Water Infrastructure Stocks Q4 Highlights: Watts Water Technologies (NYSE:WTS)

Let’s dig into the relative performance of Watts Water Technologies (NYSE:WTS) and its peers as we unravel the now-completed Q4 water infrastructure earnings season.

Trends towards conservation and reducing groundwater depletion are putting water infrastructure and treatment products front and center. Companies that can innovate and create solutions–especially automated or connected solutions–to address these thematic trends will create incremental demand and speed up replacement cycles. On the other hand, water infrastructure and treatment companies are at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

The 5 water infrastructure stocks we track reported a strong Q4. As a group, revenues beat analysts’ consensus estimates by 2.1%.

In light of this news, share prices of the companies have held steady as they are up 1.2% on average since the latest earnings results.

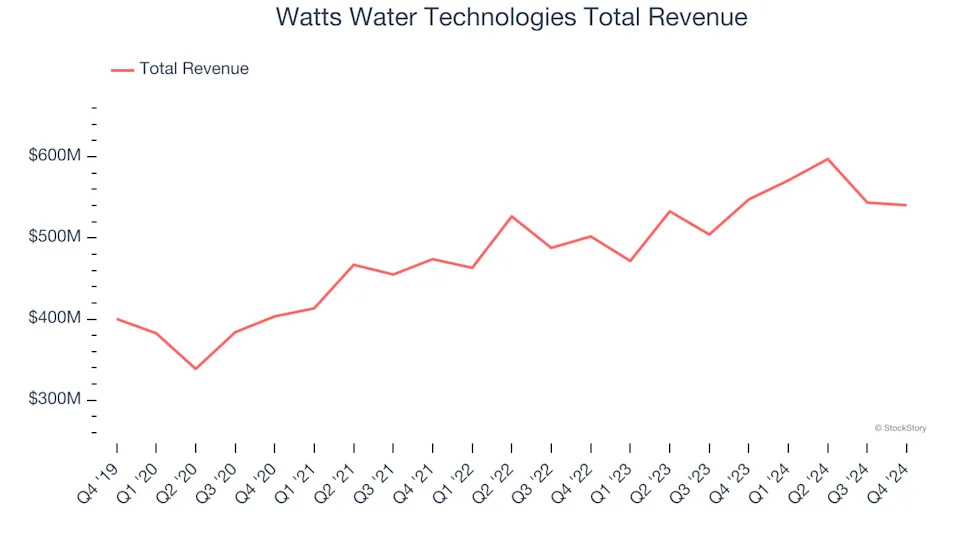

Watts Water Technologies (NYSE:WTS)

Founded in 1874, Watts Water (NYSE:WTS) specializes in manufacturing water products and systems for residential, commercial, and industrial applications globally.

Watts Water Technologies reported revenues of $540.4 million, down 1.3% year on year. This print exceeded analysts’ expectations by 0.6%. Overall, it was a strong quarter for the company with an impressive beat of analysts’ adjusted operating income estimates.

Chief Executive Officer Robert J. Pagano Jr. commented, “We closed out 2024 with record results for the quarter and full year, including record operating income, adjusted earnings per share and full year sales. I would like to commend the Watts team for their dedication throughout 2024 as we delivered on our commitments to serve our customers, executed on new product development and advanced our long-term strategy.”

Watts Water Technologies delivered the slowest revenue growth of the whole group. The stock is down 2.2% since reporting and currently trades at $204.42.

Is now the time to buy Watts Water Technologies? Access our full analysis of the earnings results here, it’s free .

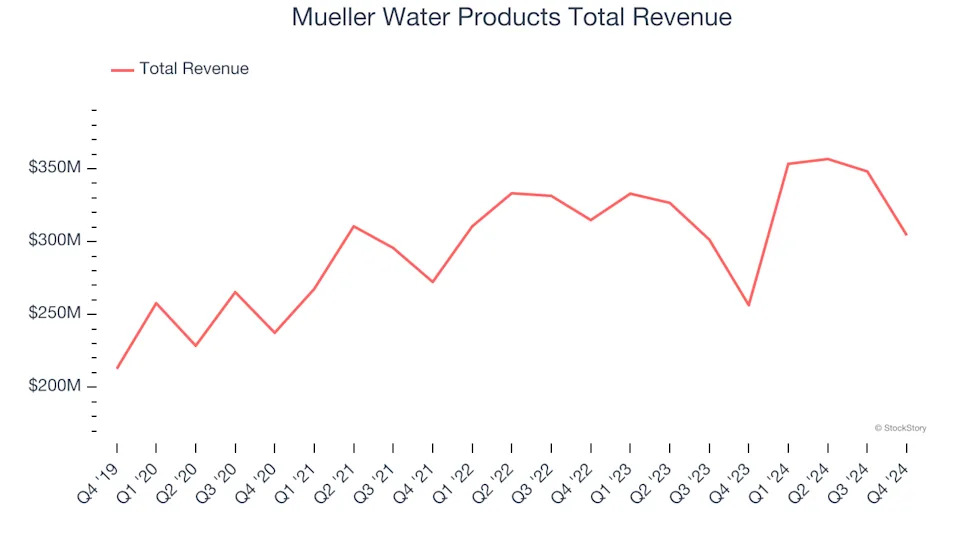

Best Q4: Mueller Water Products (NYSE:MWA)

As one of the oldest companies in the water infrastructure industry, Mueller (NYSE:MWA) is a provider of water infrastructure products and flow control systems for various sectors.

Mueller Water Products reported revenues of $304.3 million, up 18.7% year on year, outperforming analysts’ expectations by 5.4%. The business had a stunning quarter with an impressive beat of analysts’ EPS estimates and a solid beat of analysts’ EBITDA estimates.