3 Reasons to Avoid KIND and 1 Stock to Buy Instead

Nextdoor has gotten torched over the last six months - since September 2024, its stock price has dropped 28.5% to $1.71 per share. This was partly driven by its softer quarterly results and might have investors contemplating their next move.

Is there a buying opportunity in Nextdoor, or does it present a risk to your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free .

Despite the more favorable entry price, we're sitting this one out for now. Here are three reasons why KIND doesn't excite us and a stock we'd rather own.

Why Is Nextdoor Not Exciting?

Helping residents figure out what's happening on their block in real time, Nextdoor (NYSE:KIND) is a social network that connects neighbors with each other and with local businesses.

1. Customer Spending Decreases, Engagement Falling?

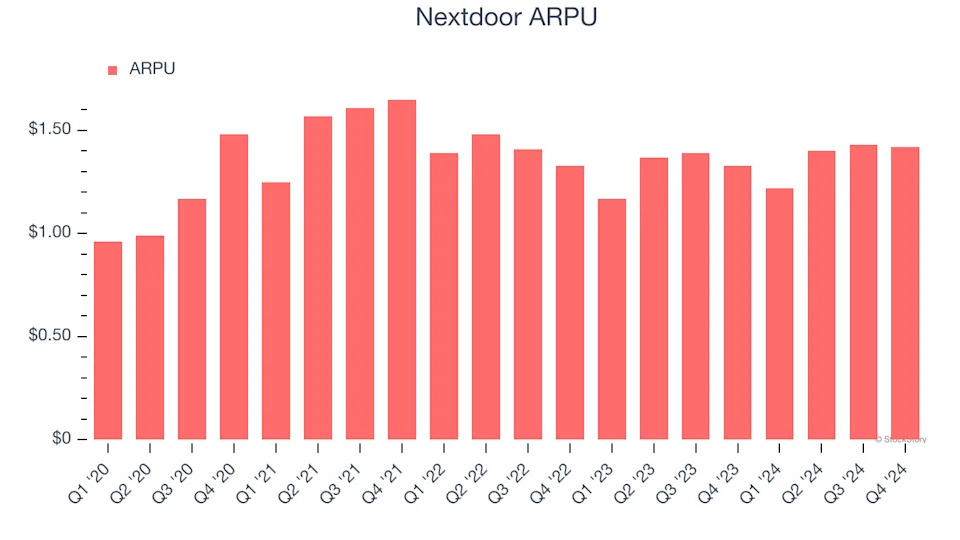

Average revenue per user (ARPU) is a critical metric to track because it measures how much the company earns from the ads shown to its users. ARPU can also be a proxy for how valuable advertisers find Nextdoor’s audience and its ad-targeting capabilities.

Nextdoor’s ARPU fell over the last two years, averaging 1.1% annual declines. This isn’t great, but the increase in weekly active users is more relevant for assessing long-term business potential. We’ll monitor the situation closely; if Nextdoor tries boosting ARPU by taking a more aggressive approach to monetization, it’s unclear whether users can continue growing at the current pace.

2. Operating Losses Sound the Alarms

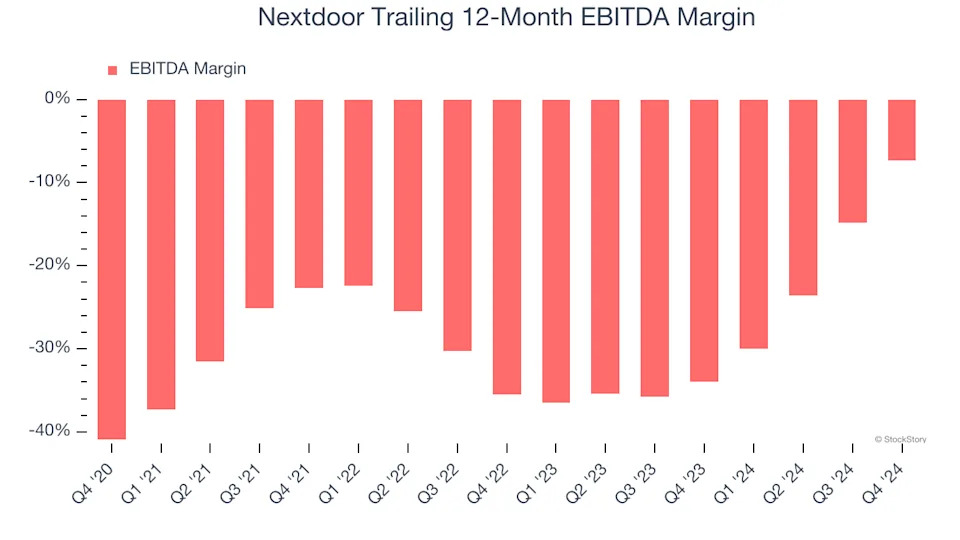

Investors frequently analyze operating income to understand a business’s core profitability. Similar to operating income, EBITDA is a common profitability metric for consumer internet companies because it removes various one-time or non-cash expenses, offering a more normalized view of profit potential.

Although Nextdoor was profitable this quarter from an operational perspective, it’s generally struggled over a longer time period. Its expensive cost structure has contributed to an average EBITDA margin of negative 19.8% over the last two years. Unprofitable consumer internet companies require extra attention because they spend heaps of money to capture market share. As seen in its historically underwhelming revenue performance, this strategy hasn’t worked so far, and it’s unclear what would happen if Nextdoor reeled back its investments. Wall Street seems to think it will face some obstacles, and we tend to agree.

3. Cash Burn Ignites Concerns

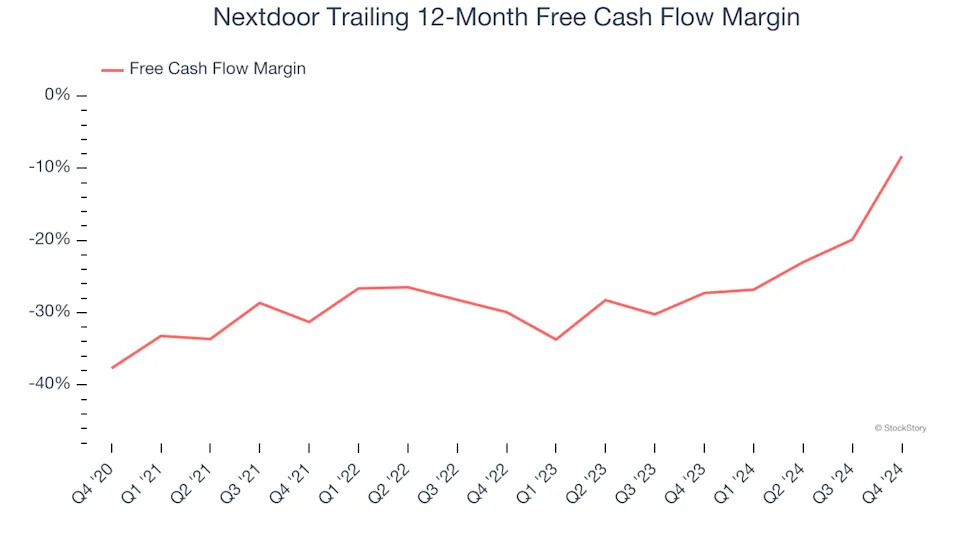

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.