Financial Conduct Authority despite mounting speculation that he too could fall victim to her offensive against regulators.

The Treasury said under Mr Rathi’s leadership the financial watchdog had risen to the challenge of pushing growth-enhancing policies, embracing ideas such as easing mortgage lending criteria. He is the first FCA chief to be offered a second term.

Ms Reeves earlier this year ousted Competition and Markets Authority boss Marcus Bokkerink over his reported lack of enthusiasm for growth reforms.

10:25 AM BST

Office construction drops to 15-year low amid Trump tariff unease

Unease over Donald Trump’s tariffs is putting UK construction activity at risk as office projects slump to their lowest levels in more than 15 years, experts warn.

Developers made a start on just 4.3m sq ft of office projects during the year ending 31 March, down 57pc year-on-year, according to findings shared by data analytics firm CoStar.

The amount of office space under construction was 22.5m sq ft, the lowest since Q1 2015.

Separate findings from the latest S&P Global UK Construction PMI show UK construction companies have been delaying decision-making on commercial building projects.

Researchers at S&P pinpointed a decline in business activity in March, citing “worries about the impact of rising global economic uncertainty” on clients’ investment spending.

Mark Stansfield, senior director of UK analytics at CoStar, told The Telegraph: “Trump tariffs have made the path of inflation – and therefore of interest rates – more uncertain.

“This is unlikely to encourage developers to build speculative new offices and will more likely have a negative effect on near-term plans to do so.”

10:07 AM BST

US to fall into recession despite Trump tariff pause, bond giant warns

The $2 trillion American bond investor Pimco has warned the US economy will likely enter recession in the second half of this year despite Donald Trump’s tariff pause.

Tiffany Wilding from Pimco said: “We now expect US growth to contract in the second half of the year. We estimate core CPI inflation could accelerate to 4.5pc, though headline inflation may be around 1 percentage point lower if the 20pc decline in global energy prices is sustained.

“While these estimates are highly variable, it’s clear the U.S. economy hasn’t seen a shock like this since the 1920s and 1930s.”

Ms Wilding said that even if the 90-day tariff pause announced by Mr Trump on Wednesday gets extended, the US could still be in for a big downturn.

She said: “Even if the 90-day reprieve turns into a longer stint, we still think U.S. recession odds are 50/50. Higher tariffs on US imports raise costs for domestic consumers and businesses and reduce real disposable incomes and profit margins.”

Borrowers outside the US hoping the turmoil will force central banks to swiftly cut rates may be disappointed, she added.

Ms Wilding said: “These policies are likely to be deflationary for the rest of the world, resulting in fewer constraints on central banks outside the US to cut rates.”

09:49 AM BST

Telegraph readers: The damage is already done

Donald Trump is “damaging everybody and everything at a whim” according to Telegraph readers amid dramatic swings in stock markets over his tariff policies.

Here is a selection of views from the comments section below and you can join the debate here :

09:32 AM BST

Watch: Bond market is beautiful, says Trump

Donald Trump hailed the “beautiful” state of the bond market as his reversal on tariffs sent government borrowing costs lower.

The yield on 10-year US Treasury gilts - a benchmark for the cost of servicing federal debt - has eased four basis points today to 4.29pc.

Yields had surged higher amid a crisis in confidence from investors concerned the US economy was heading for recession.

The move has also helped push down UK government borrowing costs, with 10-year gilt yields down 10 basis points to 4.68pc.

Credit: Reuters

09:13 AM BST

Trump’s ‘extreme measures’ on China will ‘create problems for everybody’, says Badenoch

Kemi Badenoch said the “extreme” tariffs imposed by Donald Trump on China will “create problems for everybody”.

But the Tory leader stressed the importance of rules-based trade and said Beijing too often did not play by those rules.

She told BBC Breakfast: “The real problem right now is that China doesn’t follow those rules.

“I saw this as trade secretary, they were dumping steel, put our steel industry in crisis and many of the countries that I have spoken about are also concerned about the way China operates.

