3 Reasons to Avoid JJSF and 1 Stock to Buy Instead

What a brutal six months it’s been for J&J Snack Foods. The stock has dropped 20.8% and now trades at $133, rattling many shareholders. This was partly driven by its softer quarterly results and might have investors contemplating their next move.

Is now the time to buy J&J Snack Foods, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free .

Despite the more favorable entry price, we don't have much confidence in J&J Snack Foods. Here are three reasons why we avoid JJSF and a stock we'd rather own.

Why Is J&J Snack Foods Not Exciting?

Best known for its SuperPretzel soft pretzels and ICEE frozen drinks, J&J Snack Foods (NASDAQ:JJSF) produces a range of snacks and beverages and distributes them primarily to supermarket and food service customers.

1. Fewer Distribution Channels Limit its Ceiling

With $1.59 billion in revenue over the past 12 months, J&J Snack Foods is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with retailers. On the bright side, it can grow faster because it has a longer list of untapped store chains to sell into.

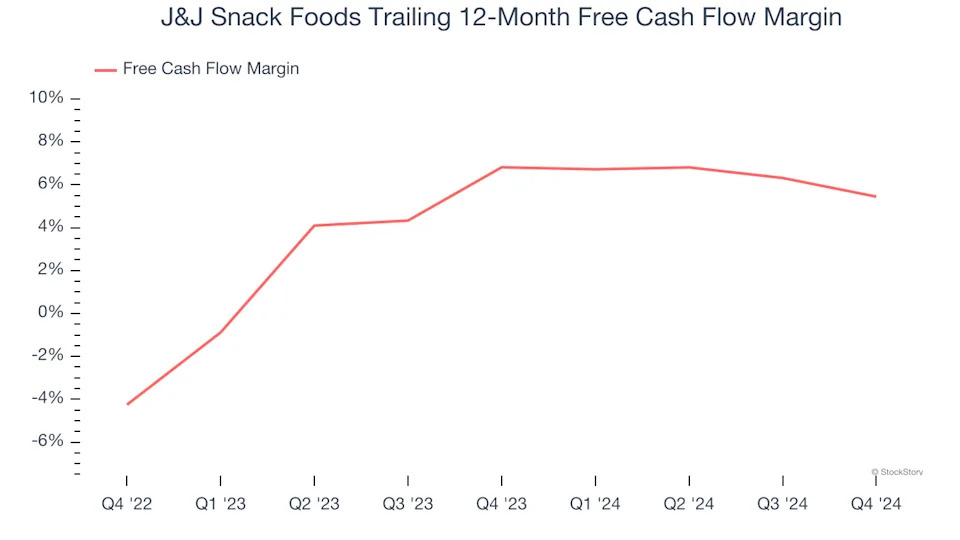

2. Free Cash Flow Margin Dropping

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, J&J Snack Foods’s margin dropped by 1.4 percentage points over the last year. If its declines continue, it could signal increasing investment needs and capital intensity. J&J Snack Foods’s free cash flow margin for the trailing 12 months was 5.4%.

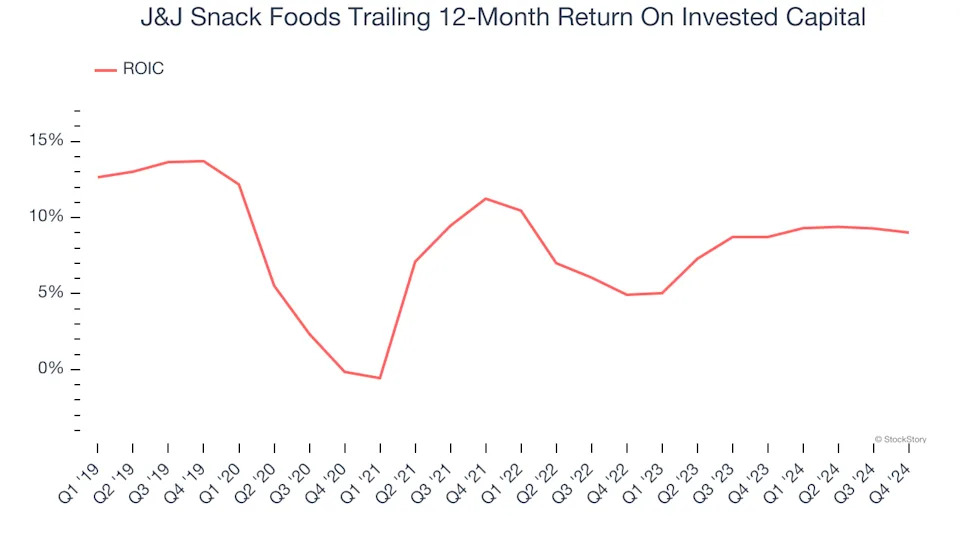

3. Previous Growth Initiatives Haven’t Impressed

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

J&J Snack Foods historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 6.8%, somewhat low compared to the best consumer staples companies that consistently pump out 20%+.

Final Judgment

J&J Snack Foods isn’t a terrible business, but it doesn’t pass our quality test. Following the recent decline, the stock trades at 23.6× forward price-to-earnings (or $133 per share). This valuation tells us a lot of optimism is priced in - we think there are better investment opportunities out there. Let us point you toward a dominant Aerospace business that has perfected its M&A strategy .