4 things history can teach us about a looming bear market in stocks

The S&P 500 briefly entered a bear market on Monday, falling 21% from its mid-February peak.

The uncertainty surrounding President Donald Trump's tariffs, which were higher than Wall Street expected, plunged the market into chaos over the past week.

An increase in market volatility has strategists at Goldman Sachs dusting off their bear market playbook and examining the various paths stocks can take based on historical trends.

Here's what to expect if the stock market decisively enters bear market territory.

There are 3 types of bear markets

Bear markets can fall into three categories: structural, cyclical, and event-driven.

Goldman said the market is currently flirting with an event-driven bear market, given that tariffs were the key catalyst to spark the recent plunge, with the S&P 500 dropping 10% right after Trump announced his tariff list.

"This could be seen as self-inflicted, given the strong prospects for global economic activity at the start of the year, particularly in the US, where our economists put the probability of recession at just 15%," Goldman Sachs said.

Betting markets and various economists now predict the odds of a recession hitting the US economy this year have risen past 50%.

Furthermore, Goldman said that an event-driven bear market could easily turn into a cyclical bear market if the economy materially slows down.

How deep could the sell-off go?

If the S&P 500 closes down 20% from its peak and officially triggers a bear market, there could be more pain ahead.

The bank said the average event-driven and cyclical bear market experiences a decline of about 30%.

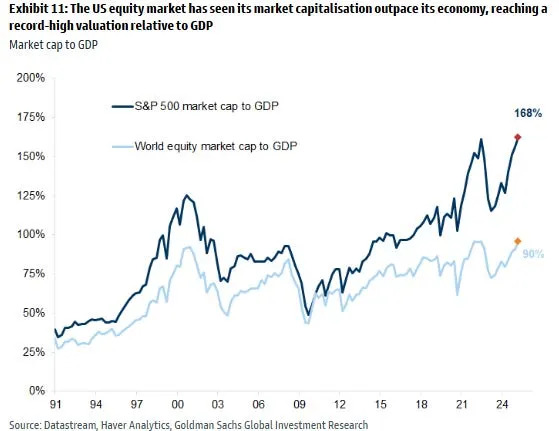

"On that basis, we would expect further downside," Goldman Sachs said. "Very low unemployment (which is likely to rise) and elevated valuation suggests that markets are still vulnerable to the downside."

A peak-to-trough decline of 30% would send the S&P 500 to about 4,300, or about 18% lower than current levels.

How long could a bear market last?

If an event-driven bear market strikes, the decline and eventual rebound could be quick.

Goldman said that this type of stock market decline tends to last about eight months, with a full recovery seen in about a year.

But if this event-driven shock to the stock market transforms into a cyclical bear market, it could last a lot longer; the decline could last about two years, and it would take five years to fully rebound, according to Goldman.