3 Reasons to Avoid HTZ and 1 Stock to Buy Instead

Hertz currently trades at $3.51 per share and has shown little upside over the past six months, posting a middling return of 2.3%. However, the stock is beating the S&P 500’s 14.1% decline during that period.

Is now the time to buy Hertz, or should you be careful about including it in your portfolio? See what our analysts have to say in our full research report, it’s free .

Even with the strong relative performance, we're cautious about Hertz. Here are three reasons why there are better opportunities than HTZ and a stock we'd rather own.

Why Do We Think Hertz Will Underperform?

Started with a dozen Model T Fords, Hertz (NASDAQ:HTZ) is a global car rental company providing vehicle rental services to leisure and business travelers.

1. Weak Sales Volumes Indicate Waning Demand

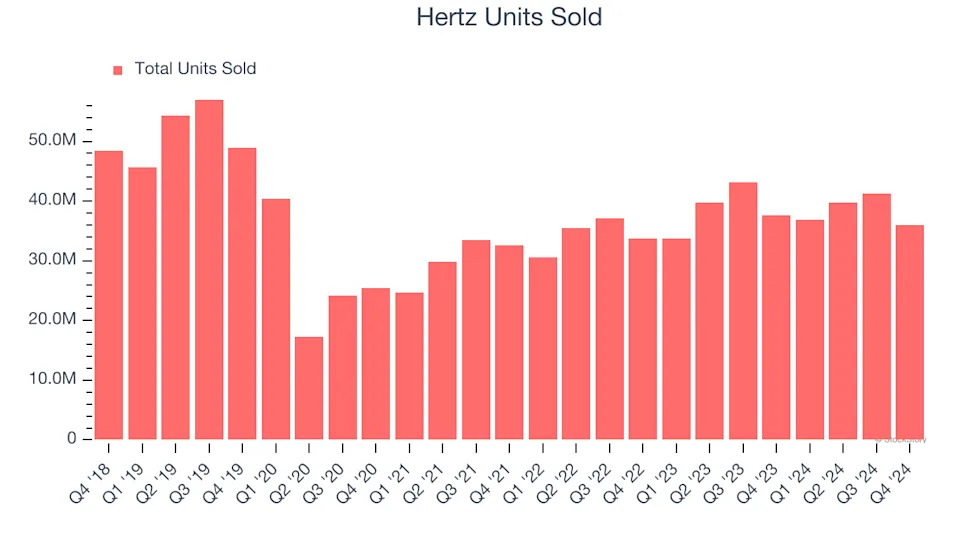

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful Ground Transportation company because there’s a ceiling to what customers will pay.

Hertz’s units sold came in at 36 million in the latest quarter, and over the last two years, averaged 6.4% year-on-year growth. This performance slightly lagged the sector and suggests it might have to lower prices or invest in product improvements to accelerate growth, factors that can hinder near-term profitability.

2. New Investments Fail to Bear Fruit as ROIC Declines

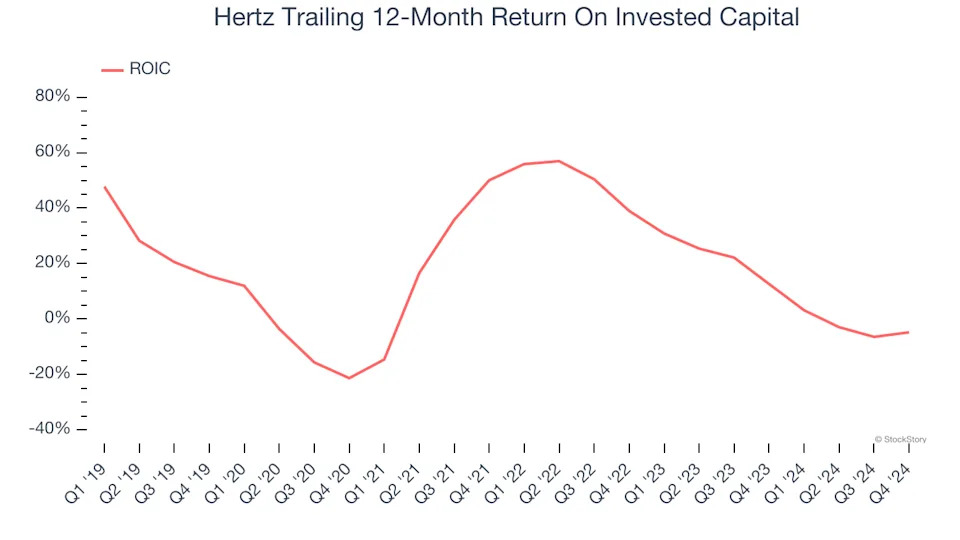

A company’s ROIC, or return on invested capital, shows how much operating profit it makes compared to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Hertz’s ROIC has decreased significantly over the last few years. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

3. Short Cash Runway Exposes Shareholders to Potential Dilution

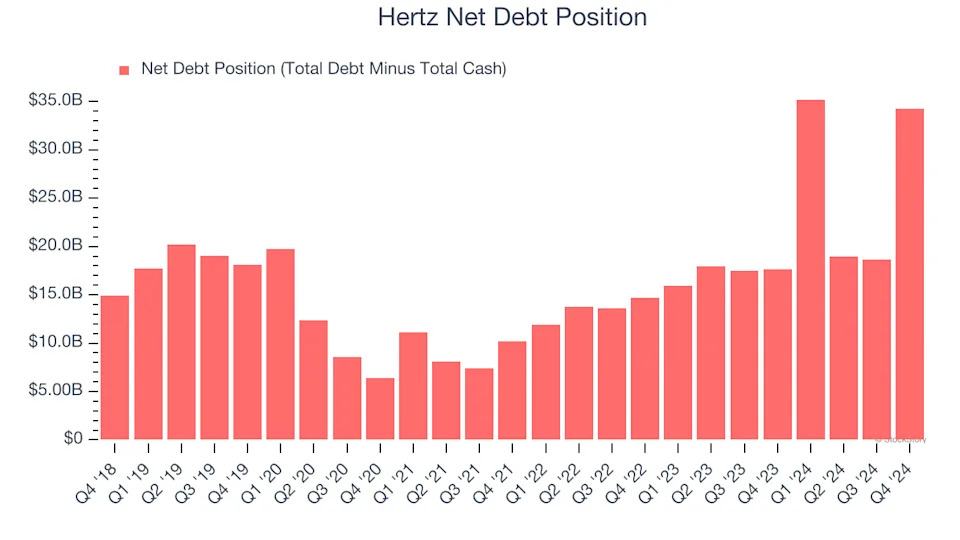

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

Hertz burned through $1.77 billion of cash over the last year, and its $35.36 billion of debt exceeds the $1.13 billion of cash on its balance sheet. This is a deal breaker for us because indebted loss-making companies spell trouble.

Unless the Hertz’s fundamentals change quickly, it might find itself in a position where it must raise capital from investors to continue operating. Whether that would be favorable is unclear because dilution is a headwind for shareholder returns.