3 Reasons to Avoid NX and 1 Stock to Buy Instead

Quanex’s stock price has taken a beating over the past six months, shedding 42.4% of its value and falling to a new 52-week low of $16.14 per share. This might have investors contemplating their next move.

Is there a buying opportunity in Quanex, or does it present a risk to your portfolio? Get the full breakdown from our expert analysts, it’s free .

Despite the more favorable entry price, we're sitting this one out for now. Here are three reasons why there are better opportunities than NX and a stock we'd rather own.

Why Is Quanex Not Exciting?

Starting in the seamless tube industry, Quanex (NYSE:NX) manufactures building products like window, door, kitchen, and bath cabinet components.

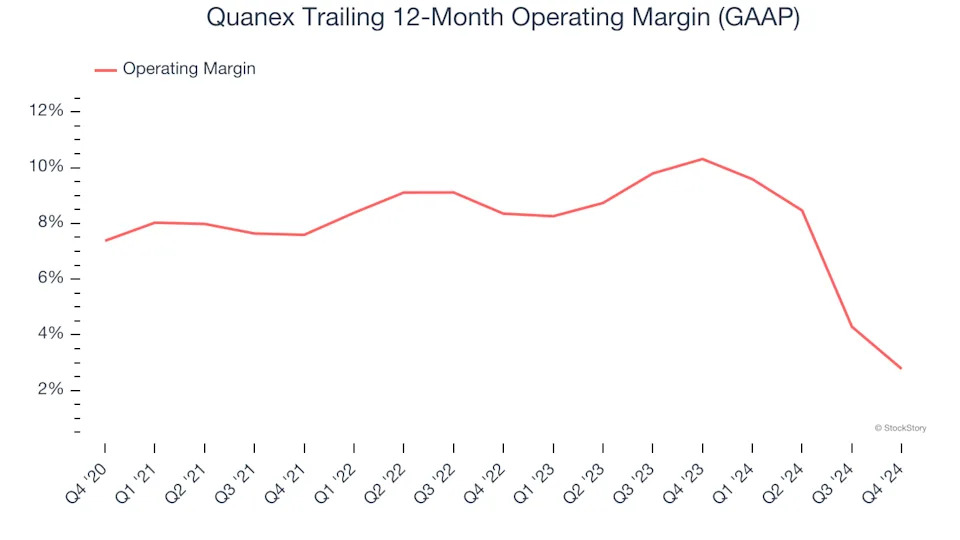

1. Shrinking Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Looking at the trend in its profitability, Quanex’s operating margin decreased by 4.6 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Quanex’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers. Its operating margin for the trailing 12 months was 2.8%.

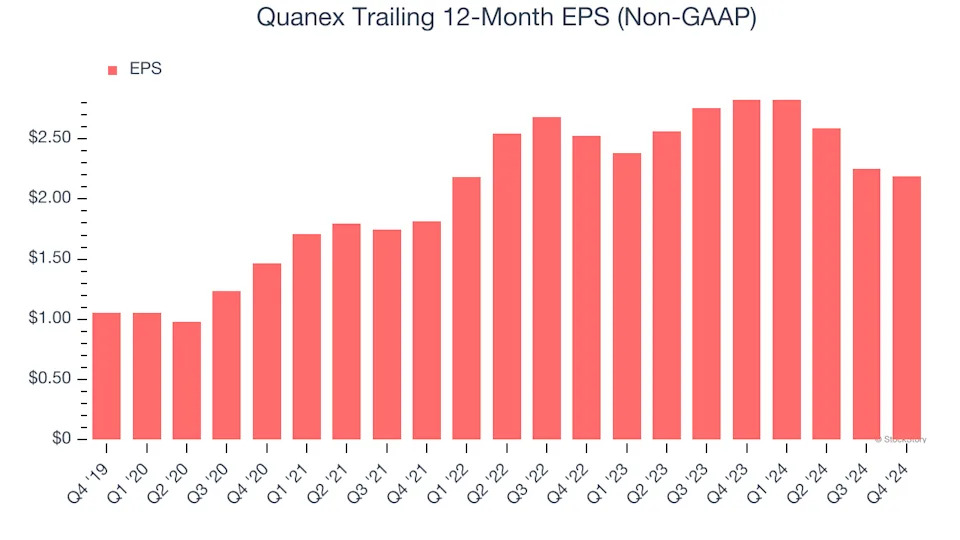

2. EPS Took a Dip Over the Last Two Years

While long-term earnings trends give us the big picture, we also track EPS over a shorter period because it can provide insight into an emerging theme or development for the business.

Sadly for Quanex, its EPS declined by 6.9% annually over the last two years while its revenue grew by 8.8%. This tells us the company became less profitable on a per-share basis as it expanded.

3. Free Cash Flow Margin Dropping

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, Quanex’s margin dropped by 6.7 percentage points over the last five years. This along with its unexciting margin put the company in a tough spot, and shareholders are likely hoping it can reverse course. If the trend continues, it could signal it’s becoming a more capital-intensive business. Quanex’s free cash flow margin for the trailing 12 months was 2.3%.