3 Reasons HTLD is Risky and 1 Stock to Buy Instead

What a brutal six months it’s been for Heartland Express. The stock has dropped 26.2% and now trades at $8.51, rattling many shareholders. This was partly due to its softer quarterly results and might have investors contemplating their next move.

Is now the time to buy Heartland Express, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free .

Even though the stock has become cheaper, we're cautious about Heartland Express. Here are three reasons why you should be careful with HTLD and a stock we'd rather own.

Why Is Heartland Express Not Exciting?

Founded by the son of a trucker, Heartland Express (NASDAQ:HTLD) offers full-truckload deliveries across the United States and Mexico.

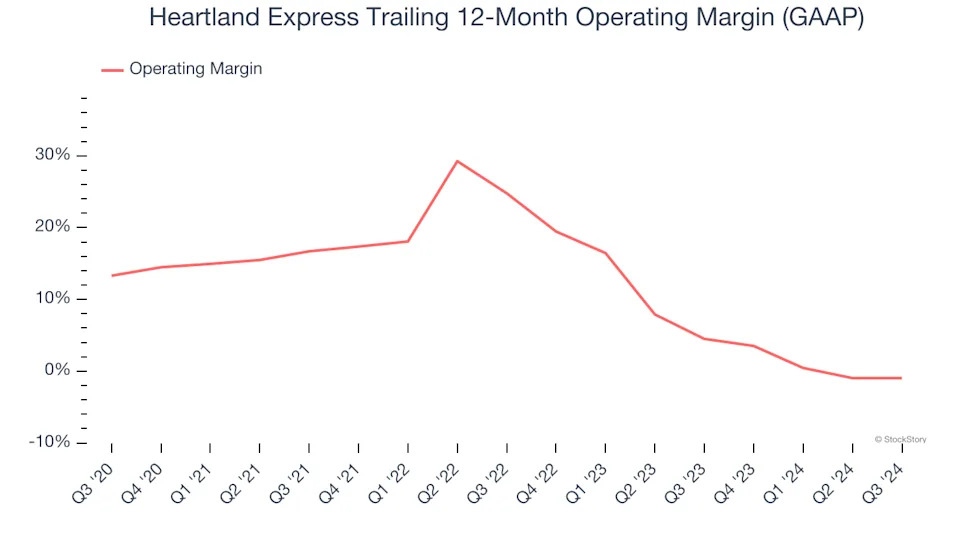

1. Shrinking Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Analyzing the trend in its profitability, Heartland Express’s operating margin decreased by 14.3 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Its operating margin for the trailing 12 months was breakeven.

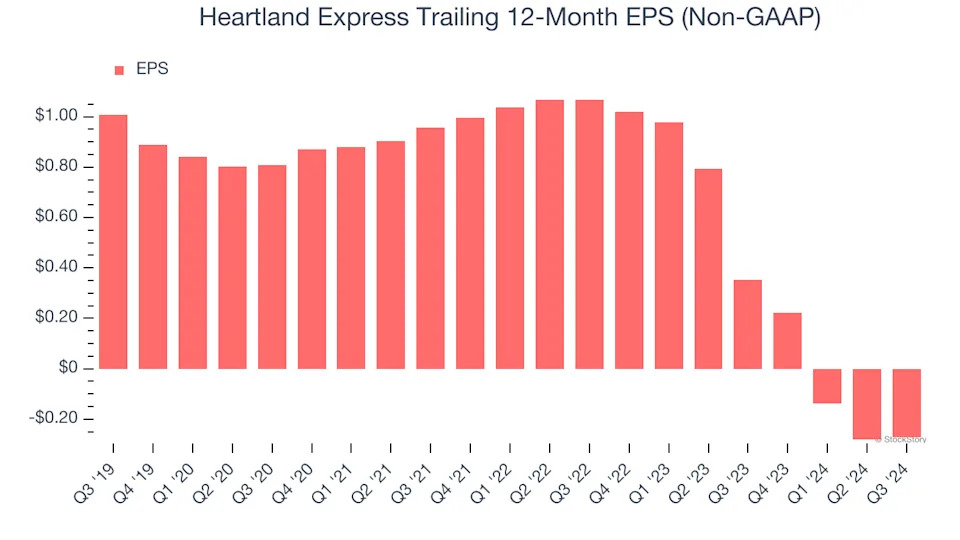

2. EPS Trending Down

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Sadly for Heartland Express, its EPS declined by 17.8% annually over the last five years while its revenue grew by 13.4%. This tells us the company became less profitable on a per-share basis as it expanded.

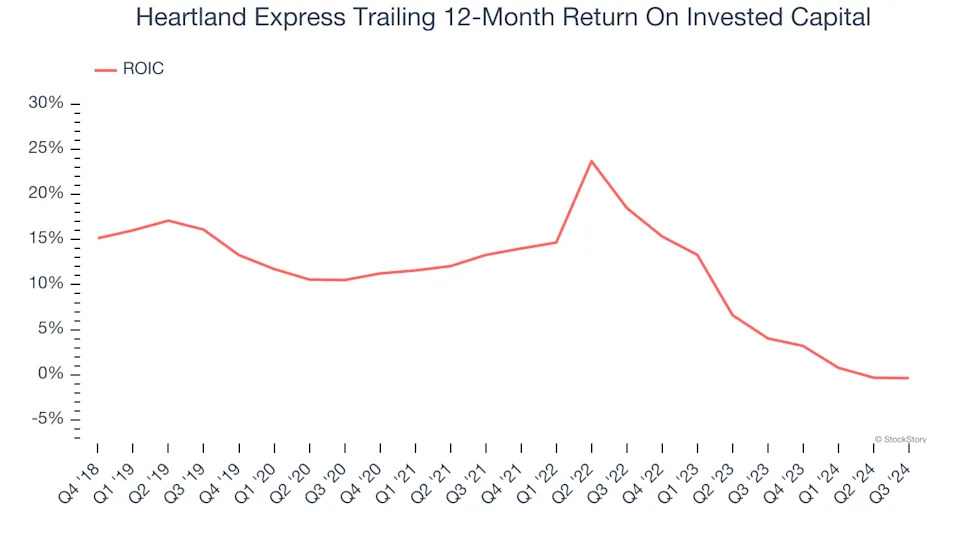

3. New Investments Fail to Bear Fruit as ROIC Declines

A company’s ROIC, or return on invested capital, shows how much operating profit it makes compared to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Heartland Express’s ROIC has unfortunately decreased significantly. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

Final Judgment

Heartland Express isn’t a terrible business, but it doesn’t pass our bar. Following the recent decline, the stock trades at 13.6× forward EV-to-EBITDA (or $8.51 per share). This multiple tells us a lot of good news is priced in - we think there are better investment opportunities out there. Let us point you toward one of our top digital advertising picks .