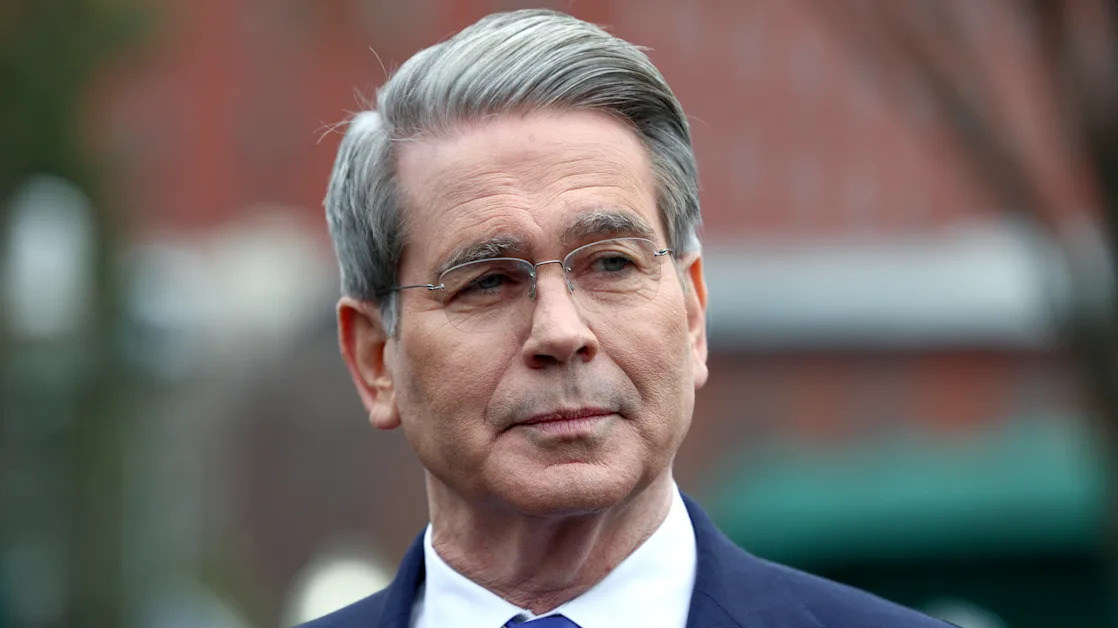

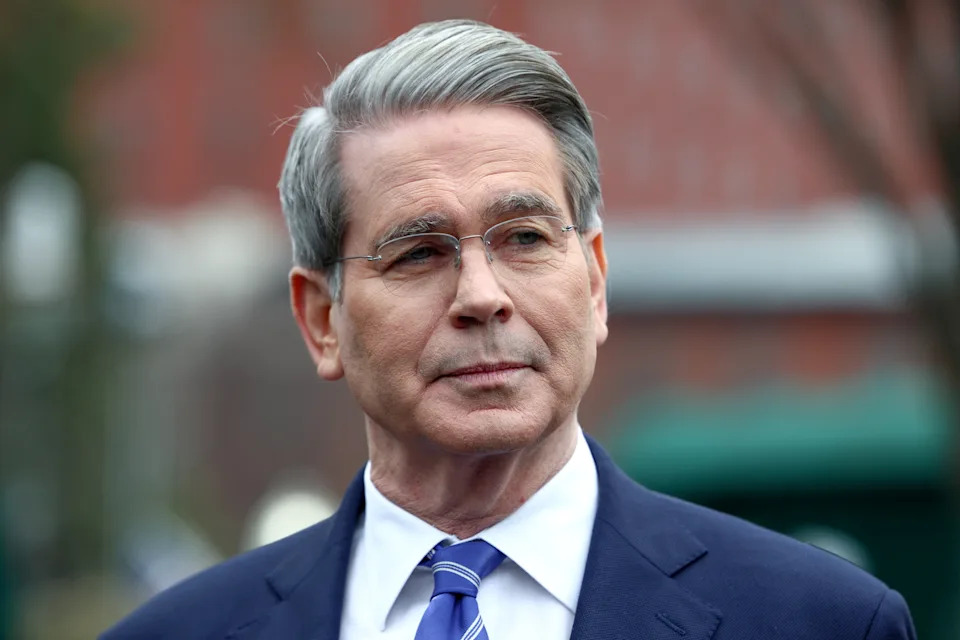

Bessent says 'convulsions' in bond market not 'systemic'

Treasury Secretary Scott Bessent on Wednesday attributed the chaos in the bond market to "some very large leveraged players" that are experiencing losses but said it is "nothing systemic."

He also issued some new warnings to China as a trade war with the US escalated, saying it shouldn’t try to devalue its currency and that all policy options are possible.

“Everything’s on the table,” he said while appearing on "Mornings with Maria” on Fox Business Network , when asked whether the US could remove Chinese companies from US stock exchanges.

“It’s unfortunate that the Chinese actually don’t want to come and negotiate because they are the worst offenders in the international trading system," Bessent said. What Beijing “should not do is try to devalue their way out of this."

Strategists this week have laid out multiple theories as to why bond yields are soaring this week amid what some are calling a "fire sale" in Treasurys. They range from investors seeking more liquidity within a volatile market to bond traders perhaps feeling more confident that the US economy can avoid a recession.

The 10-year yield ( ^TNX ) jumped 17 basis points to kick off the week, a massive 34 basis point swing from a low of 3.87% to a high of 4.21%. The yield extended those gains on Tuesday, climbing nearly 11 basis points to hover at around 4.26%.

Similarly, the 30-year yield ( ^TYX ) jumped another 12 basis points Tuesday after seeing its biggest move to the upside since March 2020. As of the market close, the 30-year yield traded at 4.72%.

The surge in Treasury yields is a challenge to Bessent’s stated goal of getting borrowing costs down as part of his larger economic plan, which also includes tax cuts and deregulation.

It is also raising questions about whether these bonds are in fact a safe haven during the current market chaos triggered by President Trump’s tariffs.

Read more: How to protect your money during economic turmoil, stock market volatility

Bessent, on “Mornings with Maria,” dismissed speculation that China could be a big seller of Treasurys at the moment. He said, “This is one of those de-leveraging convulsions” that happen in the fixed-income market and added that it was taking place among “very large leveraged players who are experiencing losses.”

Risk managers are “tapping people on the shoulders, telling them to bring their books down — which is what happens every couple years as leverage builds up.”

“I believe that there is nothing systemic about this — I think that it is an uncomfortable but normal deleveraging that’s going on in the bond market,” Bessent said.