Winners And Losers Of Q4: McDonald's (NYSE:MCD) Vs The Rest Of The Traditional Fast Food Stocks

As the Q4 earnings season wraps, let’s dig into this quarter’s best and worst performers in the traditional fast food industry, including McDonald's (NYSE:MCD) and its peers.

Traditional fast-food restaurants are renowned for their speed and convenience, boasting menus filled with familiar and budget-friendly items. Their reputations for on-the-go consumption make them favored destinations for individuals and families needing a quick meal. This class of restaurants, however, is fighting the perception that their meals are unhealthy and made with inferior ingredients, a battle that's especially relevant today given the consumers increasing focus on health and wellness.

The 14 traditional fast food stocks we track reported a satisfactory Q4. As a group, revenues were in line with analysts’ consensus estimates.

While some traditional fast food stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 1.4% since the latest earnings results.

McDonald's (NYSE:MCD)

With nicknames spanning Mickey D's in the U.S. to Makku in Japan, McDonald’s (NYSE:MCD) is a fast-food behemoth known for its convenience and broken ice cream machines.

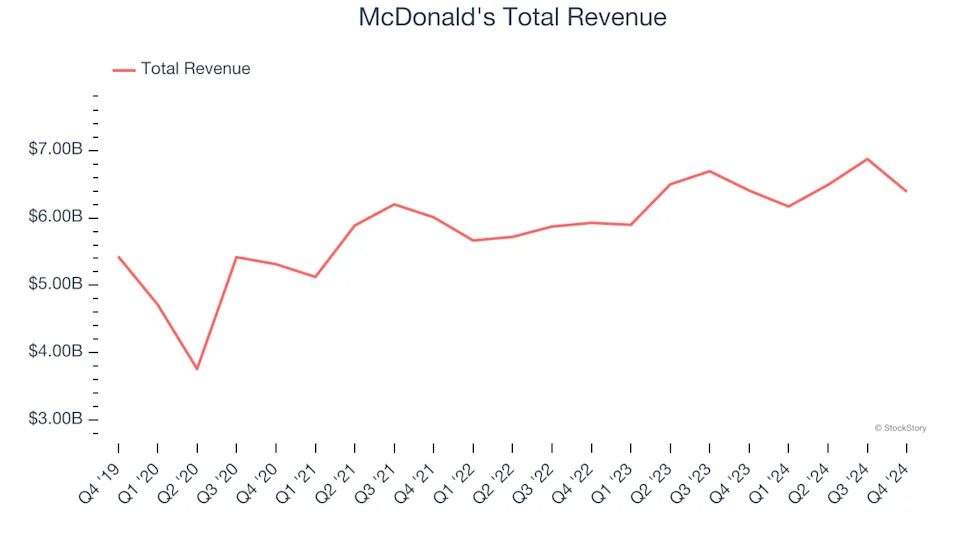

McDonald's reported revenues of $6.39 billion, flat year on year. This print fell short of analysts’ expectations by 1.1%. Overall, it was a mixed quarter for the company with a solid beat of analysts’ same-store sales estimates but a slight miss of analysts’ EPS estimates.

"Accelerating the Arches continues to be the right strategy as we focus on growing market share," said Chairman and CEO Chris Kempczinski.

The stock is up 6.8% since reporting and currently trades at $314.29.

Is now the time to buy McDonald's? Access our full analysis of the earnings results here, it’s free .

Best Q4: Dutch Bros (NYSE:BROS)

Started in 1992 by two brothers as a single pushcart, Dutch Bros (NYSE:BROS) is a dynamic coffee chain that’s captured the hearts of coffee enthusiasts across the United States.

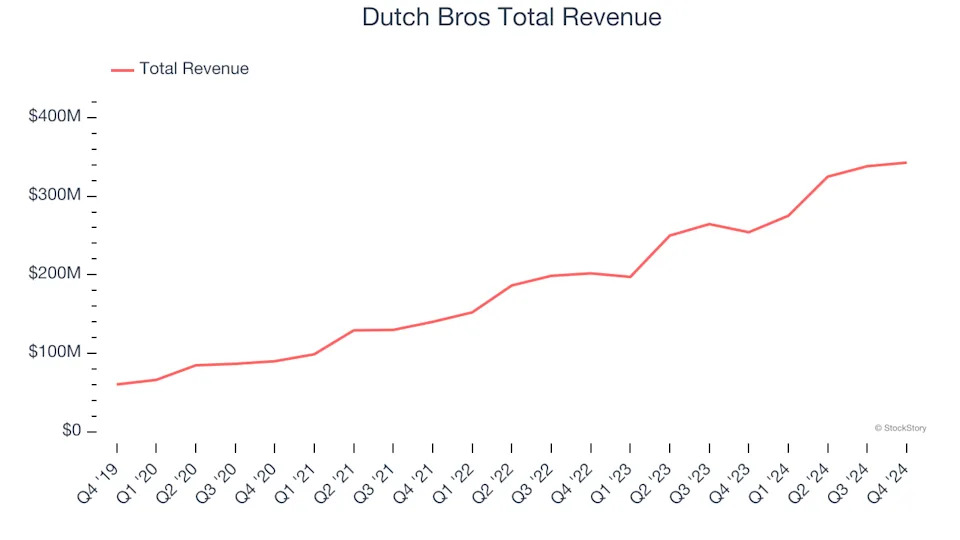

Dutch Bros reported revenues of $342.8 million, up 34.9% year on year, outperforming analysts’ expectations by 7.6%. The business had an exceptional quarter with a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

Dutch Bros pulled off the biggest analyst estimates beat, fastest revenue growth, and highest full-year guidance raise among its peers. The market seems happy with the results as the stock is up 5.8% since reporting. It currently trades at $68.50.

Is now the time to buy Dutch Bros? Access our full analysis of the earnings results here, it’s free .