China Vows ‘Fight to the End’ on Tariffs as It Props Up Markets

(Bloomberg) -- Supply Lines is a daily newsletter that tracks global trade. Sign up here.

Most Read from Bloomberg

China pledged to retaliate against Donald Trump’s latest tariff threat and mobilized state organs to send a message of resilience, raising the risk of a prolonged trade war between the world’s two largest economies.

“The US threat to escalate tariffs on China is a mistake on top of a mistake,” the Chinese Ministry of Commerce said in a Tuesday statement, hours after the US president vowed to impose additional import taxes. “If the US insists on its own way, China will fight to the end.”

The Chinese response came after Trump threatened a further 50% tariff on all Chinese goods unless Beijing withdraws its tit-for-tat retaliation against his earlier “reciprocal” levies. That takes the cumulative tariff rate announced this year to 104% — effectively doubling the import price of any goods shipped from China to the US.

Beijing moved to reassure investors after Chinese stocks listed in Hong Kong fell the most since the 2008 financial crisis the day before, with the central bank loosening its grip on the yuan to boost exports and promising more loans to stabilize the market. At the same time, the head of the country’s economic-planning agency met with representatives of private Chinese companies including Apple Inc. supplier Goertek Inc. to address their concerns.

Subscribe to the Bloomberg Daybreak podcast on Apple, Spotify or anywhere you listen.

While authorities have left the door open to dialogue, China’s reaction suggests it intends to resist the US president’s pressure campaign, dimming the prospect of a deal in the short term.

“The rhetoric from China is strong,” said Michelle Lam, greater China economist at Societe Generale SA. “Without Trump backing down investors may need to prepare for trade decoupling between both countries.”

What Bloomberg Economics Says...

“The prospect of a heavy external blow to growth heightens the urgency to fast-track monetary and fiscal stimulus — and we see it coming sooner than before.”

— Chang Shu, David Qu and Eric Zhu

Read the full note here.

The yuan slid to the weakest level since September 2023 in onshore trading after the People’s Bank of China signaled more tolerance for depreciation with a fixing past the keenly-watched 7.20 per dollar level. The Hang Seng China Enterprises Index closed 2.3% higher. The benchmark CSI 300 Index of onshore stocks rose 1.7% after booking its worst day in six months on Monday.

While China hasn’t said how it would respond if Trump follows through on his threat, two influential state-linked Chinese bloggers posted an identical set of countermeasures that they said authorities are considering. They include raising tariffs on US farm products, a ban on Hollywood movies and investigating American firms’ intellectual property gains in the country.

China will hit back at new US tariffs with equivalent measures as any fresh US levies will add limited pain to the Asian nation, according to Ding Shuang, chief economist for Greater China & North Asia at Standard Chartered.

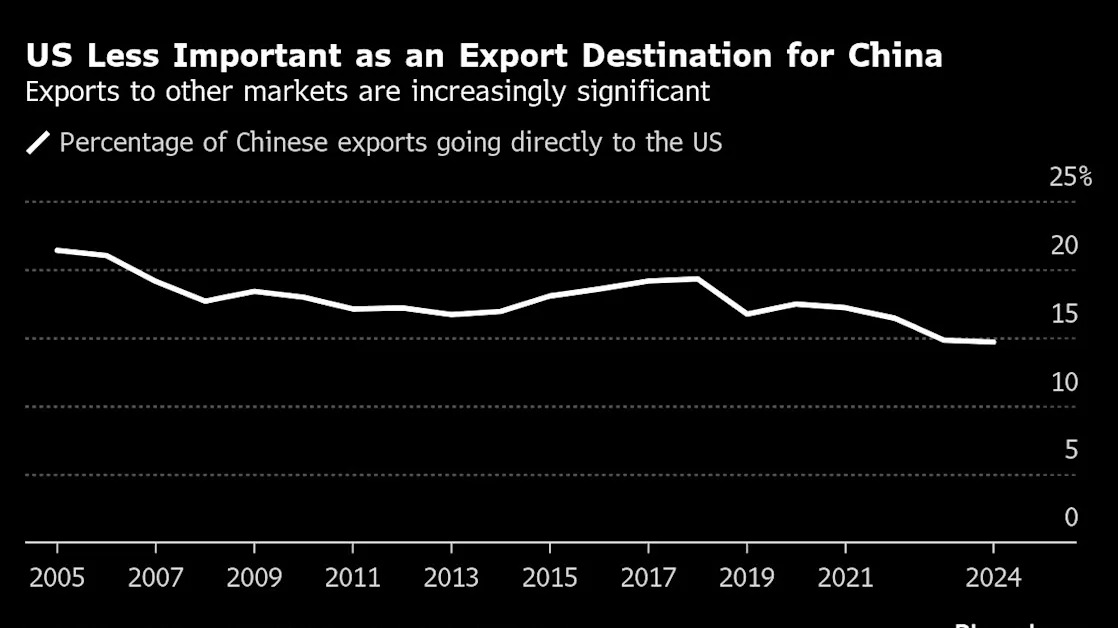

“The marginal effect of raising tariffs further from the existing level of about 65% will shrink,” he said of additional US tariffs. “Most Chinese exports to the US have already been affected. For goods that are not price sensitive, tariffs won’t work no matter how high they go.”

The escalation in tensions makes any imminent call between the two world leaders less likely. Trump hasn’t spoken with Chinese President Xi Jinping since returning to the White House, the longest a US president has gone without talking to his Chinese counterpart post-inauguration in 20 years.

The Communist Party’s official newspaper this week published an editorial declaring that Beijing is no longer “clinging to illusions” of striking a deal.

Instead, officials are focusing on shielding the economy. Xi has vowed to boost domestic consumption as tariffs are expected to hurt exports, a sector responsible for a third of China’s economic growth last year.

Domestic Support

Chinese authorities have signaled their determination to support markets. A basket of eight exchange-traded funds favored by the so-called national team saw record net inflow of 42 billion yuan ($5.7 billion) Monday.

A weaker yuan could also offset the effect of higher tariffs. Bets on monetary stimulus have supported demand for China bonds, as 10-year sovereign yield hovered close to a record low set in early February.

Zheng Shanjie, chairman of the National Development and Reform Commission, met also with solar panel manufacturer Trina Solar Co., trade service provider China-Base Ningbo Foreign Trade Co., magnetic material maker Lingyi iTECH Guangdong Co. and ride-hailing giant DiDi Global Inc.

The executives gave feedback on the implementation of economic policies and shared suggestions on how China can respond to US tariffs while pledging support for the leadership of the ruling Communist Party, according to the NDRC.

While escalating China-US tensions have fueled decoupling concerns, completely weaning off American firms’ reliance on Chinese suppliers looks impractical in the short term.

Apple, for example, now assembles and ships roughly four-fifths of its iPhones from China even after the company began migrating its supply chain to other countries like India and Vietnam since the first Trump term. That’s probably due to the complexity and cost of building the industrial ecosystem elsewhere from scratch.

China’s robust supply chain is likely one of the factors giving Xi confidence as he goes head to head with Trump, and projects a defiant image to a domestic audience.

“For President Xi, there is only one politically viable response to Trump’s latest threat: Bring it on!” according to a note from Enodo Economics, a macroeconomic forecasting company.

--With assistance from Wenjin Lv, April Ma, Winnie Hsu, Zhu Lin, Shikhar Balwani, Tian Chen, Gao Yuan, Sankalp Phartiyal, Josh Xiao and Jing Li.

(Updates with more details.)

Most Read from Bloomberg Businessweek

©2025 Bloomberg L.P.