3 Reasons to Sell JBTM and 1 Stock to Buy Instead

Since October 2024, John Bean has been in a holding pattern, posting a small return of 3.7% while floating around $102.36. However, the stock is beating the S&P 500’s 10.6% decline during that period.

Is there a buying opportunity in John Bean, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free .

Despite the relative momentum, we don't have much confidence in John Bean. Here are three reasons why there are better opportunities than JBTM and a stock we'd rather own.

Why Do We Think John Bean Will Underperform?

Tracing back to its invention of the mechanical milk bottle filler in 1884, John Bean (NYSE:JBTM) designs, manufactures, and sells equipment used for food processing and aviation.

1. Revenue Spiraling Downwards

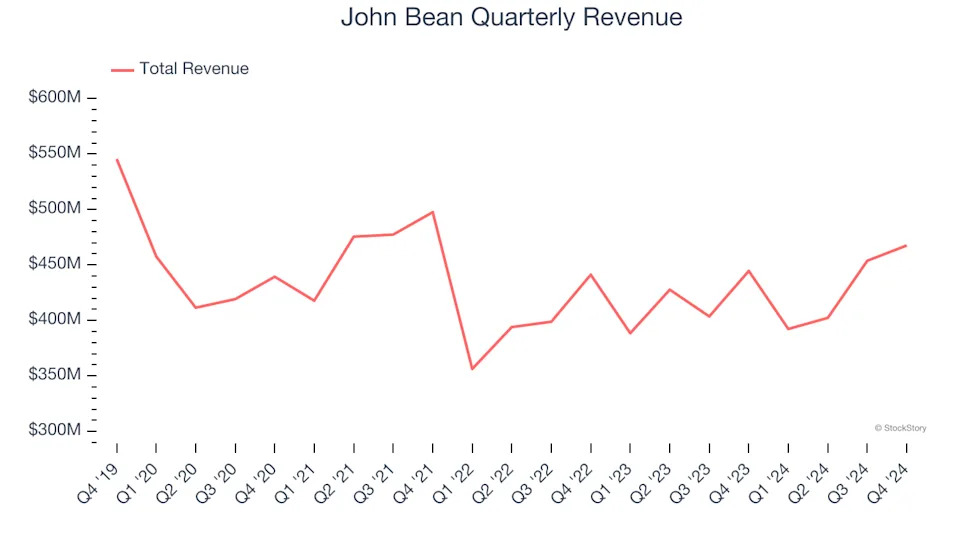

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. John Bean struggled to consistently generate demand over the last five years as its sales dropped at a 2.5% annual rate. This was below our standards and signals it’s a low quality business.

2. Slow Organic Growth Suggests Waning Demand In Core Business

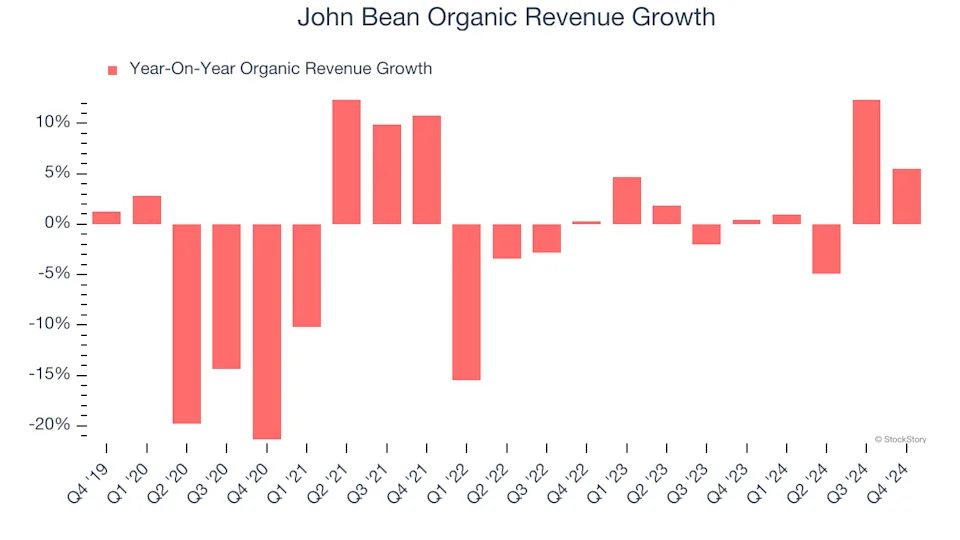

In addition to reported revenue, organic revenue is a useful data point for analyzing General Industrial Machinery companies. This metric gives visibility into John Bean’s core business because it excludes one-time events such as mergers, acquisitions, and divestitures along with foreign currency fluctuations - non-fundamental factors that can manipulate the income statement.

Over the last two years, John Bean’s organic revenue averaged 2.4% year-on-year growth. This performance was underwhelming and suggests it may need to improve its products, pricing, or go-to-market strategy, which can add an extra layer of complexity to its operations.

3. EPS Trending Down

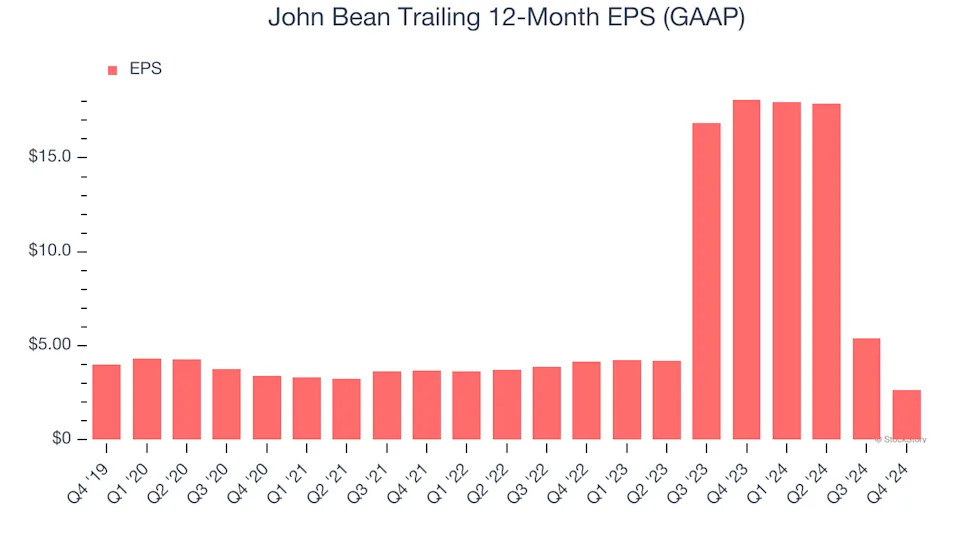

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Sadly for John Bean, its EPS declined by 8% annually over the last five years, more than its revenue. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

Final Judgment

John Bean doesn’t pass our quality test. Following its recent outperformance amid a softer market environment, the stock trades at $102.36 per share (or 0.9× forward price-to-sales). The market typically values companies like John Bean based on their anticipated profits for the next 12 months, but there aren’t enough published estimates to arrive at a reliable number. You should avoid this stock for now - better opportunities lie elsewhere. We’d recommend looking at a fast-growing restaurant franchise with an A+ ranch dressing sauce .