“The US has now taken extreme measures which will create problems for everybody but if you listen to what Donald Trump has been saying he is talking about China a lot, everyone in the world is worried about China.”

09:07 AM BST

Badenoch urges Starmer to meet trans-Pacific trade partners over tariffs

Sir Keir Starmer should “convene” the members of a trans-Pacific trading agreement to discuss ways to mitigate the impact of US tariffs, Kemi Badenoch has said.

The Conservative leader told BBC Breakfast: “When I was trade secretary we signed the biggest post-Brexit deal, CPTPP (Comprehensive and Progressive Agreement for Trans-Pacific Partnership), with countries like Mexico, Canada, Australia, Japan.

“All those countries are feeling the brunt of US tariffs.

“What I would be doing if I was prime minister is convening those countries to see what we can do to make life easier for the citizens of our various countries.

“It’s always about making life better for people, reducing the cost of living. That can happen.”

08:56 AM BST

Electronics maker warns of tariffs hit as boss steps down

Markets may be surging at the fastest pace in five years but that is not to say companies are universally feeling more positive.

TT Electronics warned that US tariffs will knock its profits and risks impacting its ability to keep operating, as its announced the sudden departure of its boss.

The Woking-based manufacturer said Donald Trump’s import taxes and retaliatory measures had led to an “uncertain and volatile” backdrop.

Shares plunged 15.9pc as the company – which has factories in the UK, North America and Asia – reported a statutory pre-tax loss of £33.4m for 2024.

It announced its chief executive Peter France was stepping down “with immediate effect”.

He has been replaced by finance chief Eric Lakin on an interim basis while the firm said it will be “assessing all options” for its struggling components division.

It has previously warned of difficulty in its US branch, with slumping demand for the components it produces and ongoing production issues at its factories. This led to it booking a £52.2m write-down due to the challenges.

It also revealed it shed 500 staff over the first half of the year in North America which it expects to result in £12m of yearly cost savings.

The US woes offset strong performances for the business in Europe and Asia, with the firm generating £521.1m in revenues for the year.

TT Electronics engineers and manufactures products to support sectors from healthcare to aerospace, and has counted customers including BAE Systems and Thales.

08:43 AM BST

China urges US to meet ‘halfway’ in tariff talks

China urged the US to meet it “halfway” in the mounting trade war between the two powers, while promising to “fight to the end” if a compromise cannot be reached.

Commerce Ministry spokesman He Yongqian said: “The door to dialogue is open, but it must be based on mutual respect and conducted in an equal manner.”

Chinese foreign ministry spokesman Lin Jian said Beijing is not interested in a fight but will not fear if the United States continues its tariff threats.

Spokesman Lin Jian said: “The US cause doesn’t win the support of the people and will end in failure.”

Mr Lin added China will not sit back and let the legitimate rights and interests of the Chinese people be deprived.

08:18 AM BST

European stocks jump most in five years

European shares leapt higher amid easing concerns about a global trade war.

The Continent-wide Stoxx 600 – which includes British companies – rocketed 7.3pc in its biggest move higher since March 2020, while France’s Cac 40 jumped 6.4pc.

The Dax in Germany gained 7.8pc, which would mean European stocks have regained about half their losses since mid-March should the rises hold until markets close.

08:13 AM BST

FTSE jumps 6pc in tariff-pause rally

The FTSE 100 quickly rose 6pc as trading got underway in London amid hopes US tariffs would not deliver as heavy a blow to the world economy.

Bank stocks jumped as traders reduced their expectations for interest rate cuts, with Barclays surging as much as 27.9pc and HSBC up 6.9pc.

08:09 AM BST

Bond market rallies after US tariff climbdown

Traders raced back into the bond market after Donald Trump’s decision to halt many of his tariffs.

The yield on 10-year UK gilts - a benchmark for government borrowing costs - fell nine basis point to 4.69pc at the start of trading.

The yield tends to fall as demand surges.

