3 Reasons to Sell TDS and 1 Stock to Buy Instead

The past six months have been a windfall for Telephone and Data Systems’s shareholders. The company’s stock price has jumped 54.8%, hitting $35.55 per share. This was partly thanks to its solid quarterly results, and the run-up might have investors contemplating their next move.

Is there a buying opportunity in Telephone and Data Systems, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free .

We’re happy investors have made money, but we're swiping left on Telephone and Data Systems for now. Here are three reasons why TDS doesn't excite us and a stock we'd rather own.

Why Do We Think Telephone and Data Systems Will Underperform?

Operating primarily through its majority-owned subsidiary UScellular and wholly-owned TDS Telecom, Telephone and Data Systems (NYSE:TDS) provides wireless, broadband, video, and voice communications services to 4.6 million wireless and 1.2 million broadband customers across the United States.

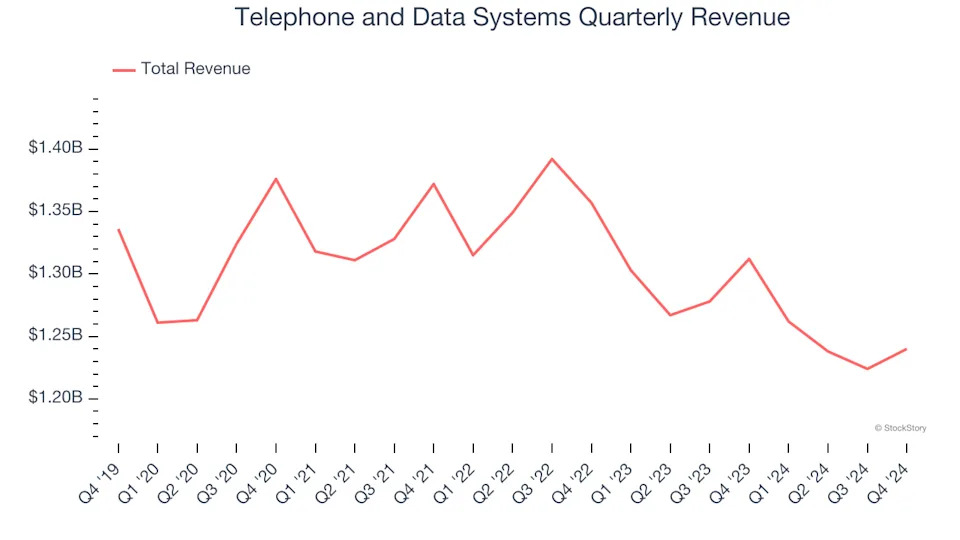

1. Revenue Spiraling Downwards

A company’s long-term sales performance can indicate its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Telephone and Data Systems’s demand was weak over the last four years as its sales fell at a 1.3% annual rate. This was below our standards and signals it’s a low quality business.

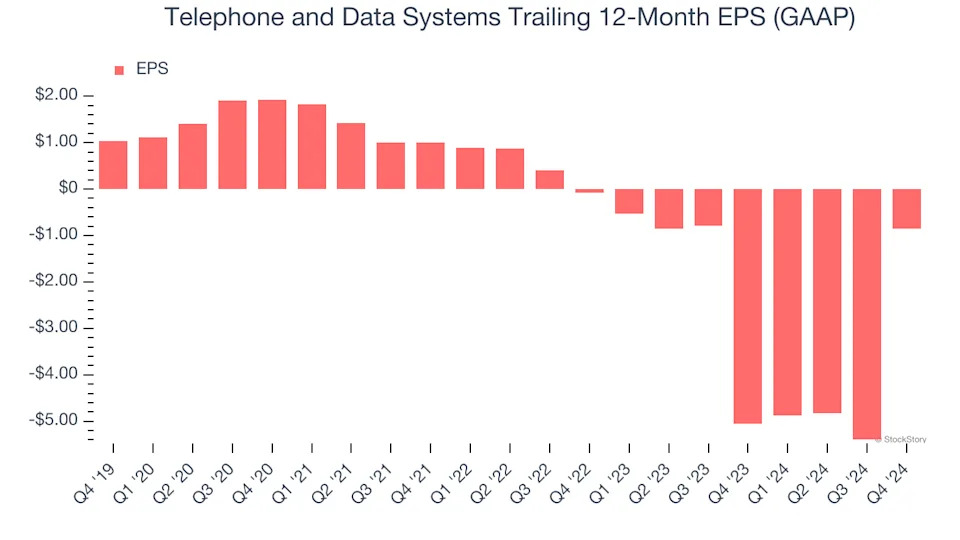

2. EPS Trending Down

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Telephone and Data Systems’s full-year EPS turned negative over the last five years. We tend to steer our readers away from companies with falling revenue and EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, Telephone and Data Systems’s low margin of safety could leave its stock price susceptible to large downswings.

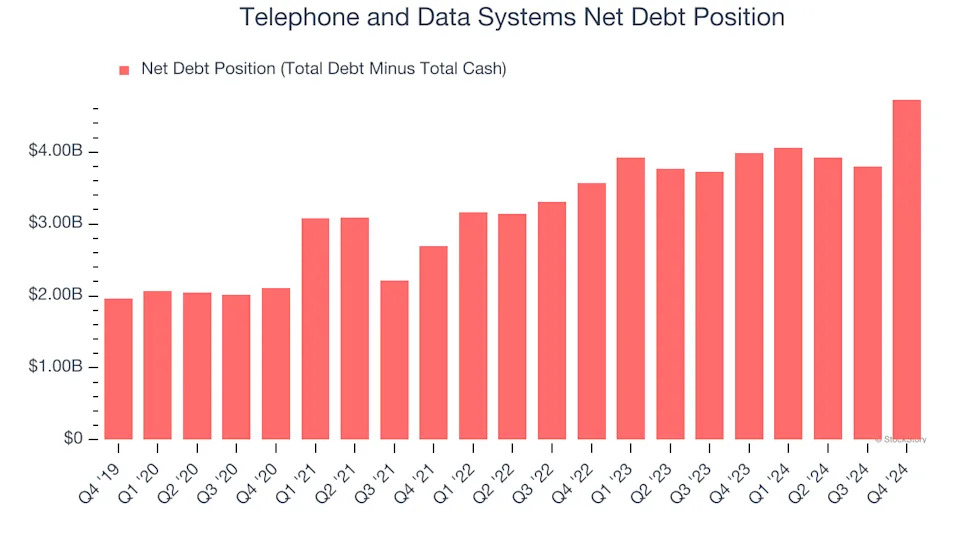

3. High Debt Levels Increase Risk

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

Telephone and Data Systems’s $5.10 billion of debt exceeds the $364 million of cash on its balance sheet. Furthermore, its 23× net-debt-to-EBITDA ratio (based on its EBITDA of $202 million over the last 12 months) shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. Telephone and Data Systems could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.