Wall Street Firms Plunge Into Europe’s Booming Active ETF Market

(Bloomberg) -- US investment firms are rushing to grab a greater chunk of Europe’s market for active exchange-traded funds, an industry projected to grow to $1 trillion in assets over the coming years.

Most Read from Bloomberg

JPMorgan Asset Management, BlackRock Inc., Invesco Ltd. and Goldman Sachs Asset Management are among the US firms to launch active ETFs on European exchanges this year, according to data from Bloomberg Intelligence. Others are waiting in the wings, with State Street Global Advisors and Texas-based Dimensional Fund Advisors laying the groundwork to debut in Europe.

Such funds’ forays across the Atlantic are part of a drive to expand in a market where ETFs still only account for 10% of the overall fund-assets pie. For active ETFs — funds that allow managers to deviate by a certain extent from the index for additional returns — the difference compared to the American market is stark. Europe contains around 340 such funds, less than a fifth of the US total.

That’s luring US ETF providers looking to diversify their business lines. And they expect particularly brisk growth for active ETF assets, because European institutions have historically tended to favor active investment strategies over index tracking, according to Hector McNeil, co-founder of HANetf, a white-label company that helps asset managers launch ETFs.

“People realize they can future-proof their business with the ETF wrapper,” McNeil said. Of the seven new active ETFs he has in the cards for the next three months, four are from US issuers.

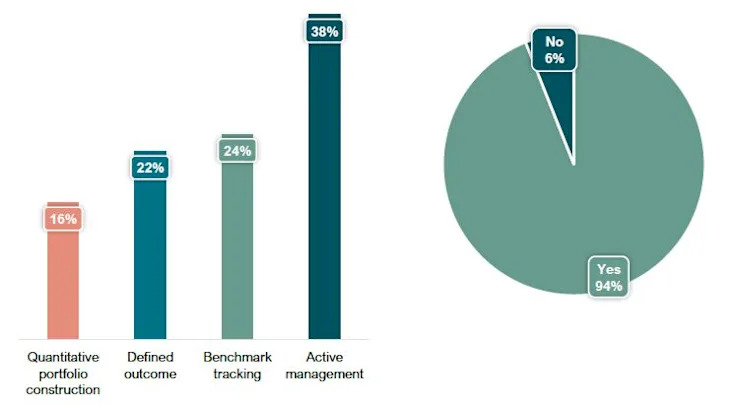

McNeil’s firm, London-based HANetf, predicts explosive growth for European active ETFs, seeing assets at $1 trillion by 2031, versus just $56 billion at present. Its recent survey of 50 European wealth managers showed more than 90% planned to increase their active ETF usage.

Additionally, HANetf found, active management is likely to see the most growth in Europe over the next five years, beating out the index-tracking category.

HANetf’s forecasts are in line with bullish projections issued by Janus Henderson and Fidelity International. But for now, ETFs — active as well as passive — make up a fraction of Europe’s investment landscape, where actively managed assets comprise roughly three quarters of the total pool. That’s partly because the industry is tightly controlled by banks, which have been slow to allocate to typically lower-revenue passive strategies, according to Bloomberg Intelligence. Firms can also charge higher fees on active products than on passive strategies.

Still, active ETF numbers are growing fast. There were 125 such funds at the end of last year in Europe, versus just 29 a year earlier, with more than 50 of those coming from US providers. American firms also accounted for two of the 10 new entrants to the European market last year, BI data show.

“Europe is an active manager’s paradise,” BI’s Athanasios Psarofagis said. “They were always wired to support it. So, the thinking by the issuers is, ‘If we can keep this party going as long as we can, we should go to a market that’s more conducive to active, which is Europe.’”

As for the performance of European funds, it’s hard to generalize, given the fractured nature of the regional investment landscape. Still, active proponents can find ammo in the recent volatility on Wall Street — a market that many European-domiciled funds have outsized exposure to given its sheer size. As diversified bets beat index-tracking allocations this year, some 75% of US quant-focused funds, known as smart beta, and 60% of thematic strategies have outperformed the S&P 500, according to a Bloomberg Intelligence analysis of active strategies.

US ETF providers’ expansion does come with challenges. For instance, JPMorgan Asset Management says it had to keep in mind key differences with the US market when it added two new active bond strategies to its growing lineup across Europe, according to Travis Spence, the firm’s global head of ETFs. He described the launches as “a natural extension of our ETF strategy,” but noted the differing composition of the investor base.

Whereas retail investors play an outsized role in the US, Spence said Europe is “dominated by asset allocators and asset owners today,” with retail comprising less than 20% overall.

Another US provider, Roundhill Investments, was forced to shutter a metaverse-themed passive ETF in 2022, just 20 months after launch in Europe, having garnered only about $2 million in assets.

Europe has far fewer self-directed investors than the US does, according to Roundhill co-founder Tim Maloney, meaning issuers might find less demand from that cohort than they anticipate. Decoding and interpreting different rules and regulations for the various European countries was another hurdle, he added.

Maloney has advice for those trying their hand in Europe:

“Everyone, when we were going into it, said, ‘Look, your model works in the US, it may not work as well here, distribution is a little bit different.’” he said. “And it’s not that we didn’t listen, but we maybe underweighted that advice.”

--With assistance from Emily Graffeo and Isabelle Lee.

Most Read from Bloomberg Businessweek

©2025 Bloomberg L.P.