08:03 AM BST

FTSE jumps at the open

The FTSE 100 lurched higher at the start of trading after Donald Trump suspended swathes of his global tariffs.

The UK’s flagship stock index rose 1.1pc to 7,764.57 while the mid-cap FTSE 250 climbed 2pc to 18,242.54.

08:00 AM BST

Carney hails ‘welcome reprieve’ and pledges trade talks with US

Mark Carney said Donald Trump’s U-turn on tariffs was a “welcome repreive” for the world economy.

The Canadian prime minister said Ottowa would commence negotiations on a new economic and security relationship with the US immediately after its next election, which he called last month.

Canada still faces 25pc tariffs imposed by Mr Trump on goods that do not comply with the United States–Mexico–Canada Agreement (USMCA) on trade.

07:54 AM BST

Von der Leyen urges Trump to agree ‘zero-for-zero’ tariff deal

European Commission president Ursula von der Leyen welcomed Donald Trump’s announcement of a pause in reciprocal tariffs as she pushed the president to agree a “zero-for-zero” agreement.

“Clear, predictable conditions are essential for trade and supply chains to function,” she wrote on X.

She added that tariffs are taxes that only hurt businesses and consumers.

“That’s why I’ve consistently advocated for a zero-for-zero tariff agreement between the European Union and the United States,” she said.

07:48 AM BST

Japan markets enjoy best day in nine months

Tokyo’s benchmark Nikkei index ended more than 9pc higher on Thursday after Donald Trump’s stunning reversal on imposing sweeping reciprocal tariffs.

The Nikkei 225 index of shares enjoyed its best day since August last year as it closed up by 2,894.97 points at 34,609.00, while the broader Topix index gained 8.1pc, or 190.07 points, to 2,539.40.

It comes a day after Wall Street stocks rocketed on Mr Trump’s pause announcement.

The S&P 500 surged 9.5pc to 5,456.90, snapping a brutal run of losses over the past week. The Nasdaq Composite leapt 12.2pc to 17,124.97 while the Dow Jones Industrial Average gained 7.9pc to 40,608.45.

07:41 AM BST

Traders reduce bets on interest rate cuts

Money markets indicated there was less likelihood of the Bank of England cutting interest rates three times this year after Donald Trump suspended tariffs around the world.

Traders still think there is a 90pc chance policymakers will reduce borrowing costs next month, but had fully priced in such a move earlier this week when US tariffs were came into effect.

There is now an 86pc chance of three cuts by the end of this year, derivatives trades indicate. Again, this had been priced in by the market earlier this week.

07:33 AM BST

UK position ‘hasn’t changed’ on Trump’s tariffs, says Cooper

Yvette Cooper said the UK’s position on US tariffs “hasn’t changed” after Donald Trump’s climbdown.

The US president paused the imposition of his biggest tariffs but the UK is still being hit with the baseline 10pc levy.

The Home Secretary said the UK would continue to seek a trade deal with the US as she refused to comment on why Mr Trump had made the decision to change tack.

She told Sky News: “Our position hasn’t changed. We are continuing to approach this in a calm, steady way, continuing to negotiate and work in the UK’s national interest.

“But look, overall what we want to see is a reduction in barriers to trade so countries can trade effectively, rather than increases.”

It was suggested to Ms Cooper that Mr Trump had “blinked” because of increasing global economic turmoil.

She said: “Our approach is to say we don’t want to see the trade barriers anywhere.”

Asked again why Mr Trump had changed his position, she said: “I can’t comment on the decisions that the US government is making. What we are doing is acting in the UK’s national interest.”

07:28 AM BST

Trump has eroded confidence in the dollar, says ECB official

Donald Trump’s tariff policies in recent weeks have eroded confidence in the US dollar, European Central Bank (ECB) policymaker Francois Villeroy de Galhau said.

Mr Villeroy - who is also head of the Bank of France - said the protectionism and unpredictability of the Trump administration were “bad elements” for the US economy.

