3 Reasons to Sell WDC and 1 Stock to Buy Instead

What a brutal six months it’s been for Western Digital. The stock has dropped 39.5% and now trades at a new 52-week low of $40.41, rattling many shareholders. This was partly driven by its softer quarterly results and may have investors wondering how to approach the situation.

Is there a buying opportunity in Western Digital, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free .

Despite the more favorable entry price, we don't have much confidence in Western Digital. Here are three reasons why WDC doesn't excite us and a stock we'd rather own.

Why Do We Think Western Digital Will Underperform?

Founded in 1970 by a Motorola employee, Western Digital (NASDAQ: WDC) is a leading producer of hard disk drives, SSDs and flash memory.

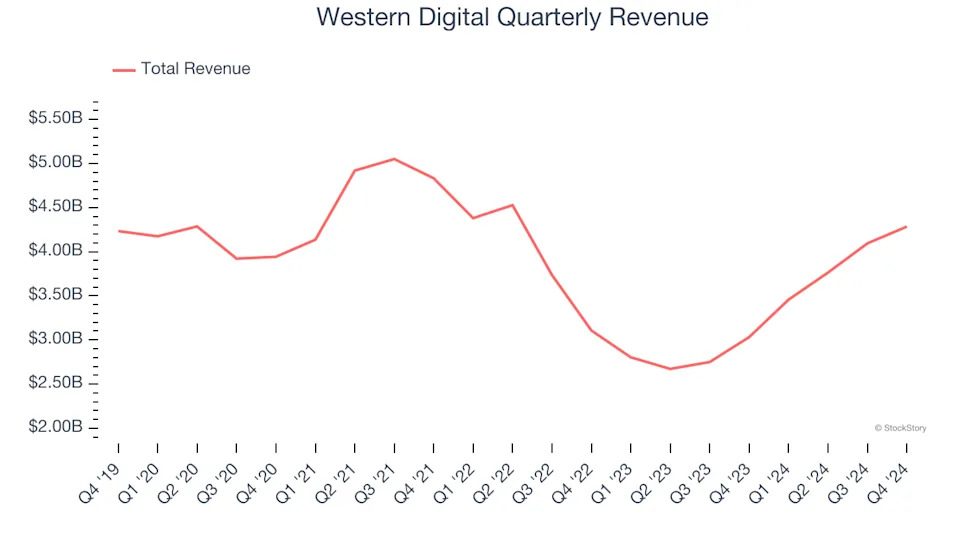

1. Long-Term Revenue Growth Flatter Than a Pancake

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Unfortunately, Western Digital struggled to consistently increase demand as its $15.6 billion of sales for the trailing 12 months was close to its revenue five years ago. This wasn’t a great result and is a sign of poor business quality. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions.

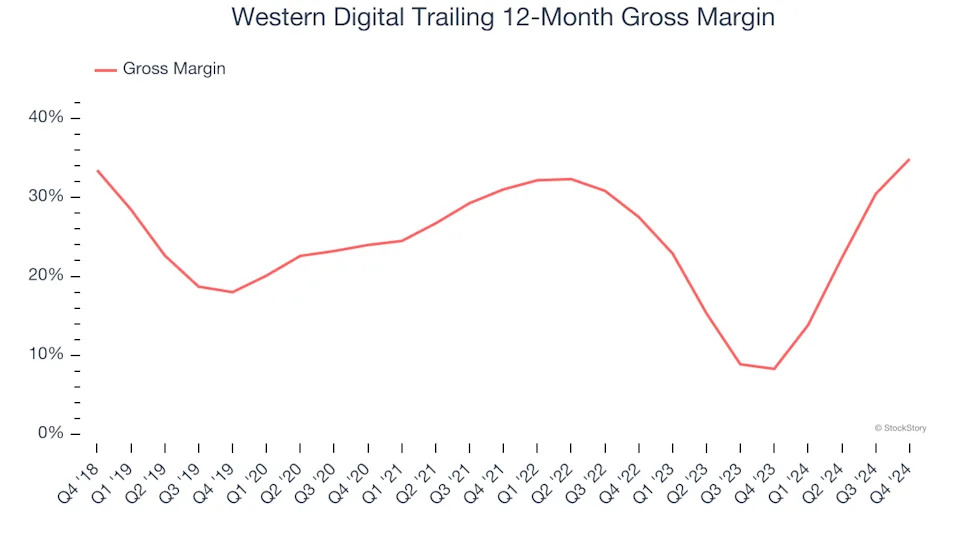

2. Low Gross Margin Reveals Weak Structural Profitability

Gross profit margin is a key metric to track because it shows how much money a semiconductor company gets to keep after paying for its raw materials, manufacturing, and other input costs.

Western Digital’s gross margin is one of the worst in the semiconductor industry, signaling it operates in a competitive market and lacks pricing power. As you can see below, it averaged a 23.7% gross margin over the last two years. That means Western Digital paid its suppliers a lot of money ($76.28 for every $100 in revenue) to run its business.

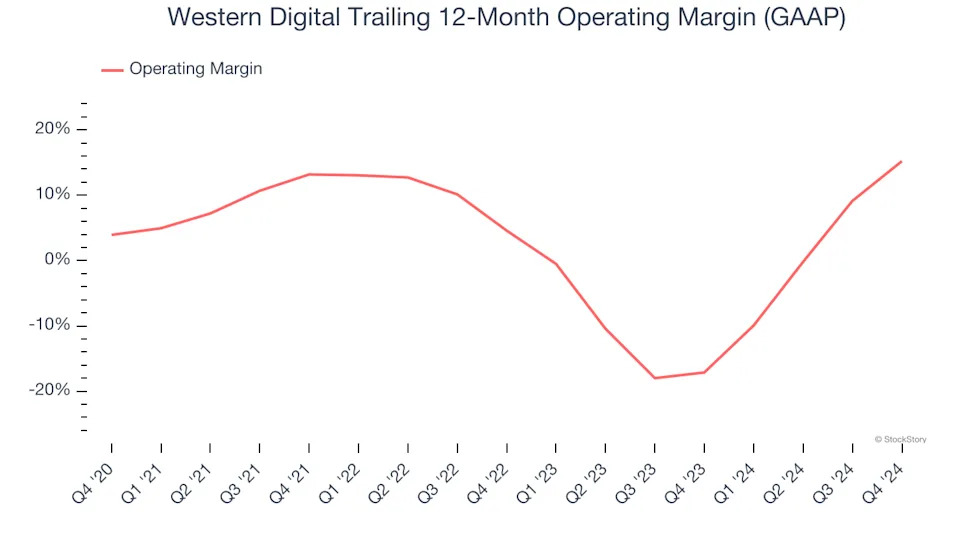

3. Weak Operating Margin Could Cause Trouble

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling those products, and most importantly, keeping them relevant through research and development.

Western Digital was profitable over the last two years but held back by its large cost base. Its average operating margin of 1.7% was among the worst in the semiconductor sector. This result isn’t too surprising given its low gross margin as a starting point.