Recession alarms are ringing on Wall Street. Here are 4 warnings economists are pointing to.

Recession talk is growing louder on Wall Street, and forecasters are pointing to a handful of warning signs that suggest am economic downturn may be on the horizon.

Earlier this month, Goldman Sachs raised its probability of a recession over the next 12 months from 15% to 20%.

According to a March survey conducted by Bank of America, 55% of fund managers said they saw a global recession triggered by a trade war as the top tail risk for the market.

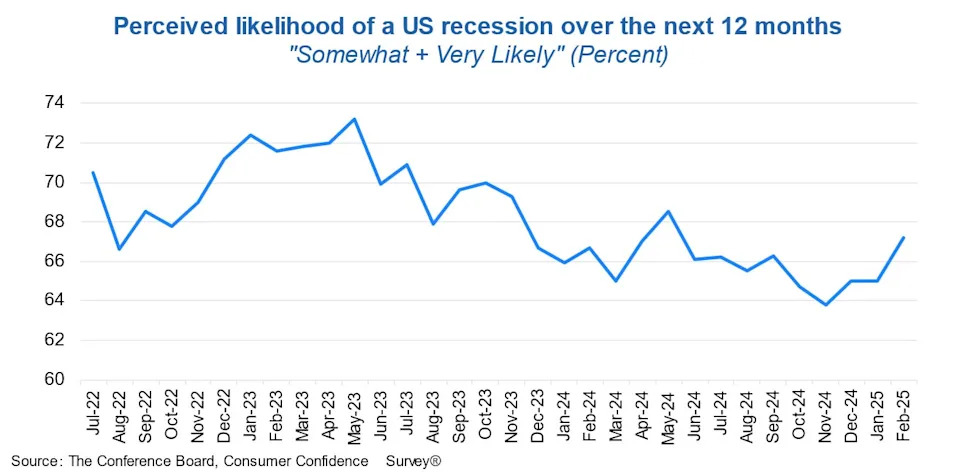

Meanwhile, the number of consumers who said they expected a recession in the next 12 months spiked to a nine-month high, according to the Conference Board's latest Consumer Confidence Survey.

David Rosenberg , an economist and a vocal market bear, said he believes a downturn could strike in the next few months. In a recent note to clients, he pointed to a handful of warnings that suggested the economy was weakening.

"We keep hearing that there is no recession and that the economy is in solid shape because of the low unemployment rate. But it is change and not the level that matters for the economic cycle," Rosenberg said. "If the past is prescient, the recession which nobody believes will rear its ugly head will materialize as early as July."

Here are four warning signs he and other economic forecasters have flagged recently.

1. Household finances are deteriorating

US households are showing signs they're struggling to keep up with the pace of inflation , something that could pose a major headwind to the US economy given that consumer spending makes up around two-thirds of GDP.

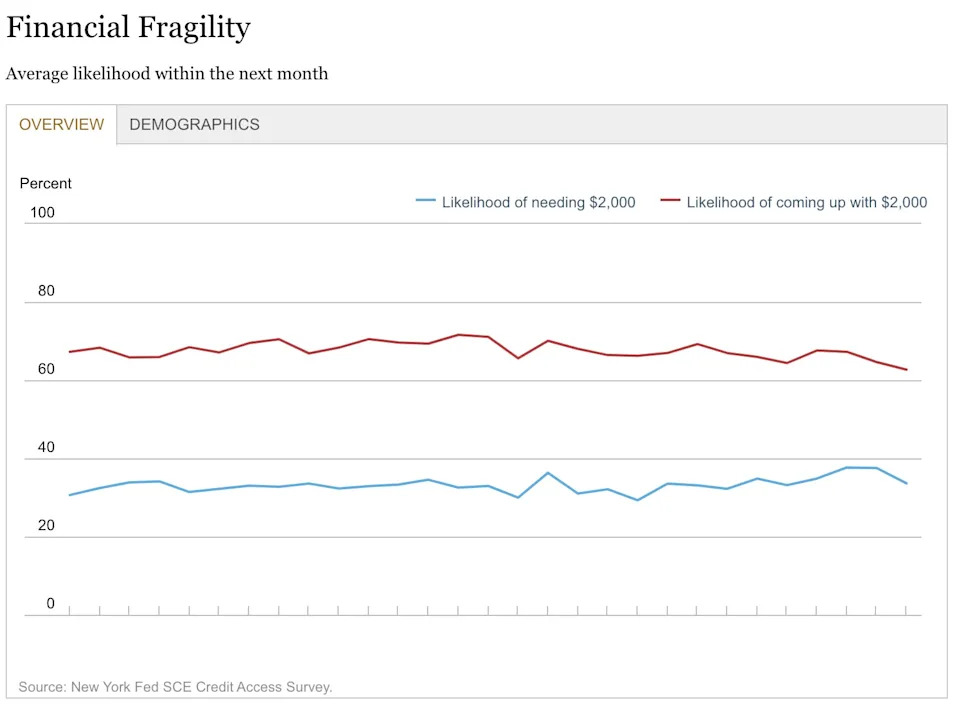

Notably, Americans are less likely to be able to cover an emergency expense. According to the latest Survey of Consumer Expectations from the New York Fed, 63% of US households said they had enough cash on hand to cover a surprise $2,000 bill.

According to an analysis from Apollo Global Management, that's the lowest percentage of Americans who said they had emergency cash on had since the fourth quarter of 2015.

"Taking into account that the CPI level today is 35% higher than in 2015, the situation is even worse," Torsten Sløk, the chief economist at Apollo, wrote.

The survey also found that 34% of Americans said they expected to have to come up with $,2000 over the next month.

At the same time, households also have higher debt burdens. Total household debt rose $93 billion over the fourth quarter, hitting a record $18 trillion, New York Fed data shows.