The US currency has fallen after the US president said on Wednesday he would temporarily halt the hefty duties he had just imposed on dozens of countries while further ramping up pressure on China, sending global stocks rocketing higher.

The pound gained 0.3pc to $1.286 while the euro rose 0.3pc to $1.098.

“The big element of constancy in US policy of the past decades is the attachment to the central role of the dollar,” Mr Villeroy told France Inter radio.

“I believe that the Trump administration also has that view, but it is very incoherent in the way it practices that. What has happened in recent days and weeks plays against the confidence in the US currency.”

He added that this can be a positive factor in the development of the international role of the euro.

“Thank God that Europe, 25 years ago, created the euro. We have created our own monetary autonomy, we can manage our interest rates in a way that is different from the Americans, that was not the case before,” he said.

07:16 AM BST

Taiwan stocks make record surge

Taiwan stocks closed up a record 9.3pc after US President Donald Trump paused tariffs on most countries.

The Taiex index rose 1,608.27 to 19,000.03, as tech giants TSMC and Foxconn soared almost 10pc each.

07:12 AM BST

FTSE poised for jump at the open

The FTSE 100 and European shares are on track to rocket higher when trading begins in an hour.

London’s flagship index was up 5.3pc in premarket trading, while the Euro Stoxx 50 was up 7.8pc.

The FTSE 100 had declined more than 10pc since Donald Trump made his “liberation day” tariff announcements.

06:48 AM BST

Japan stocks surge as Asia ‘breathes a sigh of relief’

Japan’s stock markets surged after Donald Trump delayed tariffs.

The benchmark Nikkei 225 was up more than 8pc while the broader Topix index gained more than 7pc.

Meanwhile Japan’s 10-year government bond yield jumped as much as 13 basis points as investors moved back into riskier assets.

The yen strengthened 0.6pc to 146.92 against the dollar after sinking over 1pc overnight.

Frederic Neumann, chief Asia economist at HSBC, said: “Investors across Asia and beyond are breathing a sigh of relief.

“The postponement of reciprocal tariffs by the US allows more time for negotiations.

“For export-centred Asian economies this is especially important, given the growth impact steep US tariffs would have had.”

06:41 AM BST

Vietnam to begin trade talks with US

Vietnam said its government and the United States agreed to start negotiations on a reciprocal trade agreement hours after Donald Trump backtracked on his global tariffs.

The US was Vietnam’s biggest export market in the first three months of the year but President Trump hit it with a 46pc duty under his “liberation day” announcement.

Mr Trump paused the stiff new tariffs on Wednesday and Vietnam’s deputy prime minister Ho Duc Phoc suggested the two countries “should soon negotiate a bilateral trade agreement... to promote stable and mutually beneficial economic and trade relations”.

Phoc has been appointed by top leader To Lam to negotiate with the United States on tariffs. He met with US Trade Representative Jamieson Greer on Wednesday.

06:28 AM BST

New Zealand proposes trade alliance with EU - including Britain

New Zealand’s prime minister proposed a new alliance to battle global export restrictions which would involve Britain entering a trade pact with the EU.

Christopher Luxon said the US tariffs had “shocked” financial markets and proposed a tie up involving the EU and the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP).

Britain became the first non-original member of CPTPP last year under a deal agreed by Conservative leader Kemi Badenoch when she was trade secretary.

Mr Luxon warned in a speech in Wellington that the consequences of a world retreating from trade and uncertain about the economic future would be “more significant”.

Countries in the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) - accounting for about 15pc of global economic activity - could help promote free trade, he said.

“One possibility is that members of the CPTPP and the European Union work together to champion rules-based trade and make specific commitments on how that support plays out in practice,” the prime minister said.

“My vision is that includes action to prevent restrictions on exports and efforts to ensure any retaliation is consistent with existing rules.”

06:00 AM BST

Tariff pause ‘positive’, says South Korea

South Korea welcomed Mr Trump’s decision to pause tariffs, as it seeks to cut a trade deal with the US to lower the levies imposed.

