3 Reasons to Sell FSLY and 1 Stock to Buy Instead

Over the past six months, Fastly’s shares (currently trading at $6.33) have posted a disappointing 14% loss while the S&P 500 was down 3.4%. This was partly due to its softer quarterly results and may have investors wondering how to approach the situation.

Is there a buying opportunity in Fastly, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free .

Even with the cheaper entry price, we're swiping left on Fastly for now. Here are three reasons why FSLY doesn't excite us and a stock we'd rather own.

Why Do We Think Fastly Will Underperform?

Founded in 2011, Fastly (NYSE:FSLY) provides content delivery and edge cloud computing services, enabling enterprises and developers to deliver fast, secure, and scalable digital content and experiences.

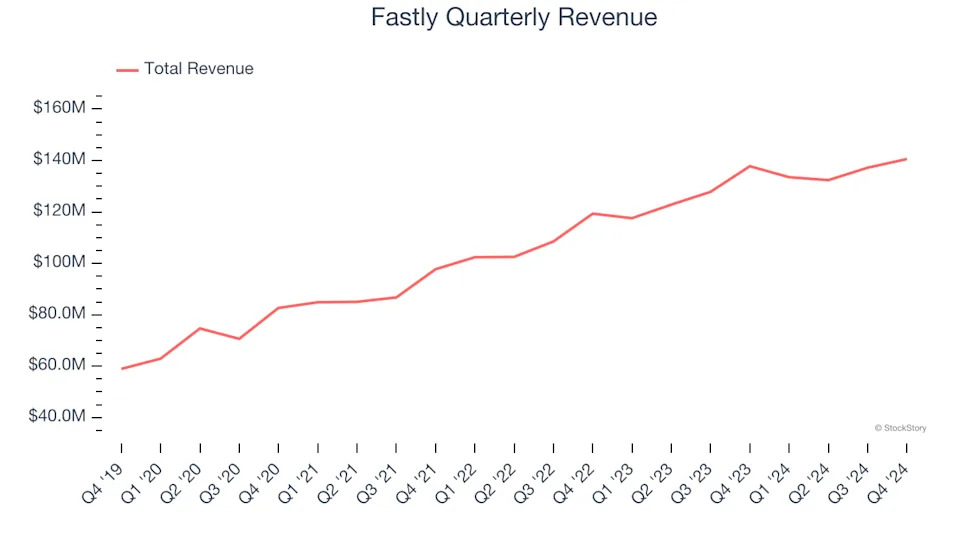

1. Long-Term Revenue Growth Disappoints

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last three years, Fastly grew its sales at a 15.3% compounded annual growth rate. Although this growth is acceptable on an absolute basis, it fell slightly short of our standards for the software sector, which enjoys a number of secular tailwinds.

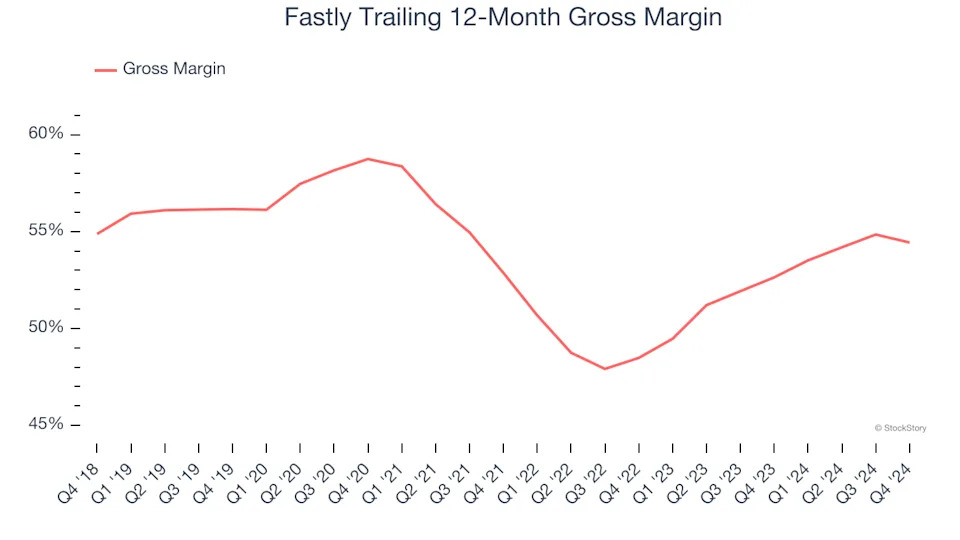

2. Low Gross Margin Reveals Weak Structural Profitability

For software companies like Fastly, gross profit tells us how much money remains after paying for the base cost of products and services (typically servers, licenses, and certain personnel). These costs are usually low as a percentage of revenue, explaining why software is more lucrative than other sectors.

Fastly’s gross margin is substantially worse than most software businesses, signaling it has relatively high infrastructure costs compared to asset-lite businesses like ServiceNow. As you can see below, it averaged a 54.4% gross margin over the last year. Said differently, Fastly had to pay a chunky $45.57 to its service providers for every $100 in revenue.

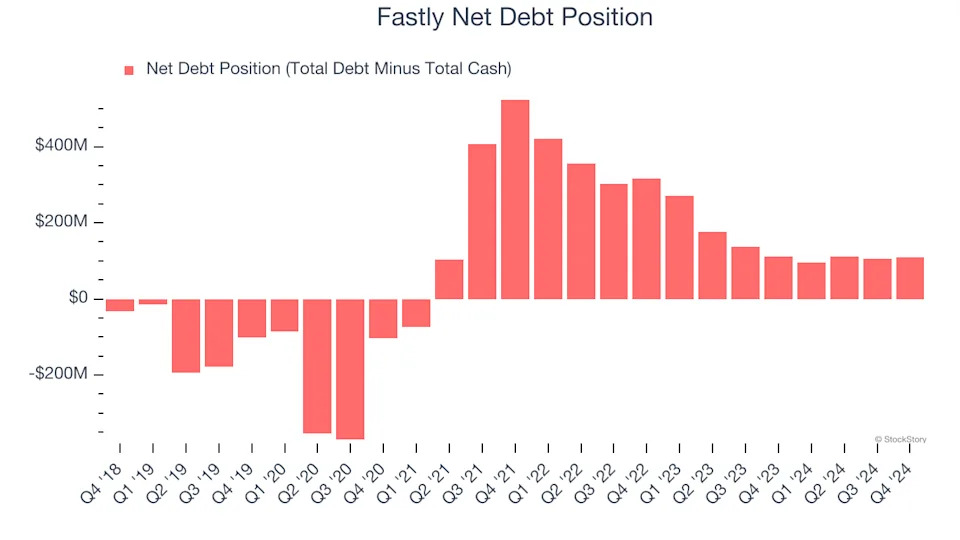

3. Short Cash Runway Exposes Shareholders to Potential Dilution

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

Fastly burned through $35.74 million of cash over the last year, and its $404.7 million of debt exceeds the $295.9 million of cash on its balance sheet. This is a deal breaker for us because indebted loss-making companies spell trouble.