3 Reasons to Sell OPEN and 1 Stock to Buy Instead

What a brutal six months it’s been for Opendoor. The stock has dropped 43.1% and now trades at $1.23, rattling many shareholders. This might have investors contemplating their next move.

Is now the time to buy Opendoor, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free .

Even though the stock has become cheaper, we don't have much confidence in Opendoor. Here are three reasons why OPEN doesn't excite us and a stock we'd rather own.

Why Do We Think Opendoor Will Underperform?

Founded by real estate guru Eric Wu, Opendoor (NASDAQ:OPEN) offers a technology-driven, convenient, and streamlined process to buy and sell homes.

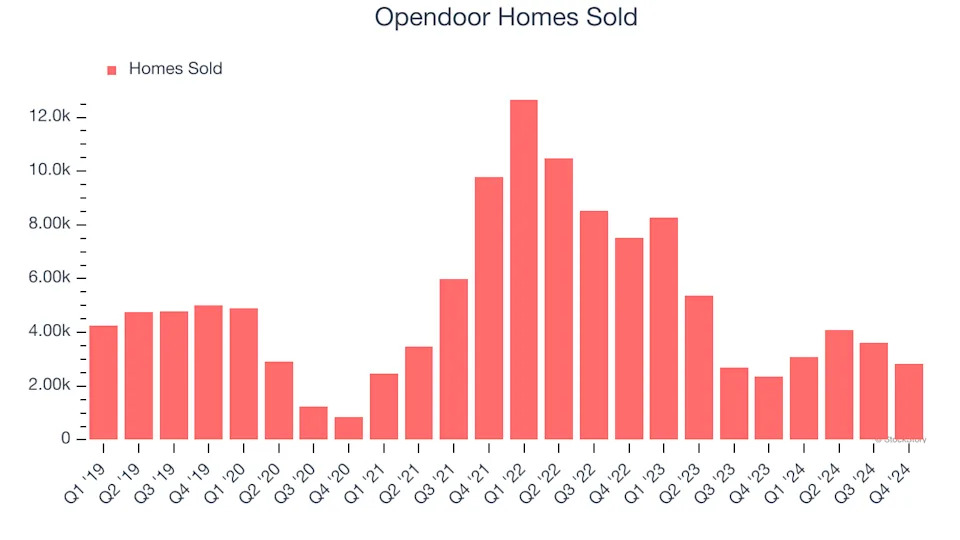

1. Decline in Homes Sold Points to Weak Demand

Revenue growth can be broken down into changes in price and volume (for companies like Opendoor, our preferred volume metric is homes sold). While both are important, the latter is the most critical to analyze because prices have a ceiling.

Opendoor’s homes sold came in at 2,822 in the latest quarter, and over the last two years, averaged 31.7% year-on-year declines. This performance was underwhelming and implies there may be increasing competition or market saturation. It also suggests Opendoor might have to lower prices or invest in product improvements to grow, factors that can hinder near-term profitability.

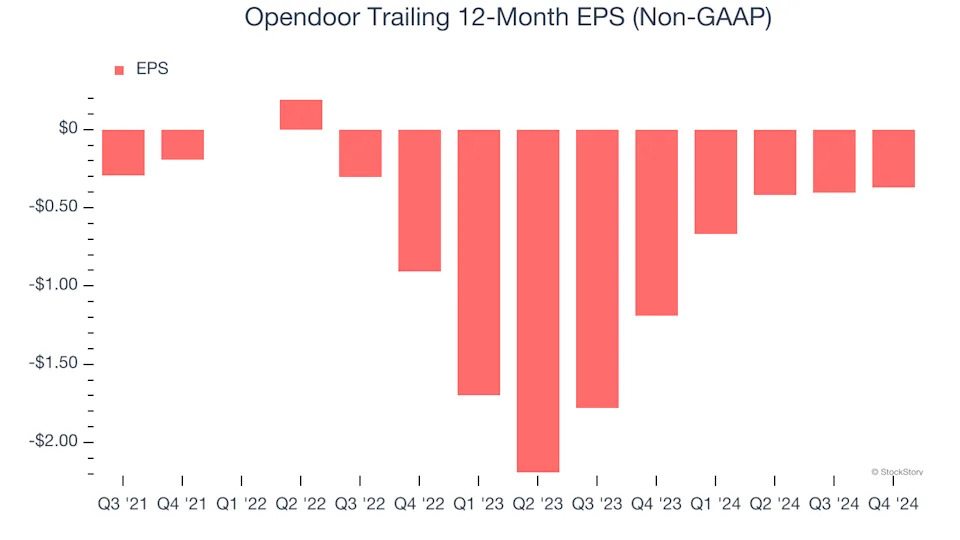

2. EPS Trending Down

Analyzing the change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Opendoor’s earnings losses deepened over the last three years as its EPS dropped 24.2% annually. We tend to steer our readers away from companies with falling EPS, where diminishing earnings could imply changing secular trends and preferences. Consumer Discretionary companies are particularly exposed to this, and if the tide turns unexpectedly, Opendoor’s low margin of safety could leave its stock price susceptible to large downswings.

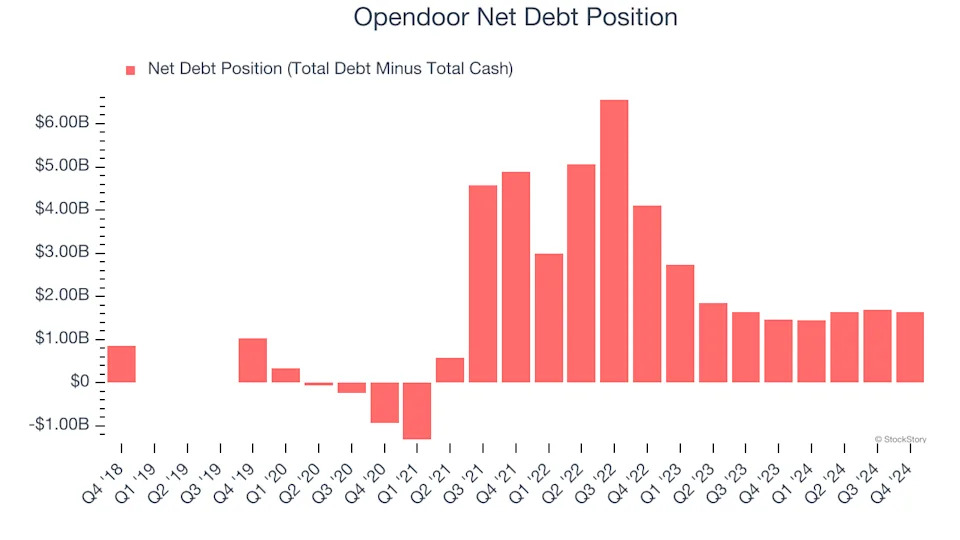

3. Short Cash Runway Exposes Shareholders to Potential Dilution

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

Opendoor burned through $620 million of cash over the last year, and its $2.32 billion of debt exceeds the $679 million of cash on its balance sheet. This is a deal breaker for us because indebted loss-making companies spell trouble.