“The latest pause decision can be evaluated positively in that it gives us room to minimise impact on our industries while continuing tariff negotiations with the US,” Yonhap News quoted South Korean Trade Minister Cheong Inkyo as saying in Washington on Wednesday.

05:43 AM BST

Taiwan floats zero tariffs on US goods

Taiwan president Lai Ching-te said his government could eliminate duties on US products if Washington did the same.

“While Taiwan already maintains low tariffs, with an average nominal rate of 6pc, we are willing to further cut this rate to zero on the basis of reciprocity with the US,” he wrote in a piece for Bloomberg Opinion on Thursday.

By wiping out the last obstacles to fair trade, Mr Lai wrote: “We seek to encourage greater trade and investment flows between our two economies.”

05:29 AM BST

Insight: Trump forced into a Truss climbdown

Donald Trump shocked Wall Street with his surprisingly strong stomach for the stock market plunge that his tariffs precipitated.

But although wiping $10 trillion (£7.8 trillion) off global share prices in a matter of days apparently failed to rattle the US president, he was no match for all-out market Armageddon.

Just as Liz Truss was forced to reverse her unfunded tax cuts after a bond vigilante rebellion in September 2022, Mr Trump has suddenly U-turned on his “reciprocal” tariffs in the face of a looming global financial meltdown.

The enormous row back shows that even Mr Trump has to bow to markets and what had become a tidal wave of criticism as economists sounded huge alarm bells over an imminent recession and financial crisis.

Mr Trump might have played it down, but he could not deny that his big problem was bond yields.

Read the full piece here

05:20 AM BST

China retaliates with 84pc tariffs on US goods

China’s retaliatory tariffs of 84pc on all American goods have now come into effect, deepening the trade war between Beijing and Washington.

After China’s tit-for-tat move, Mr Trump on Wednesday said the US would raise tariffs on Chinese imports to a staggering 125pc, citing a “lack of respect” from Beijing.

04:53 AM BST

Good morning

Thanks for joining us. Asian shares jumped in morning trading and US stocks soared to historic gains last night following Donald Trump’s decision to pause his tariff onslaught for 90 days.

5 things to start your day

-

Murdoch abandons new bid for Rightmove over tariff chaos | Other multibillion dollar deals and stock market floats are also at risk amid uncertainty

-

iPhone prices ‘risk doubling’ if production moves to US | Shifting manufacturing to America will be ‘logistically challenging’, warns Wall Street bank

-

China trolls Trump with AI clip of overweight Americans | Mocking video follows Beijing’s outrage at JD Vance referring to Chinese workers as ‘peasants’

-

Andrew Lilico: Trump’s delayed tariff pause shows how wedded he is to chaos | The meltdown in markets may do some of the president’s bidding – albeit accidentally

-

Telegraph View: Who benefits from Trumpian chaos? | The real fear must be that the US president has unleashed such instability in our markets that financial institutions are threatened

What happened overnight

Following days of market turmoil, Wall Street stocks saw historic surges on Wednesday night in reaction to Mr Trump’s announcement that he was halting a levy hike for almost all nations for 90 days.

The Dow Jones Industrial Average rose 7.9pc, to 40,608.45, the S&P 500 rose 9.5pc, to 5,456.90 and the Nasdaq Composite rose 12.2pc, to 17,124.97.

Asian shares surged in trading on Thursday, with Japan’s benchmark Nikkei 225 jumping 8.3pc to 34,353.17 almost immediately after the Tokyo exchange opened, as investors welcomed Mr Trump’s decision to back off on most of his tariffs.

Australia’s S&P/ASX 200 climbed 4.7pc to 7,722.90 and South Korea’s Kospi gained 5.5pc to 2,419.37.

Meanwhile, Hong Kong’s Hang Seng added 3.7pc to 21,003.84 and the Shanghai Composite edged up 1.5pc to 3,232.86.