Q4 Earnings Highs And Lows: Couchbase (NASDAQ:BASE) Vs The Rest Of The Data Storage Stocks

Earnings results often indicate what direction a company will take in the months ahead. With Q4 behind us, let’s have a look at Couchbase (NASDAQ:BASE) and its peers.

Data is the lifeblood of the internet and software in general, and the amount of data created is accelerating. As a result, the importance of storing the data in scalable and efficient formats continues to rise, especially as its diversity and associated use cases expand from analyzing simple, structured datasets to high-scale processing of unstructured data such as images, audio, and video.

The 5 data storage stocks we track reported a strong Q4. As a group, revenues beat analysts’ consensus estimates by 4.2% while next quarter’s revenue guidance was in line.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 9.7% since the latest earnings results.

Couchbase (NASDAQ:BASE)

Formed in 2011 with the merger of Membase and CouchOne, Couchbase (NASDAQ:BASE) is a database-as-a-service platform that allows enterprises to store large volumes of semi-structured data.

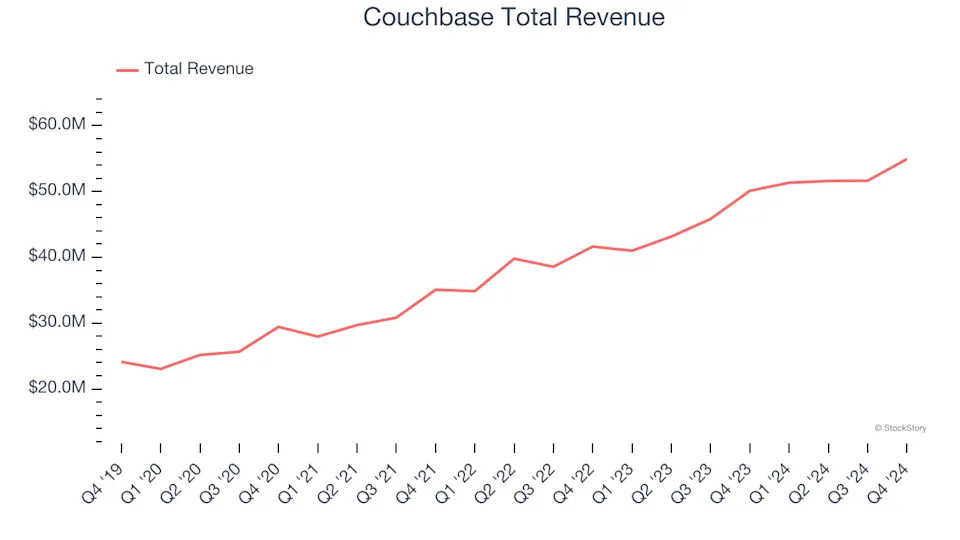

Couchbase reported revenues of $54.92 million, up 9.6% year on year. This print exceeded analysts’ expectations by 3.1%. Overall, it was a satisfactory quarter for the company with a solid beat of analysts’ billings estimates but full-year guidance of slowing revenue growth.

"We finished fiscal 2025 on a strong note, including the highest quarterly free cash flow and net new ARR results in company history," said Matt Cain, Chair, President and CEO of Couchbase.

Couchbase delivered the slowest revenue growth and weakest full-year guidance update of the whole group. The stock is down 15.4% since reporting and currently trades at $13.76.

Is now the time to buy Couchbase? Access our full analysis of the earnings results here, it’s free .

Best Q4: Commvault Systems (NASDAQ:CVLT)

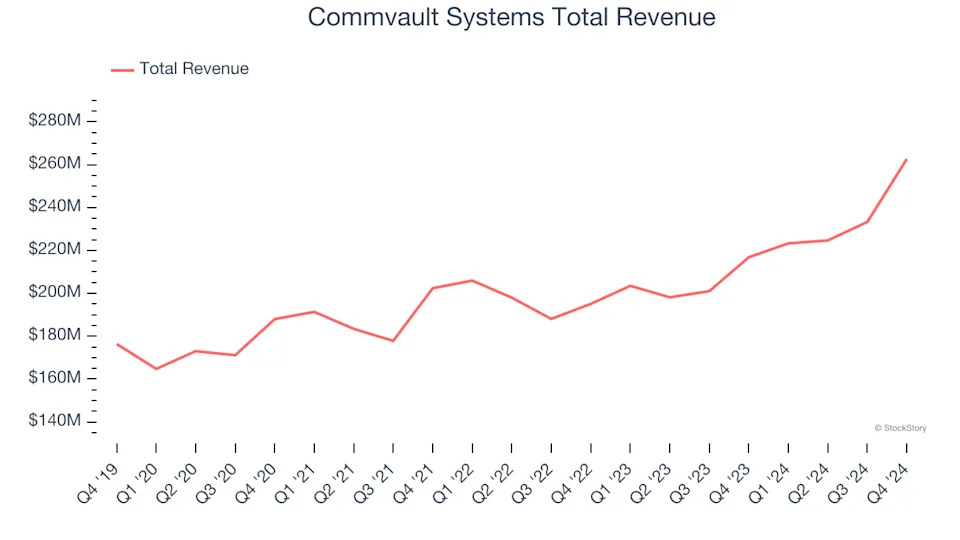

Originally formed in 1988 as part of Bell Labs, Commvault (NASDAQ: CVLT) provides enterprise software used for data backup and recovery, cloud and infrastructure management, retention, and compliance.

Commvault Systems reported revenues of $262.6 million, up 21.1% year on year, outperforming analysts’ expectations by 6.9%. The business had a very strong quarter with a solid beat of analysts’ billings estimates and an impressive beat of analysts’ EBITDA estimates.

Commvault Systems achieved the biggest analyst estimates beat and highest full-year guidance raise among its peers. However, the results were likely priced into the stock as it’s traded sideways since reporting. Shares currently sit at $160.06.