3 Reasons ONEW is Risky and 1 Stock to Buy Instead

The past six months haven’t been great for OneWater. It just made a new 52-week low of $11.41, and shareholders have lost 46.8% of their capital. This might have investors contemplating their next move.

Is there a buying opportunity in OneWater, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free .

Even though the stock has become cheaper, we're sitting this one out for now. Here are three reasons why you should be careful with ONEW and a stock we'd rather own.

Why Is OneWater Not Exciting?

A public company since early 2020, OneWater Marine (NASDAQ:ONEW) sells boats, yachts, and other marine products.

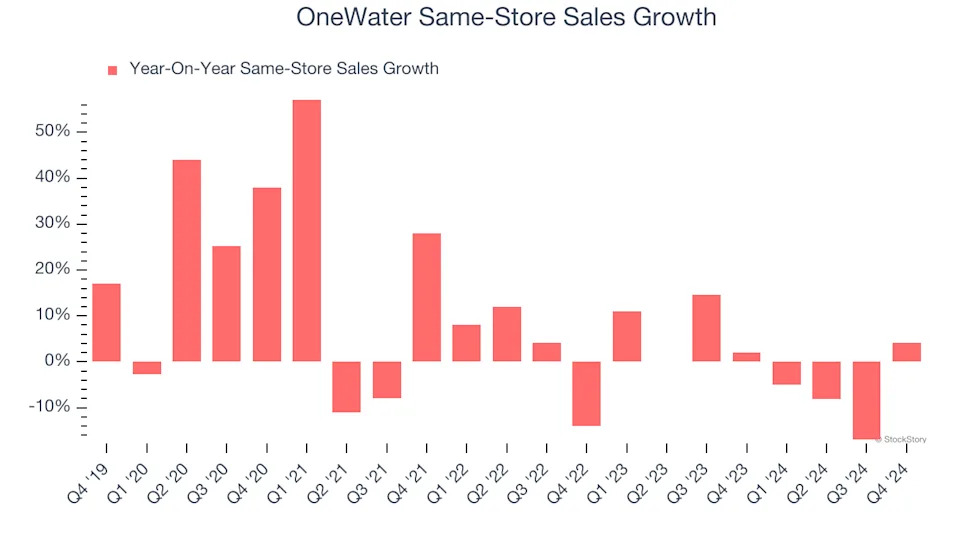

1. Flat Same-Store Sales Indicate Weak Demand

Same-store sales show the change in sales for a retailer's e-commerce platform and brick-and-mortar shops that have existed for at least a year. This is a key performance indicator because it measures organic growth.

OneWater’s demand within its existing locations has barely increased over the last two years as its same-store sales were flat.

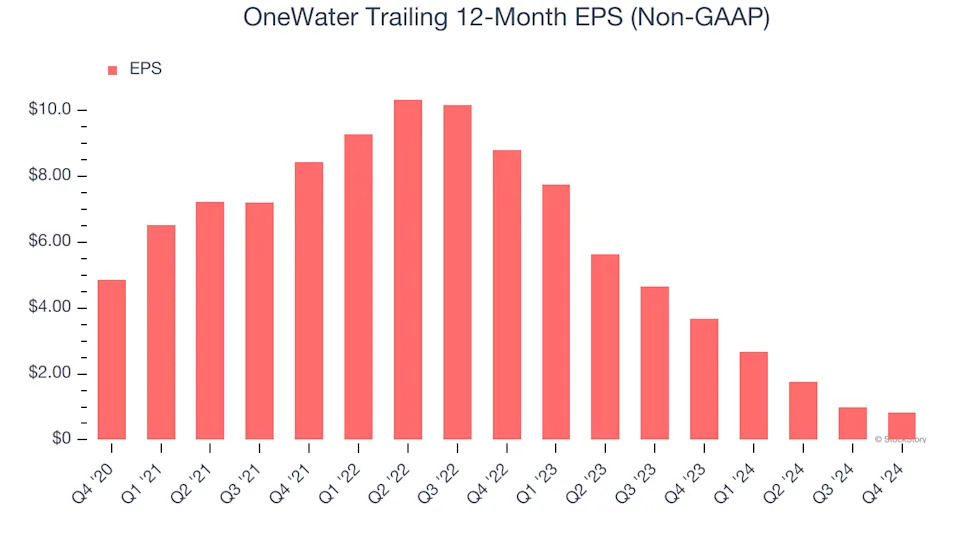

2. EPS Trending Down

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

OneWater’s full-year EPS dropped 242%, or 35.9% annually, over the last four years. In a mature sector such as consumer retail, we tend to steer our readers away from companies with falling EPS because it could imply changing secular trends and preferences. If the tide turns unexpectedly, OneWater’s low margin of safety could leave its stock price susceptible to large downswings.

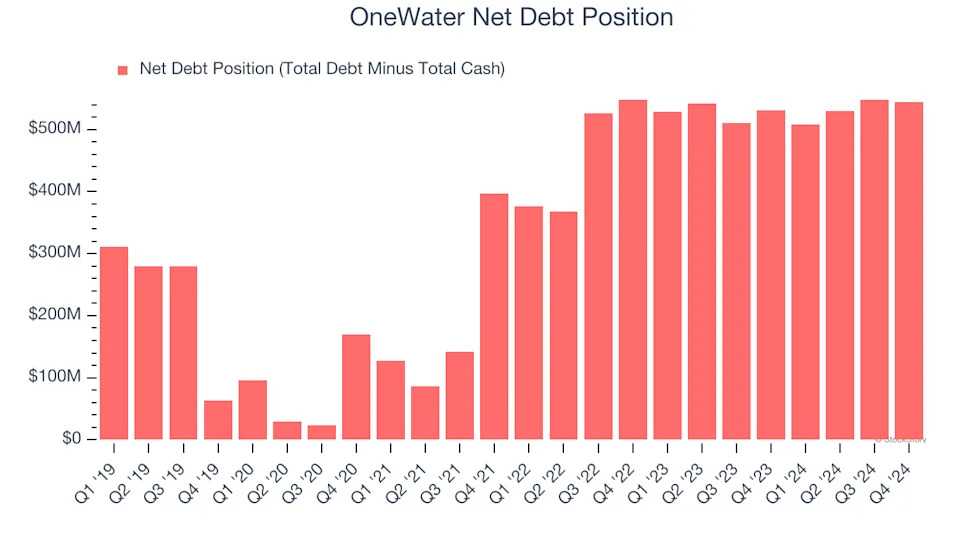

3. High Debt Levels Increase Risk

Debt is a tool that can boost company returns but presents risks if used irresponsibly. As long-term investors, we aim to avoid companies taking excessive advantage of this instrument because it could lead to insolvency.

OneWater’s $567.3 million of debt exceeds the $22.71 million of cash on its balance sheet. Furthermore, its 7× net-debt-to-EBITDA ratio (based on its EBITDA of $77.26 million over the last 12 months) shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. OneWater could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.

We hope OneWater can improve its balance sheet and remain cautious until it increases its profitability or pays down its debt.