3 Reasons to Sell BLDR and 1 Stock to Buy Instead

Builders FirstSource has gotten torched over the last six months - since October 2024, its stock price has dropped 41.9% to a new 52-week low of $113.01 per share. This was partly due to its softer quarterly results and might have investors contemplating their next move.

Is now the time to buy Builders FirstSource, or should you be careful about including it in your portfolio? See what our analysts have to say in our full research report, it’s free .

Despite the more favorable entry price, we're swiping left on Builders FirstSource for now. Here are three reasons why we avoid BLDR and a stock we'd rather own.

Why Is Builders FirstSource Not Exciting?

Headquartered in Irving, TX, Builders FirstSource (NYSE:BLDR) is a construction materials manufacturer that offers a variety of lumber and lumber-related building products.

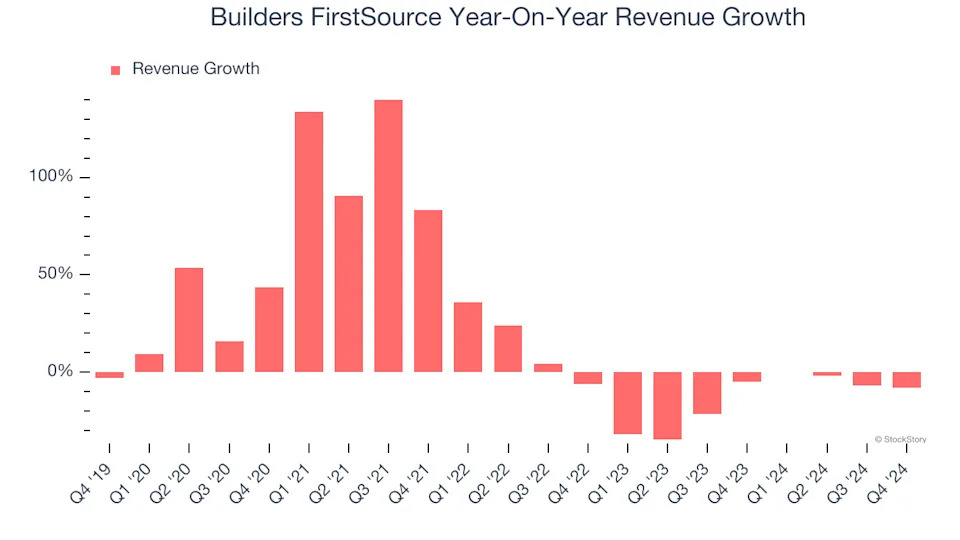

1. Revenue Tumbling Downwards

Long-term growth is the most important, but within industrials, a stretched historical view may miss new industry trends or demand cycles. Builders FirstSource’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 15.1% over the last two years.

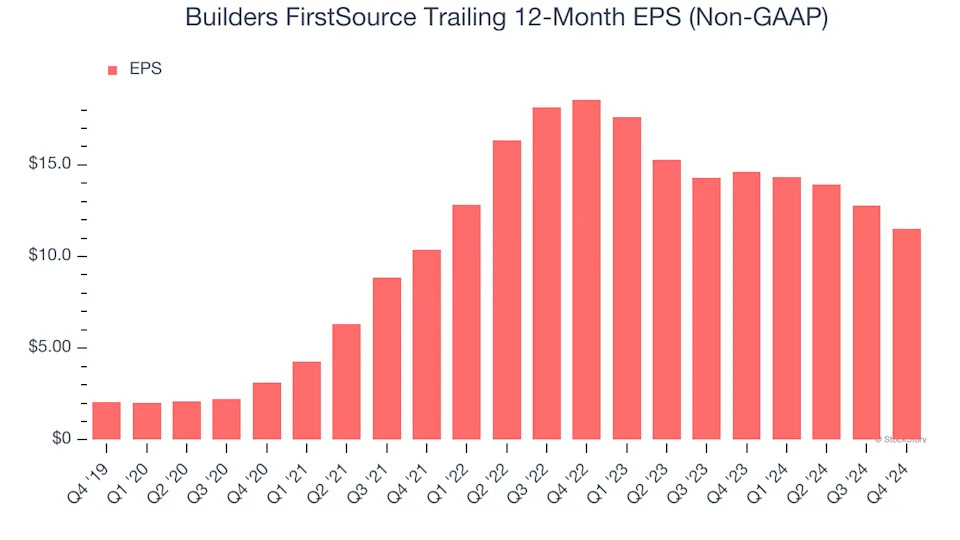

2. EPS Took a Dip Over the Last Two Years

While long-term earnings trends give us the big picture, we also track EPS over a shorter period because it can provide insight into an emerging theme or development for the business.

Sadly for Builders FirstSource, its EPS declined by more than its revenue over the last two years, dropping 21.2%. This tells us the company struggled to adjust to shrinking demand.

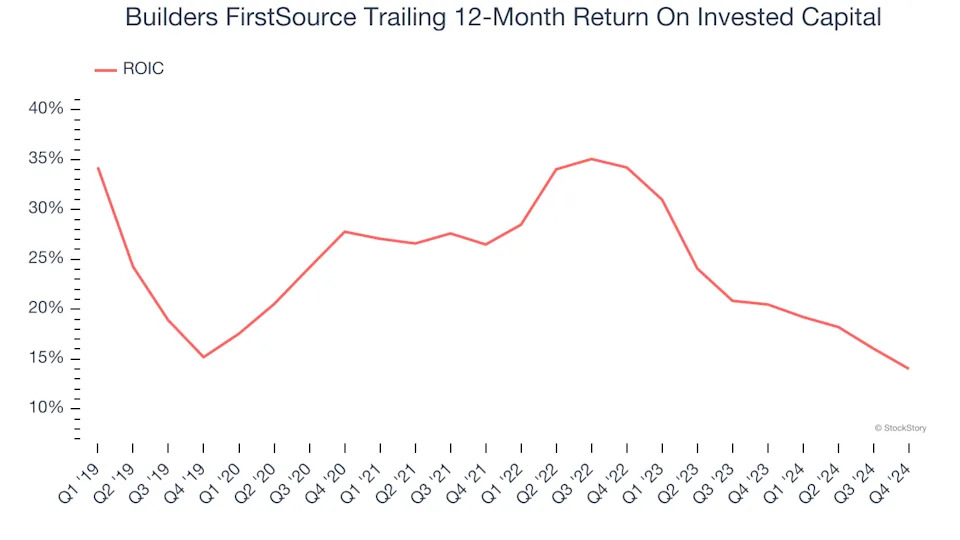

3. New Investments Fail to Bear Fruit as ROIC Declines

A company’s ROIC, or return on invested capital, shows how much operating profit it makes compared to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Builders FirstSource’s ROIC has decreased over the last few years. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

Final Judgment

Builders FirstSource isn’t a terrible business, but it doesn’t pass our quality test. After the recent drawdown, the stock trades at 9.9× forward price-to-earnings (or $113.01 per share). While this valuation is reasonable, we don’t really see a big opportunity at the moment. We're fairly confident there are better stocks to buy right now. We’d suggest looking at a fast-growing restaurant franchise with an A+ ranch dressing sauce .