Unpacking Q4 Earnings: Grand Canyon Education (NASDAQ:LOPE) In The Context Of Other Education Services Stocks

The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how Grand Canyon Education (NASDAQ:LOPE) and the rest of the education services stocks fared in Q4.

A whole industry has emerged to address the problem of rising education costs, offering consumers alternatives to traditional education paths such as four-year colleges. These alternative paths, which may include online courses or flexible schedules, make education more accessible to those with work or child-rearing obligations. However, some have run into issues around the value of the degrees and certifications they provide and whether customers are getting a good deal. Those who don’t prove their value could struggle to retain students, or even worse, invite the heavy hand of regulation.

The 8 education services stocks we track reported a strong Q4. As a group, revenues beat analysts’ consensus estimates by 3.7% while next quarter’s revenue guidance was in line.

While some education services stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 5% since the latest earnings results.

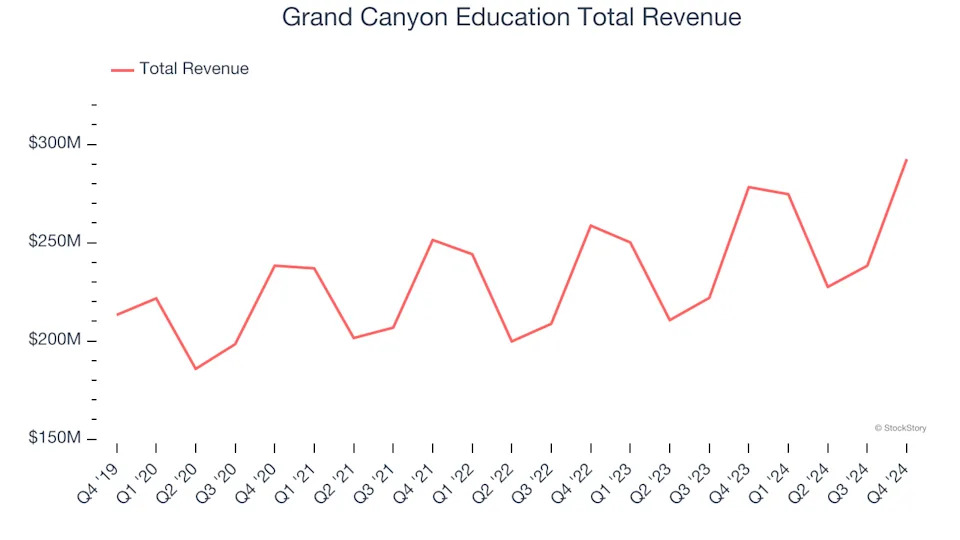

Grand Canyon Education (NASDAQ:LOPE)

Founded in 1949, Grand Canyon Education (NASDAQ:LOPE) is an educational services provider known for its operation at Grand Canyon University.

Grand Canyon Education reported revenues of $292.6 million, up 5.1% year on year. This print exceeded analysts’ expectations by 1.1%. Despite the top-line beat, it was still a decent quarter for the company with EPS guidance for next quarter beating analysts’ expectations.

The stock is down 3.9% since reporting and currently trades at $176.92.

Is now the time to buy Grand Canyon Education? Access our full analysis of the earnings results here, it’s free .

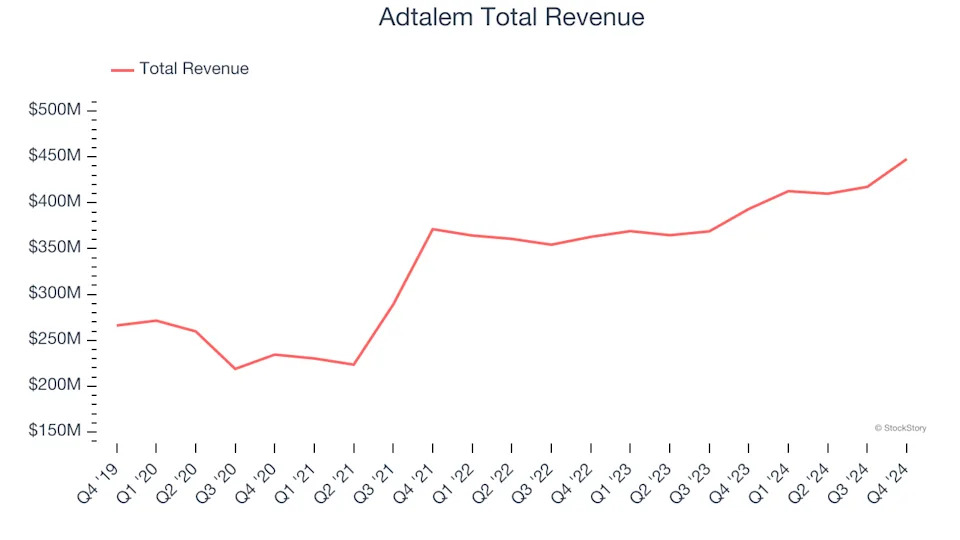

Best Q4: Adtalem (NYSE:ATGE)

Formerly known as DeVry Education Group, Adtalem Global Education (NYSE:ATGE) is a global provider of workforce solutions and educational services.

Adtalem reported revenues of $447.7 million, up 13.9% year on year, outperforming analysts’ expectations by 4.7%. The business had an exceptional quarter with a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

However, the results were likely priced into the stock as it’s traded sideways since reporting. Shares currently sit at $103.02.

Is now the time to buy Adtalem? Access our full analysis of the earnings results here, it’s free .

Weakest Q4: Laureate Education (NASDAQ:LAUR)

Founded in 1998 by Douglas L. Becker and based in Miami, Laureate Education (NASDAQ:LAUR) is a global network of higher education institutions.