Walgreens’s (NASDAQ:WBA) Q1: Beats On Revenue

Pharmacy chain Walgreens Boots Alliance (NASDAQ:WBA) reported Q1 CY2025 results beating Wall Street’s revenue expectations , with sales up 4.1% year on year to $38.59 billion. Its non-GAAP profit of $0.63 per share was 21% above analysts’ consensus estimates.

Is now the time to buy Walgreens? Find out in our full research report .

Walgreens (WBA) Q1 CY2025 Highlights:

Company Overview

Primarily offering prescription medicine, health, and beauty products, Walgreens Boots Alliance (NASDAQ:WBA) is a pharmacy chain formed through the 2014 major merger of American company Walgreens and European company Alliance Boots.

General Merchandise Retail

General merchandise retailers–also called broadline retailers–know you’re busy and don’t want to drive around wasting time and gas, so they offer a one-stop shop. Convenience is the name of the game, so these stores may sell clothing in one section, toys in another, and home decor in a third. This concept has evolved over time from department stores to more niche concepts targeting bargain hunters or young adults, and e-commerce has forced these retailers to be extra sharp in their value propositions to consumers, whether that’s unique product or competitive prices.

Sales Growth

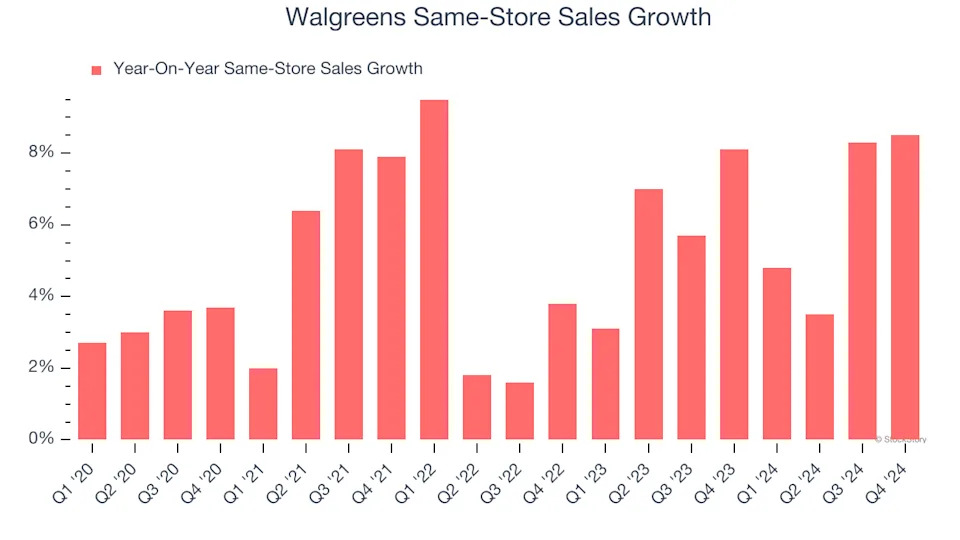

Examining a company’s long-term performance can provide clues about its quality. Any business can have short-term success, but a top-tier one grows for years.

With $151.9 billion in revenue over the past 12 months, Walgreens is a behemoth in the consumer retail sector and benefits from economies of scale, giving it an edge in distribution. This also enables it to gain more leverage on its fixed costs than smaller competitors and the flexibility to offer lower prices. However, its scale is a double-edged sword because it’s harder to find incremental growth when you’ve penetrated most of the market. For Walgreens to boost its sales, it likely needs to adjust its prices or lean into foreign markets.

As you can see below, Walgreens grew its sales at a sluggish 2.9% compounded annual growth rate over the last six years (we compare to 2019 to normalize for COVID-19 impacts). This shows it failed to generate demand in any major way and is a rough starting point for our analysis.